Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Snapchat appears ready to unleash its inner ad beast, according to publishing partners.

The Los Angeles-based messaging company has signaled a willingness to expand the number of sponsorships it allows on media channels and to increase the frequency of ads served to each user, said sources with knowledge of the conversations taking place.

“We have talked to them about some changes to ads,” said one source who spoke on the condition of anonymity. “They’re talking about different rules like the number of edition takeovers that are allowed and frequency capping so the user doesn’t see the same thing over and over again.”

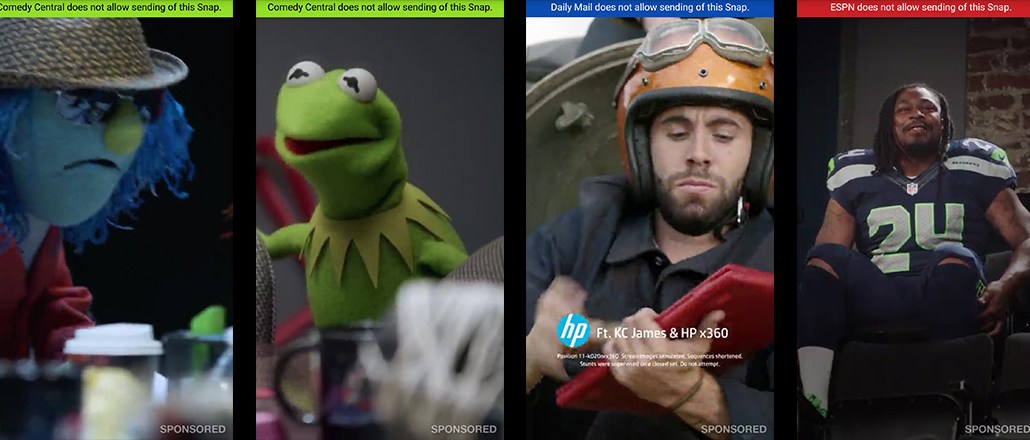

These rules apply to Snapchat’s Discover channels, which launched at the beginning of the year and are run by media companies like BuzzFeed, ESPN, Cosmopolitan, Comedy Central, IGN, Vice, Refinery29 and others. The partners publish daily editions with specially crafted content targeted to the app’s young audience.

An edition takeover, for example, is when a brand sponsors all the content on a channel for the day. A few partners have reported selling out of edition takeovers with ease and have expressed desire for more flexibility to deliver more orders.

Snapchat and the publishers work closely on selling sponsorships and educating brands on how to build the best ads. They sell for a minimum of 2 cents a view, but publishers have said they can charge more if they can get it.

It also tightly controls the advertising parameters, because of the classic Internet dilemma — how to grow an ad business while staying true to the user experience.

“I am consistently impressed with their regard for their user base and not wanting to do too much,” the source said. “They are super sensitive about not overwhelming the audience with advertising.”

This attention to users has limited the ad potential, however, the same source said. This summer, Ad Age reported that publishers were only allowed to sell five edition takeovers a month.

It was unclear how many takeovers Snapchat would eventually allow for each publisher, but it has shown an interest in increasing the maximum, the sources said. The company also could increase the number of brands a user can see every day: The current model only shows an individual user one set of sponsors for the day on a given Discover channel. That means if a user visits the same channel more than once a day, it will see the same set of ads.

Publishers think they could increase their ad haul if they could deliver a new set of ads to repeat viewers.

The ability to double up ad sales against the most active users would mean more money for publishing partners — and Snapchat, of course. Some of the top publishers on Discover have said they can attract more than a million viewers a day, and the platform is becoming a consistent source of revenue for the more successful ones.

Snapchat declined to comment for this story.

Snapchat also has a Live Stories section where some Discover partners post videos from major events and sell ads amid the footage. The platform also recently launched Sponsored Discover channels, where brands create their own content dedicated to a single product. And now there are Sponsored Lenses, too.

The growing mix of ad products is seen as an inevitability for a company that has promised to focus on making money for investors. Snapchat is on pace to make $100 million a year, according to sources that confirmed a recent report from Business Insider.

“Snapchat is still so young so the rate of change you see from them is phenomenal,” said an ad agency executive, speaking on condition of anonymity. “Things change dramatically when you’re in the early days of building an ad business.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.