Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘The Big Bang has happened’: Reach gets proactive on AI-era referrals, starting with subscriptions

A series talking to C-suite executives about the strategies guiding their bottom lines. More from the series →

A year of painful cuts and strategic shifts has reshaped Reach’s business. Next year, the publisher wants to show it can punch back in an AI-driven market.

This week, the publisher of national U.K. titles Daily Mirror, Daily Express and Daily Star, is rolling out its first paid digital subscriptions — a big departure from the free, ad-funded model it’s had throughout its 120-year history.

It’s the first in a string of changes planned within the publisher, which includes reshaping its newsroom more acutely around video production — all changes designed to safeguard its presence in the AI era, where referral traffic no longer helps pay the bills.

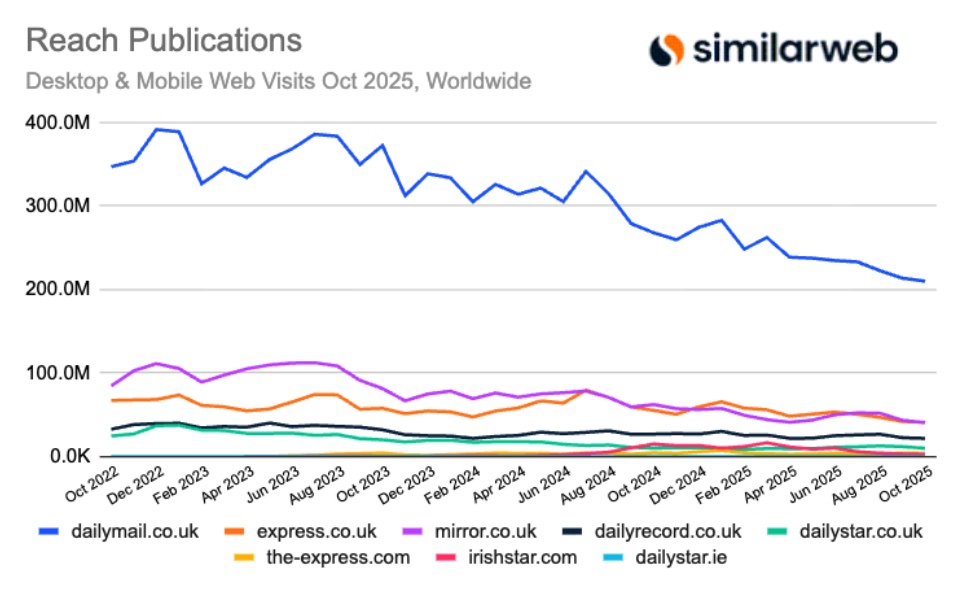

In the last year, Reach’s combined traffic across the Express in UK and US, Mirror UK, Daily Record, Daily Star UK, Irish Star and the Daily Star, have dropped by approximately 30 percent year over year in October — a drop of 51.6 million visits, leaving October’s total visits on those sites at 123 million, according to Similarweb data. (Reach also owns OK! Magazine, Sunday People and dozens of regional sites not included in this data.) That’s in line with what many sites have experienced over the last year due to Google search volatility and the erosion of AI summaries. Forbes recently told Digiday it had experienced a 40 percent drop in traffic this year; meanwhile, the Daily Mail saw a 22 percent YoY drop in October, losing 58 million visits, per Similarweb data.

However, Reach CEO Piers North cautions against reading too much into big headline percentages about search declines. A double-digit drop might sound dramatic, but if a publisher only gets a small share of traffic from search, it may not mean as much in absolute terms (AKA revenue fall) he stressed. He added that even within Google there isn’t a single, unified trend: Search, Discover, and Google News all behave differently, which makes the referral picture far more complicated than a single number suggests.

He’s under no illusion that the traditional referral landscape and business model has shifted, it’s just not clear that it’s been one single source (Google AI overviews etc) that’s caused it.

“There is no question a Big Bang has happened,” he told Digiday. “And what you’ve seen is the universe has kind of massively expanded, but the number of stars has remained the same, and what has filled it is like dark matter. It’s this space that we’re not quite sure what is there. Is the traffic going elsewhere? To AI [Google] Overviews? We genuinely don’t know what happened. What we do know is something has happened in that space, and we’re looking for all the signals to work out what that is. But our traditional referral model is challenged,” he said.

In its 2025 third-quarter earnings, Reach cited a 2 percent growth in digital revenue, and it’s currently guiding flat, which it has attributed largely to referral volume erosion. “Realistically, we need it to accelerate way faster than 2 percent,” said North, who took the helm this March, from his former role as chief revenue officer. He noted that the mix of indirect revenue (mainly open-web programmatic and platform distribution) can move in strange ways. For example, programmatic display might fall while Facebook distribution revenue rises, making the overall picture harder to predict. His bottom line: regardless of the mix, Reach needs to get back to overall digital growth.

