This story originally appeared on Glossy, Digiday’s sister publication for all things tech, fashion and luxury.

Luxury brands are putting more resources into China’s booming mobile app WeChat, where they can sell products directly to more than 600 million users.

That’s no surprise. According to Bain & Company’s 2016 survey of nearly 1,500 Chinese consumers, 60 percent identified WeChat and Weibo as their online source for information on luxury goods.

Here’s how Burberry, Coach and Chanel are using WeChat.

Burberry

Burberry is widely recognized as the most digitally savvy fashion house. Its digital partnerships include Snapchat Discover, Apple Music, Instagram and WeChat. Burberry uses WeChat to keep consumers informed about new arrivals, trending products, and further link them back to Burberry’s official website.

Burberry also carved out a section in its official WeChat account to present classic styles and recap its events in order to create a sense of nostalgia. There, followers can learn stories about Burberry Heritage Trench Coat and have a 360-degree view of Burberry’s catwalk extravaganza in 2014. The theatrical performance marked the opening of Burberry’s fourth flagship store in Shanghai and its largest in Asia.

Burberry also uses WeChat for customer service. When this reporter text messaged Burberry’s main WeChat account, asking the most recent promotions and deals in Beijing, the brand answered the request within 24 hours.

Burberry has also run a few WeChat campaigns tied to local festivals. From Jan. 6 to Jan. 19, 2016, for example, Burberry curated a collection of gifts for Chinese New Year on Feb. 8. The brand sent its WeChat followers a photo of a cylinder-shaped gift in gold wrapping and encouraged them to “Shake, tap and swipe to try and open the gift.”

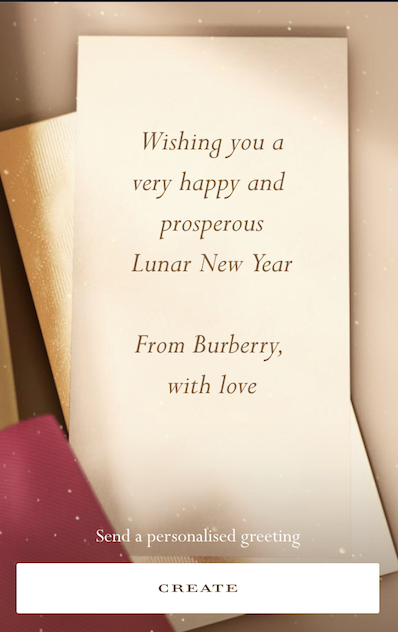

Upon doing so, users received a letter from Burberry and were offered an option of “Send a personalized greeting.” Then fans were able to select the colors of a Burberry cashmere scarf, personalize the greeting and send it to a friend.

After the greeting was sent, users could choose to shop Burberry’s Lunar New Year collection without leaving WeChat. All participants had a chance to win limited-edition Burberry Lunar New Year envelopes that were only available for in-store pickup. This way, Burberry was able to drive foot traffic to its boutiques and drive in-store purchases.

Coach

Where Burberry uses WeChat mainly for content marketing and customer service, Coach makes a big play in product promotions and loyalty programs. Only 17 percent of fashion and 16 percent of watches and jewelry brands have integrated loyalty programs on WeChat, according to researcher L2.

Once a user follows Coach’s main WeChat account, the brand pushes the user to become a member by entering their Chinese mobile number with a chance to win a Coach handbag. Meanwhile, Coach has a dedicated section for its members, where they can manage their membership cards and unlock exclusive offers.

Loyalty programs aside, the “Discover Stores” directs followers back to Coach’s official website and offers a Map to help shoppers find the nearest store. As of June 2015, Coach directly operated over 500 locations across Japan, China, Korea, Taiwan, Malaysia and Singapore.

Coach has also smartly linked WeChat and Weibo with the company website. For example, to celebrate Mother’s Day in 2015, Coach ran a campaign called “#MyFirstCoach” to address how mothers were their daughters’ first coach. Weibo users who uploaded photos of themselves and their mothers had an opportunity to be featured on Coach’s homepage and win a Coach wristlet.

The brand also purchased WeChat Moments ads (minimal entry price for one Moment ad is around $30,380) to promote “#MyFirstCoach.” The campaign increased Coach’s WeChat followers by 35,000, as well as received more than 5,000 submissions and 2 million impressions in three weeks, according to L2.

Coach ran a similar campaign for Father’s Day last year, as well.

Chanel

Like Burberry, Chanel uses WeChat as a content-marketing platform. But instead of running a service account like Burberry and Coach, Chanel is one of the few luxury brands that has a “Subscription” account.

A Subscription account allows Chanel to post content more frequently, but it limits Chanel’s access to mobile commerce features. Through a Subscription account, Chanel is able to build a few mini-sites to offer followers product information, brand history, fashion tests, events, make-up tips and company news, in the form of both text-based articles and video content.

This way, Chanel can engage with WeChat followers without taking them out of a familiar app environment.

Homepage images via Burberry and Chanel.

More in Marketing

WTF is the CMA — the Competition and Markets Authority

Why does the CMA’s opinion on Google’s Privacy Sandbox matter so much? Stick around to uncover why.

Marketing Briefing: How the ‘proliferation of boycotting’ has marketers working understand the real harm of brand blockades

While the reasons for the boycotts vary, there’s a recognition among marketers now that a brand boycott could happen regardless of their efforts – and for reasons outside of marketing and advertising – that will need to be dealt with.

Temu’s ad blitz exposes DTC turmoil: decoding the turbulent terrain

DTC marketers are pointing fingers at Temu, attributing the sharp surge in advertising costs across Meta’s ad platforms to its ad dollars.