Programmatic’s on the rise, but buyers will define “premium” in the future

This article was written by Michael Connolly, CEO and founder of Sonobi.

It’s safe to say that programmatic is here to stay.

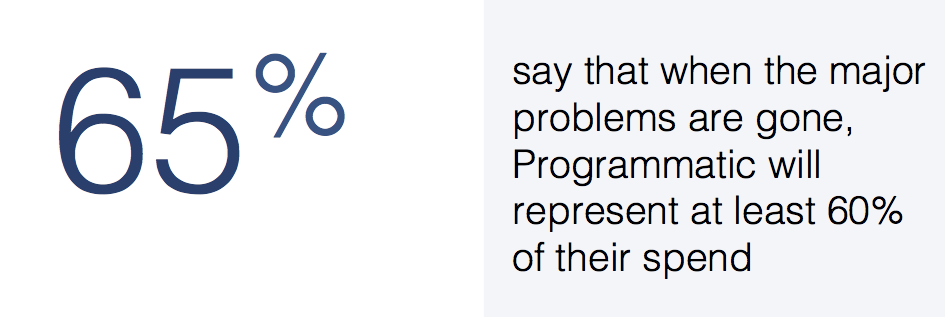

Advertisers have not only validated that buying media powered by impression-level decision logic against a defined set of objectives is the right model – they are looking to increase the percentage of media they buy this way. More, they seek to migrate budgets traditionally managed through direct premium channels to premium programmatic channels.

Publishers have been quick to understand and embrace this shift in buying models, and are anxious to increase the volume of premium inventory they can sell programmatically.

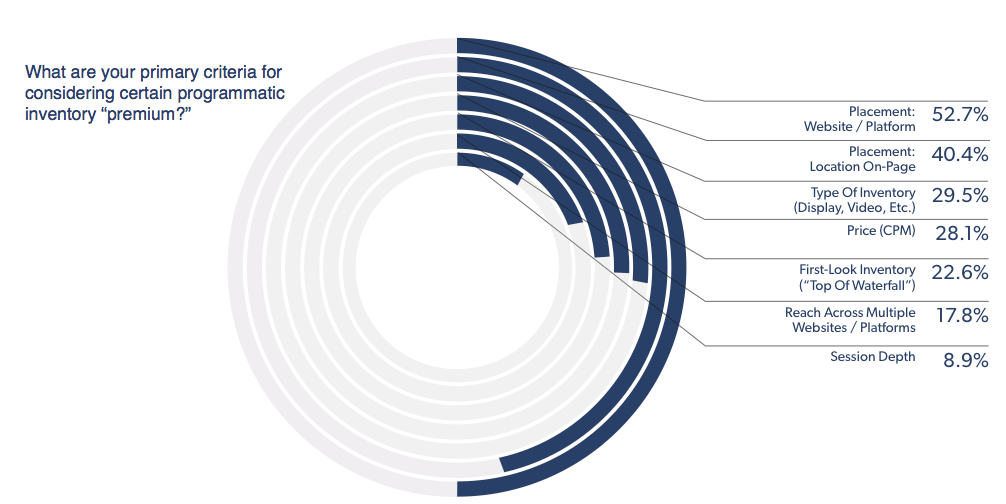

But this implies an important question: what exactly is “premium” programmatic? What qualities must inventory and audiences possess to ensure previously direct premium marketing budgets are funneled through programmatic channels instead?

This is what we set out to understand in our recent State of the Industry research with Digiday, and the answer is surprisingly subjective.

For most advertisers, the first driver of programmatic adoption is audience, and the second is site. When a buyer is able to access their audience directly on a highly desirable media brand, they will invest and pay a premium.

But from there, the research makes it clear that different marketers have different expectations of what defines premium inventory. So what my client considers premium may be very different than what your client considers premium.

The challenge for publishers becomes straightforward: they need technology to isolate the buyer’s audiences against inventory. Then they need to understand what constitutes a “premium” by the standards of each brand they work with, making their inventory available according to these highly specific needs.

Publishers able to meaningfully address multiple definitions of “premium” and integrate their selling efforts accordingly will accelerate revenue growth in the coming year.

Today’s media buyers are savvy. They have a clear idea of what they want. Publishers simply need to listen and provide flexible tools to help them plan, negotiate, and buy premium inventory programmatically based on the criteria buyers value most.

As we see it, there are two core capabilities publishers must master to maximize the high-value inventory they can sell programmatically:

Forecast the audience

Publishers must understand the specific audiences their buyers want to reach. They must size these audiences, and forecast impressions against them that will meet each marketer’s quality and placement criteria.

Guarantee the opportunity

Beyond this, publishers must leverage technology to deliver those audiences.They must prioritize access, and thus be able to issue delivery guarantees to marketers – whether through upfront or spot buying channels.

According to the research we conducted, programmatic revenue is set to exceed direct sales revenue for premium publishers.To profit from this shift, sellers must do what they’ve always done: understand their buyer’s needs and deliver against them.

Technology will help manage what constitutes “premium,” even as it varies from buyer to buyer. But this shift should be exciting, not scary. It will benefit all parties, and the expertise and tools required to manage it exist. This is our mission at Sonobi.

The future belongs to those who embrace this shift; we are there to help those buyers and sellers move forward.

More from Digiday

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.