“Every quarter is tough at the moment…you can’t divorce the macro headwinds from any publisher. That said, there are still loads of opportunities,” he said.

“We can’t accept that our indirect revenues are just going to disappear because search is changing. If that is true, and the open marketplace, or search marketplace, is going to change, then we need to find compensation methods,” he said.

Giving readers more ad-free content experiences

Reach was the last major British commercial publisher to hold out on pushing into digital subscriptions. The aim is to keep the majority of its sites free to access, but to gradually roll out a premium tier of paid-for content, starting with its regional titles.

The shift isn’t just another product launch — it’s a signal that even the scale tabloids that once swore off paywalls are retooling their models for the AI era. “As search changes, we need to think around: how do we best fit a publishing business to take on the new world?” North told Digiday.

The first stage of its subscription rollout will begin in the coming days for Manchester Evening News, priced at £1 for the first month, rising to £4.99 ($6.56) a month after that. An annual subscription is £39.99 ($52.58). It will likely tweak the pricing depending on uptake, which it will monitor via its subscriptions vendor Piano.

Readers on the site will see premium-labelled articles on in-depth, long-form articles, which will take them to a paywall and messages to subscribe will be served to people on their return visits to the site, so as to target the most loyal readers. Premium subscribers will get access to all exclusive content and access to additional offers like discounts on the OK! Beauty Box and printed products.

The Liverpool Echo and WalesOnline will follow with paid subscription offers in the coming weeks, with more titles to roll out in 2026. Reach hired its first digital subscriptions head Harry Fawkes, in September, to lead the charge. Fawkes was previously head of subscriptions for The i Paper.

Its long history of free-to-access content has meant the publisher has drawn criticism over the years for having too many ads cluttering its onsite experiences, particularly on its tabloid-style brands. North said that’s been a necessary trade-off for a free-to-access site to monetize itself effectively. But the subscriptions open the door for those who’d prefer to have fewer ads in exchange for a cleaner site experience.

He noted that the publisher’s first foray into subscriptions is going to involve learning as they go. In time, the aim is to have the regional titles subscriptions pave the way for subscription tiers across the group’s portfolio, including its national titles.

“If I had a magic wand, you’d be signing up to the whole portfolio,” said North. That would mean having a single Reach account that works across its full portfolio from its OK! Beauty Box product subscription and archive photo purchases to print and digital newspaper subscriptions. The aim is to give users one login for everything and to surface more of the company’s brands to readers who may only know one title.

But he stressed that this will take time. “We’re going to still be an ad-supported business. It’s just about providing that little top of the pyramid, because, at the moment, we’re a pyramid without its top.”

Being proactive about the changing referral ecosystem

He said the shift to subscriptions hasn’t required major newsroom changes yet, beyond hiring a head of subscriptions, investing in Piano and building a small team. But he acknowledged that some of Reach’s strongest journalism doesn’t always travel well on Facebook or in Google Discover, which raises questions internally about its value under a purely distribution-driven model.

Subscriptions, he said, give that kind of work more room to breathe. It forces Reach to think more deliberately about which content is meant for mass reach versus engaged, loyal readers — a model already working well for smaller subscription-based publishers like Manchester Mill and various Substack writers who “aren’t playing the Discover game,” noted North. “We need to play in that space as well,” he added.

Another major priority is tech and AI, both from managing the hit to referrals and using the first-party data it has built through its customer value strategy in the last five years, which has involved setting aggressive registration targets and generating millions of signed-in users whose data it can use to personalize content and ads.

Like most publishers, Reach will invest more in video, which currently accounts for approximately 20 percent of its business, per North. The publisher announced in September that it had to cut 321 employees, with plans to create 135 new roles with a focus on video.

North said he wants more video consumption on its own sites, where the economics are strongest. But with referral traffic under pressure, it’s harder to scale on-site video when audiences are spending hours on TikTok, YouTube and Instagram, he said. That’s why it plans to scale up its internal video talent, while leveraging AI to take “the mundane” out of video editing. Exact roles are yet to be firmed up, but they’ll be specific to what’s needed to ensure it can ramp up the kind of video people want to consume, both across its high-production output like “All Out Football” and more social video distribution.

Reach isn’t among the handful of media giants that have secured major lump-sum licensing deals with the biggest AI companies. But North believes AI licensing in some form will show up in Reach’s revenue mix, especially with how the market is moving toward pay-per-use licensing.

“AI engines will differentiate themselves by the quality of their output… I think the market will settle down, and we will get to the point where both parties, the people who provide the content, AKA the data, will understand the value, and the AI companies themselves will start to realize the importance of their engines being only so good as what they’re being fed,” he said. “Because right now, do consumers really understand or detect the difference between Gemini, Copilot, ChatGPT – all of them?”

More in Media

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.

Overheard at the Digiday AI Marketing Strategies event

Marketers, brands, and tech companies chat in-person at Digiday’s AI Marketing Strategies event about internal friction, how best to use AI tools, and more.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.