Digiday Research: 54% of marketers say they allocated more ad money to Instagram this year

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Brand marketers kept their marketing mix steady across the majority of platforms and channels this past year, with the exception of Instagram.

In a survey of 67 brand marketers by Digiday this past summer, brand marketers were asked how their ad spending on platforms and channels including Facebook, Instagram, YouTube, other social platforms, Amazon, other retail sites and television changed in the past year. Generally, marketers said their spending stayed the same across those platforms and channels.

Instagram, however, seems to be where marketers increased as 26% said they increased their spending significantly and 28% said they increased their spending. That’s likely due to the work Instagram has done to boost advertising on Instagram Stories.

“Brands love Instagram,” said Barry Lowenthal, CEO of The Media Kitchen, adding that the increase is likely due to brands seeing a better response on the platform and optimizing their budgets based on performance.

YouTube’s growth seems to be slowing, with most marketers keeping their spend on the platform as is, with just 10% increasing their spend on the platform significantly and 19% increasing their spend. In recent years, YouTube has tried to mitigate multiple brand safety issues on the platform, which could be why marketers are hesitant to increase their spending. Another reason could be that there’s simply more competition for video now, said Lowenthal, with OTT and programmatic video ad inventory growing.

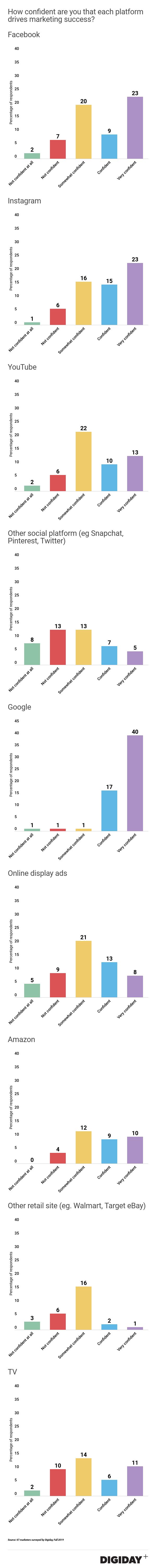

Those same marketers were asked to rank how confident they were in each platform or channel to drive marketing success. Overall, Google comes out ahead in terms of confidence. Of the 67% of brand marketers surveyed by Digiday, nearly 60% said they are very confident in Google to drive marketing success. As for Facebook and Instagram, roughly 34% of marketers said they are very confident in the platforms.

Meanwhile, the rise of retail media is buzzy this year, but brand marketers aren’t yet confident in its performance. In the survey, 23% said they were somewhat confident in retail media channels (excluding Amazon) like Walmart, Target, and eBay, among others, almost 3% said they were confident and 1.4% said they were very confident. At the same time, 17% of brand marketers said they were somewhat confident in Amazon, 13% said they were confident and 15% said they were very confident.

Brand marketers were asked to rank how confident they were in each platform or channel to drive marketing success.

Marketers’ trepidation with attributing success to retail media makes sense. While many retailers’ media networks have existed for years, many of them weren’t nearly as focused on bolstering those capabilities as they are now. Given that it’s still early days, it’s easy to see why marketers aren’t yet sure if retail media is currently delivering the success they hope it will. And in Digiday Research from earlier this fall, brand marketers said they aren’t spending ad dollars on retail media and had no plans to do so for the next six months.

Still, retail media continues to be buzzy among brand marketers. “Low confidence doesn’t equal a lack of interest, investment, or attention,” said Joshua Lowcock, chief digital and innovation officer and global brand safety officer, UM. “It’s just a sign that marketers are still trying to make sense of the complexity but do realize the value.”

More in Marketing

CVS Media Exchange bets on solving the measurement gap to stand out in the retail media landscape

Measurement and attribution are common pain points for advertisers looking to track campaign performance in retail media. They’re pain points that CVS Media Exchange, CVS’s retail media arm, which is also known as CMX, is aiming to solve to help it stand out in an increasingly crowded landscape.

After years of caution, pharma advertisers are embracing influencer marketing

Pharma clients used to be wary of the creator economy. Why are they now throwing caution to the wind?

In the marketing world, anime is following in the footsteps of gaming

As marketers look to take advantage of anime’s entry into the zeitgeist, they might be wise to observe the parallels between the evolution of anime as a marketing channel and the ways brands have learned to better leverage gaming in recent years.