Last chance to save on Digiday Publishing Summit passes is February 9

In the shift to mobile, the tech cognoscenti agree that apps have trounced the mobile Web. Tell that to the publishers.

Despite over 14,000 apps in the Apple Newsstand alone, publishers have churned out apps in the hopes of getting a coveted piece of real estate on home screens.

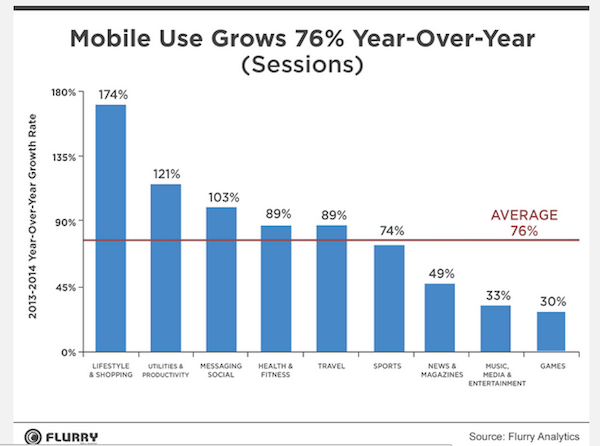

And yet, news apps are becoming marginalized, according to Flurry. Across all mobile devices, app usage exploded in 2014, with user sessions up 76 percent, according to the analytics company. But the fastest growth occurred in shopping, productivity and messaging apps, while growth of news, media and games apps tapered off. The New York Times specifically has struggled to attract new readers with new ancillary apps.

Exact figures for publisher apps are hard to come by, but in the case of consumer magazines, digital subscriptions remain a tiny portion of their total circulation. Across 367 consumer magazines tracked by the Alliance for Audited Media, digital subscribers stood at 3.8 percent of their total circulation in the first half of 2014, up only from 3.3 percent a year earlier. As small as that percent is, it’s completely inflated by one publication: Game Informer, which accounts for about one-third of all digital editions.

“People keep trying, but at this point, the outlook is not good for apps,” said Steve Goldberg, managing director at Empirical Media, which consults to publishers. “It’s important that your content is accessible no matter where people want to access it. As a general rule, you get a very good user experience in an app, and you’re serving your best customers. The big challenge is, no one has really come up with a substantive way to monetize them.”

Publishers defend their apps on the basis of the consumer connection they foster, if not the ad revenue. Men’s Fitness has published two single-topic products and plans to do four this year after seeing people spend better than average time with them, publisher Patrick Connors said. Men’s Health charges about $23 for an annual subscription to its digital edition, making it a profitable, if small, business line, publisher Ronan Gardiner said.

“Certainly, from a circulation percentage it’s proving more of a revenue driver than an advertising perspective,” Gardiner said. “We do think there’s still an opportunity for it. It’s just not as great as we hoped it would be.”

It’s not just legacy publishers, either. Despite mounting evidence that news apps are not the way to go, digital natives like NowThis, BuzzFeed and Circa are all betting on apps as their core business or a complement to it.

Likewise, despite general industry trends, Tribune Broadcasting is rebuilding the apps for its 40-plus TV stations to make them more customizable.

“We see it still as an onramp to our content,” said Devin Johnson, svp and head of digital media at Tribune Broadcasting. “The app users are the crown jewel of the mobile world, because they’re seeking it out. They’re the most engaged users.”

Homepage image courtesy of Shutterstock

More in Media

Brands invest in creators for reach as celebs fill the Big Game spots

The Super Bowl is no longer just about day-of posts or prime-time commercials, but the expanding creator ecosystem surrounding it.

WTF is the IAB’s AI Accountability for Publishers Act (and what happens next)?

The IAB introduced a draft bill to make AI companies pay for scraping publishers’ content. Here’s how it’ll differ from copyright law, and what comes next.

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

Q4 gave publishers a win — but as ad dollars return, AI-driven discovery shifts mean growth in 2026 will hinge on relevance, not reach.