Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Google and Facebook make up less than 5 percent of publishers’ digital revenue

Google and Facebook are the biggest tech companies in terms of advertising and biggest traffic sources for publishers, but they still only account for less than 5 percent of publishers’ digital revenue, a new report from publisher trade group Digital Content Next shows.

Looking just at the revenue publishers make from their distributed content, across sources like Facebook Instant Articles, Google AMP and Instagram, Google and Facebook account for about 30 percent, according to the Distributed Content Revenue Benchmark Report, which will be released Feb. 8.

The report is notable because there isn’t a lot of industry data about how much revenue publishers are getting back from the platforms they heavily lean on to distribute their content. A survey last year by WAN-IFRA members similarly found that Facebook was responsible for an average of 7 percent of digital revenue.

This is the second year DCN has done the report, and what’s significant is that the revenue publishers are taking in from third-party platforms has barely budged in a year — despite platforms’ gestures to help publishers to help them better monetize their content as the platforms, particularly Google and Facebook, tighten their grip on digital ad spending.

In the first half of 2017, publishers that took part in the study took in $10 million from third-party platforms, representing 16 percent of their total digital revenue. That’s nearly flat with the first half of 2016, when third-party revenue was 14 percent. That’s pocket change for Google and Facebook, which together took in more than $52 billion in digital ad revenue just in the U.S. in 2017.

“The biggest surprise is how little has changed,” DCN CEO Jason Kint said. “You’re still looking at a situation where the best in class in news and entertainment isn’t being supported in a way it should be.”

The report was based on numbers reported by 20 members of DCN, which represents 75 digital content publishers including The New York Times, ESPN and PBS. (About two-thirds of that 20 are the same as the comparative group of the earlier report, so the comparison isn’t perfect.)

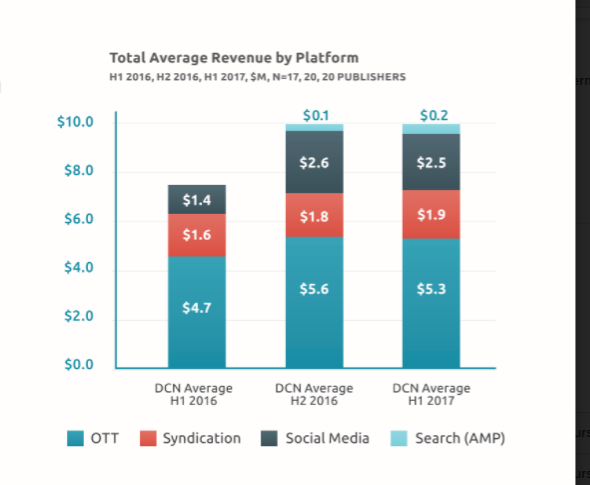

The report also shows that video revenue continues to drive monetization for publishers. Video represented about 85 percent of all third-party revenue. That might seem like a vindication for publishers that have organized their businesses around video, but the reality is that most of the video dollars went to companies that were established video producers. TV/cable companies reaping a disproportionate share of third-party platform monetization and growth through OTT and syndication partners including YouTube. OTT sources like Roku and Amazon represented more than half the distributed content revenue (see chart below). Also, video is more expensive to make than text content, which makes the distributed video dollars less impressive.

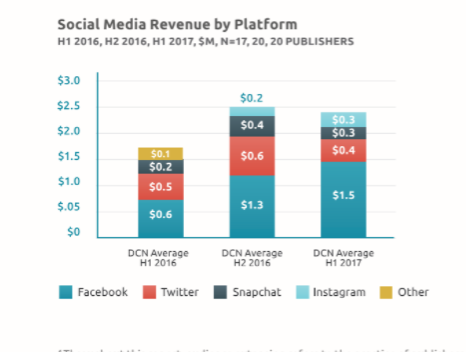

For all the attention the social platforms outside of YouTube get, they accounted for a smaller chunk of the revenue. Facebook, Twitter, Snapchat and Instagram represented just $2.5 million of the total $10 million in publishers’ distributed-content revenue. Facebook drove more than half of the social media revenue pie (see chart below), increasing slightly from the second half of 2016 to the first half of 2017. Twitter, Snapchat and Instagram each represented a sliver, reflecting the fact that those platforms are hard to scale and it can be labor-intensive to create content for them. Snapchat is a closed platform, and publishers have to be picked to join its publishing section, Discover.

The DCN report comes at a time of growing publisher frustration with the monetization they’re getting from the platform giants, which has led some to scale back the amount of content they distribute there and think twice about dedicating resources to make content specifically for those platforms with too little or uncertain benefits in return. They’re also facing fresh concerns with Facebook announcing in January it would show less news in the news feed.

More than the revenue share, the traffic cut will have a bigger impact on publishers, most of whom weren’t living on distributed-content revenue anyway, said Jim Spanfeller, founder of Spanfeller Media and now a consultant.

“The revenue stuff was gravy,” he said. “The traffic people get from Facebook is going to go down dramatically, which is probably the most important thing. If you get 40 percent of your traffic from Facebook and if that gets cut in half, your business is crushed. The second issue is, publishers were getting relatively cheap reach on Facebook for native content. If that costs more, that’s obviously a big issue.”

The big catch for publishers is that they have little leverage individually with the platforms and they still get a lot of audience exposure by being seen there, which makes pulling out unrealistic.

“A lot might say it’s not worth it to give up prized assets if you get such a small percent of revenue,” Kint said. “But users are going to Facebook more and more for news and information. You have to match up the interest with the value in the platforms. There’s two big gaps: Where users are going and whether content’s properly valued, and where people are going and do they trust those platforms.”

More in Media

In graphic detail: Middle-tier creators are fueling the next phase of the creator economy

Facts and figures behind the growing middle tier of creators who make less than macro creators, but convert more.

How medical creator Nick Norwitz grew his Substack paid subscribers from 900 to 5,200 within 8 months

Creator Playbook: Unpacking the strategy behind medical YouTuber Nick Norwitz turning to Substack to significantly grow his brand.

Media Briefing: In the AI era, subscribers are the real prize — and the Telegraph proves it

In an era where AI is eroding referral traffic and third-party distribution, a subscriber who pays directly has become the most valuable reader a publisher can own. Springer just bought over a million of them.