Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Snapchat and Twitter are trending in opposite directions in the eyes of investors.

Last week, Snapchat’s IPO was speculated to have a $25 billion value. Meanwhile, Twitter’s bidders have backed off. “Twitter has not succeeded in monetizing the platform,” said media analyst Rebecca Lieb. “And Snapchat is the darling of the moment.”

But how did we get to this point? Here are five charts that show why Snapchat is sparking excitement while Twitter inspires indifference.

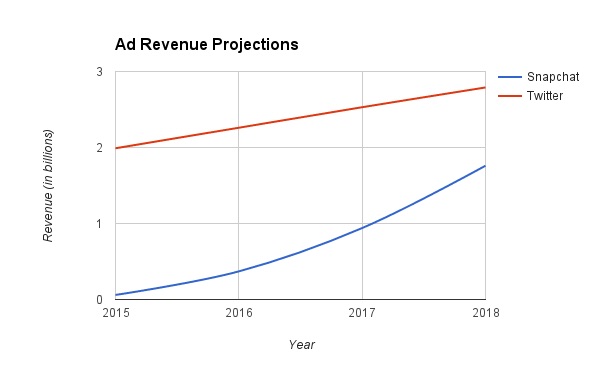

Ad revenue

Twitter is about twice as old as Snapchat and has been generating revenue far longer than the ephemeral communication app has. But eMarketer projects that Snapchat will quickly catch up. By 2018, it’s projected that Snapchat’s ad revenue will close within a billion dollars of Twitter’s ad revenue.

Jane Quigley, chief client officer at social media consultancy Converseon, said that part of the reason analysts are bullish on Snapchat advertising is because its ads are more seamless for users than Twitter’s. “Twitter’s brand experience has to get a lot better,” she said. “Right now, ads just show up that don’t add to the user experience. And they can be really intrusive.”

Altimeter Group analyst Brian Solis added that Snapchat has done a better job of “being careful of user experience and commanding a premium for advertising.”

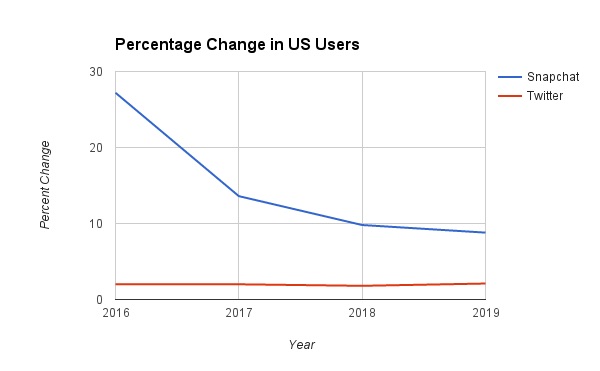

User growth

Like its revenue projections, Snapchat’s user base is expected to grow significantly. Twitter’s user base is expected to expand just moderately.

EMarketer projects that while its growth will slow, Snapchat will still far outperform Twitter, nearing double-digit user growth in the U.S. over the next few years. And while Twitter has a greater reach internationally, in the U.S. its user base is expected to grow just about 2 percent annually for the next few years.

“Twitter’s user base has somewhat plateaued,” Lieb said.

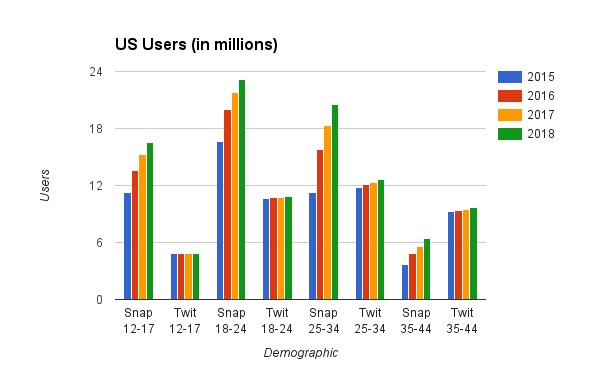

Growth by demographics

A growing user base is usually attractive to investors. But for Snapchat, it’s where the growth comes from that’s particularly intriguing. Because advertisers hope that Snapchat will give them a way to reach the elusive millennial audience.

According to eMarketer, Twitter’s reach with young people will remain stagnant while young people will continue to adopt Snapchat in droves.

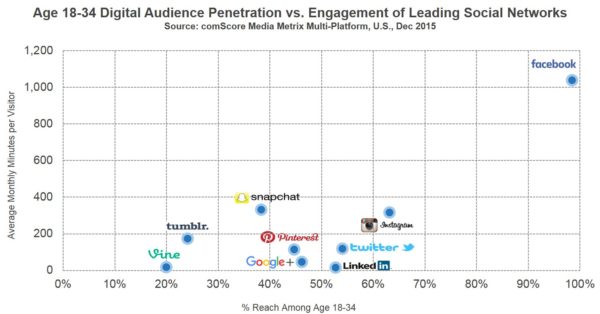

Time spent on platforms

Each platform uses different engagement metrics to drive their agenda. Which is why “engagement numbers are controversial at best,” Solis said.

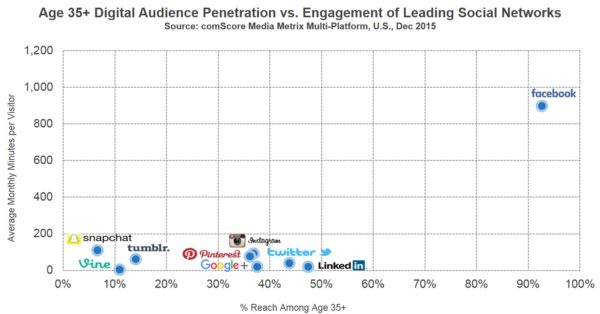

Although people use Snapchat and Twitter in much different ways, one way to standardize engagement is to look at time spent on the platform. And by this metric, Snapchat performs better than Twitter at engaging both young and old audiences, according to comScore data.

While Snapchat’s engagement numbers and projected revenue and user growth are favorable compared to Twitter’s, Lieb points out that Snapchat’s advertising products are still quite young.

“It’s incredibly early,” she said. “When it’s incredibly early, there’s a lot hope. Just like there was a lot of hope six years ago with Twitter. It’s important to keep that in context.”

More in Media

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.