Digiday Research: Contextual targeting will have its renaissance

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

There is a lot of uncertainty about how the coming Google changes will affect the ad-buying habits of brands and agencies.

But publishers that have been hoping for a return to more contextual targeting can rejoice.

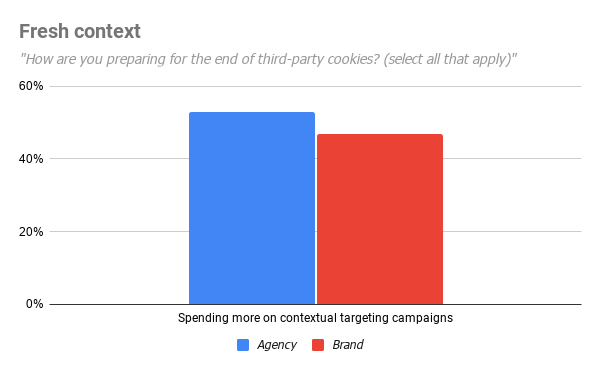

Digiday polled 146 buy-side professionals about how they and their employers were preparing for the end of the third-party cookie and found that slightly more than half of respondents said they would be spending more money on ad campaigns that used contextual ad targeting.

More respondents named contextual targeting among their approaches than “investing in technology to acquire more first-party data” and “using ad tech-built cookie alternatives.” Only one option — “revising attribution/measurement frameworks” — was selected by more respondents.

After years of losing ground to tracking tactics that allowed companies to track people’s behavior across the internet, contextual ad targeting has finally come back en vogue, partly because it offers ad buyers a mixture of privacy compliance and scale that, to date, third-party cookie alternatives do not.

It has also gotten considerably more sophisticated, as publishers have built their own identifiers and developed deeper, more nuanced understanding of the audience cohorts and segments their content attracts.

Contextual targeting still presents challenges to ad buyers — there is no uniform definition or taxonomy for audience segments, for example.

But as ad buyers continue to prepare for the end of third-party cookies, significant numbers of them are going to gravitate toward what they know works, particularly as the coming changes scramble targeting and measurement methods that ad buyers have been honing for years — 69% of the survey’s respondents admitted that they were worried about their ability to target and measure ads without third-party cookies.

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.