Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

By now, mobile’s ascent is uncontested. But still unknown is how fast it will continue to climb — and how high it will go.

Start with the usage numbers. Americans spend an average of two hours and 57 minutes a day on mobile devices, a hair more than they do on television, according to app analysis company Flurry. EMarketer expects the global number of smartphone owners to surpass 2 billion by 2016, which represents half of mobile phone owners overall.

With those kinds of penetration and usage numbers, ad spending is also on the rise. Here are the latest projections.

Mobile display revenue will surpass desktop by 2018.

The display ad has seen better days. The rise of ad blocking, coupled with sinking click-through rates and CPMs, has made the display ad format an increasingly tough sell. At the same time, mobile’s prospects are rising as more people around the world get their first smartphones and spend more time glued to their screens. The result is that by 2018, mobile ad spend will overtake that of desktop, according to a recent report from PwC.

Mobile ad share is eating into print, desktop and even television.

While mobile ad spending is on the rise, most of the global spend still goes to television, which controls 39 percent of global ad spend, according to a new report from ZenithOptimedia. Television, however, is showing slight signs of decline. By 2017, its share could dip to 36.8 percent, while mobile’s overall share will climb to 12.9 percent.

Mobile spend is speeding up, while television’s is slowing down.

In terms of growth, mobile is where the action is. Global mobile advertising revenue is expected to climb 52 percent this year, while television ad revenue will increase just 1.2 percent, according to a new report from Magna Global. In absolute terms, though, there’s still a wide gap between the two mediums: Global mobile ad revenue next year will hit $68 billion, while that of television will top $208 billion.

Facebook and Google will keep dominating mobile ad spend.

Still, the mobile revenue opportunity isn’t evenly distributed, and few projections expect that picture to change. This year, Facebook and Google alone will account for half of the $28 billion spent on mobile advertising in the U.S., according to eMarketer. Twitter, the next-largest competitor, will control 4.6 percent, while Yahoo’s share will clock in at 4.1 percent.

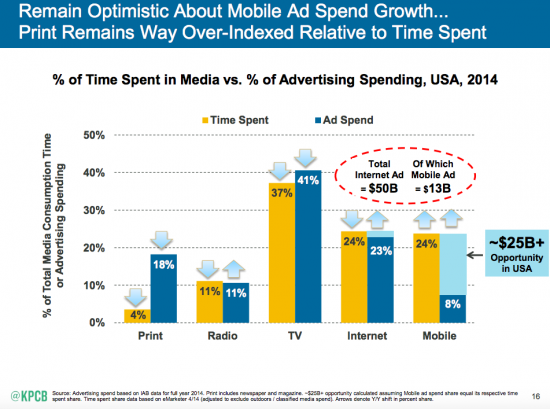

Mobile still isn’t getting its fair share.

One of the most oft-cited slides in Kleiner Perkins analyst Mary Meeker’s Internet Trends Report is the so-called mobile monetization gap: While Americans spend 24 percent of their time using mobile devices, only 8 percent of ad dollars go to the format. That represents a gap of $25 billion, according to Meeker. Contrast that with newspapers, which command 18 percent of ad spending despite the fact that Americans spend only 4 percent of their time on the format.

More in Media

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.

Overheard at the Digiday AI Marketing Strategies event

Marketers, brands, and tech companies chat in-person at Digiday’s AI Marketing Strategies event about internal friction, how best to use AI tools, and more.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.