Artificial intelligence is hot right now: IBM, Google and Facebook are all competing to push the boundaries of AI, while big agencies like MDC, Huge, GroupM and Team One are rushing out bot services.

The global market for smart machines — hardware or software systems that can accomplish a specific task — is estimated to increase from $7.4 billion this year to around $15 billion in 2021, at a compound annual growth rate of 15 percent, according to BCC Research. Forrester predicts that insight-driven businesses will pull in around $1.2 trillion in 2020 from over $250 billion last year, while CB Insights’ research confirms that funding for AI has been growing.

“AI is growing because there are real, legacy business problems that current technologies and processes have been unable to solve for,” said Amy Inlow, CMO of AI firm Adgorithms. “One problem in marketing, for example, is the inability to process mass amounts of data and subsequently act on it in real time without relying on a team of marketers to analyze and make decisions.”

But there’s a discrepancy between the hype and the actual implementation of AI. And consumers and marketing executives have some concerns like cyber attacks, job losses and talent shift in the workforce, per a joint report by Weber Shanwick and KRC Research.

Here are five charts that sum up the state of AI globally, based on research from several companies.

VC funding for AI has been growing

The number of AI deals reached a new high of 397 in 2015. As of June 15 of this year, more than 200 AI-focused companies have raised around $1.5 billion, according to CB Insights.

Investment reached an all-time quarterly high in the first three months of this year, with around 145 deals raising equity funding rounds from investors like Goldman Sachs and IBM Watson.

Customer experience is a big focus

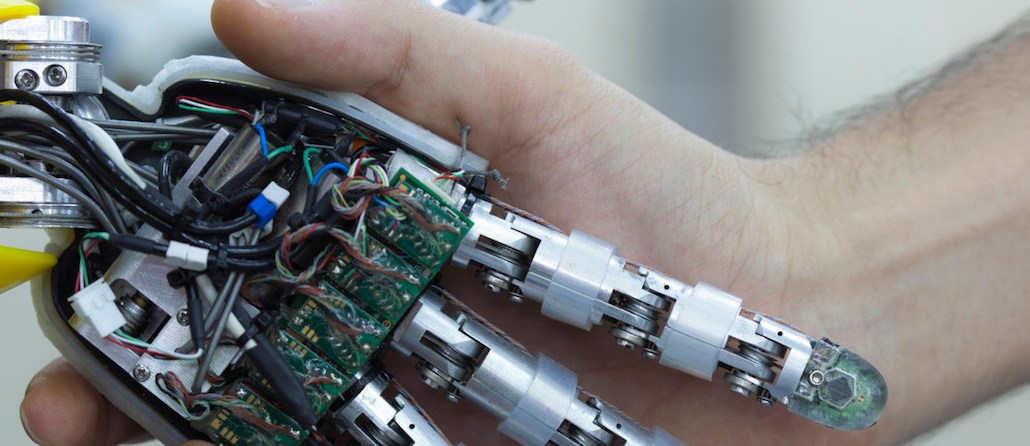

AI is a broad term that entails robotics, knowledge engineering, image analysis and natural language processing. In the business context, however, many companies want to use AI to create a better customer experience.

Based on responses from 598 business and tech professionals, Forrester found that 57 percent believe that AI can help them improve customer support, and 44 percent think that AI can provide the ability to improve existing products and services. In comparison, 18 percent consider AI as another revenue stream.

There’s a gap between interest in AI and the actual use of AI

The same Forrester report shows that while 58 percent of the 391 business and tech professionals surveyed are researching AI, only 12 percent have developed AI systems.

An online survey of 500 marketing managers conducted by tech firm Demandbase in November of this year also shows that 78 percent of them feel very or somewhat confident about how AI can be used specifically in marketing, but a mere 10 percent are currently using AI.

Consumers don’t have much understanding of AI

Brands and marketers have some time to catch up. The demand isn’t quite there yet. A joint research by Weber Shanwick and KRC Research shows that among the 2,100 adult consumers in the U.S., Canada, the UK, China and Brazil surveyed online, only 18 percent responded that they know a lot about AI, 48 percent know a little and 34 percent know nothing about AI.

For those who reported to know a lot about AI, 21 percent view IBM as an AI brand leader, followed by Google (17 percent), Apple (11 percent) and Microsoft (11 percent), according to the report.

CMOs anticipate a large talent shift in the workforce because of AI

AI, as an advanced technology, is likely to require new skill sets and lead to a job reduction in the near future. The same report from Weber Shanwick and KRC Research also surveyed 150 CMOs across the U.S., the U.K. and China. It shows that a vast majority of them predict that AI will change their workforce by reducing jobs (45 percent) or requiring new skill sets (40 percent). A small number (11 percent) expect no change at all.

Aside from job losses, consumers are also concerned about cyber-attacks and the criminal use of AI technologies, according to the report.

More in Media

Why some publishers aren’t ready to monetize generative AI chatbots with ads yet

Monetization of generative AI chatbot experiences is slow going. Some publishing execs said they’re not ready to add advertising to these products until they scale or can build a subscription model first.

Media Briefing: Publishers who bet on events and franchises this year are reaping the rewards

Tentpole events and franchises are helping publishers lock in advertising revenue.

With Firefly Image 3, Adobe aims to integrate more AI tools for various apps

New tools let people make images in seconds, create image backgrounds, replacing parts of an image and use reference images to create with AI.