Secure your place at the Digiday Publishing Summit in Vail, March 23-25

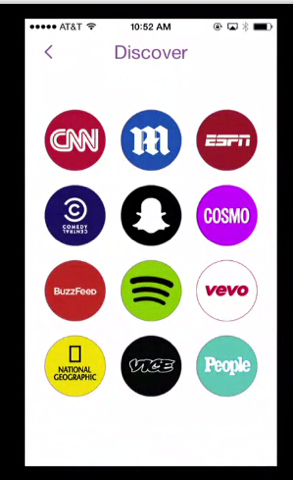

Snapchat is in negotiations with Comedy Central, Spotify and Vice for the upcoming launch of Discover, a section within the app that will serve users articles, music and video produced by prominent media companies, according to people familiar with the matter.

Other media companies that Snapchat is in talks with include BuzzFeed, CNN, the Daily Mail, ESPN, Hearst (Cosmopolitan magazine), National Geographic, Time Inc. (People magazine) and Vevo, according to a mock-up of the Discover section obtained by Digiday.

Spokespeople at ESPN and Vevo confirmed that they were in conversations with Snapchat about Discover, while all of the other media companies featured in the mockup either declined to comment or did not respond to comment requests at the time of this writing. Snapchat declined a request to comment.

The Wall Street Journal previously reported the section will be called Snapchat Discovery, but it’s unclear which name Snapchat will ultimately use.

The conversations illustrate just how grand Snapchat’s media distribution ambitions are. It’s natural for Snapchat to want to partner with Comedy Central and National Geographic since they specialize in creating compelling video and still imagery, the two kinds of messages Snapchat trades in. But Snapchat also wants to serve its users text and audio, which would make it an all-inclusive media consumption app.

Those text partners include venerated old-media publishing houses Hearst and Time Inc. as well as upstarts BuzzFeed and Vice — which, like Snapchat, boast sizable young audiences and growing media offerings.

Part of the Discover partnership will include original content created by those companies, according to sources familiar with the talks. Snapchat is also urging these media companies to seek brands that want to advertise against the media they will distribute on Discover, with Snapchat retaining a portion of the revenue.

True to Snapchat’s form, the media distributed through Discover will have a truncated shelf life: After a certain amount of time, it will no longer be available, thus encouraging users to check in routinely.

That doesn’t mean all the media in Discover will be short, though. People familiar with Discover said it will host stories of all lengths. As Pew research has continuously found, longer stories have thrived on mobile, despite the assumption that smartphones are only for short bursts of consumption.

Discover was originally slated to be released in November, but technical issues with its launch have put its debut date in question, according to those familiar with the situation.

Snapchat’s Discover strategy is nearly identical to Facebook’s recent proposal to publishers, in which it is has offered to host publishers’ stories within Facebook’s app and give publishers a cut of mobile ad revenue in return. Snapchat CEO Evan Spiegel famously rebuffed a $3 billion buyout offer from Facebook CEO Mark Zuckerberg. Facebook responded by launching a Snapchat copycat app called Poke that failed to attract an audience. Now the notoriously cavalier Spiegel is directly competing with Facebook’s mobile media distribution plans.

But Facebook’s pitch to publishers elicited a strong backlash from the publishing community, many of whom felt that publishers hosting their stories on Facebook would give the already powerful social network too much leverage.

Given the breadth and prestige of the companies at least interested in speaking with Snapchat, it appears that the media world is open to hearing what the app has to say — for a limited time at least.

Image via Shutterstock

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.