Secure your place at the Digiday Publishing Summit in Vail, March 23-25

As a Digiday+ member, you were able to access this article early through the Digiday+ Story Preview email. See other exclusives or manage your account.This article was provided as an exclusive preview for Digiday+ members, who were able to access it early. Check out the other features included with Digiday+ to help you stay ahead

As President Donald Trump leans on tariffs as a global bargaining chip in trade negotiations, the digital services tax (DST) is back in the spotlight — this time as politicians across Europe weigh it as a potential point of leverage.

Below we break down what the DST is, how the U.S. has responded to it so far and what it could mean for the advertising industry.

What is the digital services tax?

The DST is a levy that’s been imposed by certain countries on revenue generated by digital services like social media platforms, search engines or even online marketplaces.

Currently, the U.K., which launched its DST in April 2020, imposes a 2% tax on companies that have a global revenue of £500 million ($659.2 million) or more.

The European Union started out by introducing a 3% levy in 2018. However, this was just an interim measure that was adopted while the EU waited for broader international reforms, such as what’s available under the Organisation for Economy Co-operation and Development’s pillar one framework. The OECD framework aims to ensure large multinational enterprises, including those whose users and consumers are located in countries where they don’t have a physical presence, can still be taxed accordingly. However, OECD negotiations stalled while the U.S. withdrew from those talks in January.

The move means the EU still doesn’t have a unified way of dealing with the DST.

OK, so what’s the point of it?

Some governments view the DST as a way of clamping down on digital businesses that operate across borders. Typically, they do so and make tons of cash while paying pretty low taxes. This has sparked concerns among politicians and society in general over how fair this actually is, given how much revenue for public spending is otherwise lost as a result.

Simply put, the DST is meant to help ensure tech giants pay what these countries believe is a fair tax.

“The reason DST is considered is because creating a global agreement on a fairer distribution of tax income has been slow,” said Karsten Weide, principal and chief analyst at W Media Research.

Right. So who does the digital services tax apply to?

Given the nature of the businesses, the DST primarily targets large tech behemoths, most of which are headquartered in the U.S. and operate globally. So, think Meta, Amazon, Google, even Apple.

Have there been any concerns or criticism about it?

Unsurprisingly, since this really hits U.S.-based mega platforms, politicians aren’t too happy about it. In fact, both the Biden and Trump administrations responded with retaliatory tariffs.

Retaliatory tariffs? Has that been the U.S.’s response to the digital services tax?

Yep. When Biden was in office, he imposed tariffs on countries including France, the U.K., Italy and Spain — but these were suspended to allow negotiations to take place under OECD’s pillar one framework.

However, as mentioned above, President Trump withdrew from those chats in January. And shortly after on Feb. 21, Trump signed an executive order to investigate DSTs imposed by countries including France, the U.K., Italy, Spain, Turkey, Austria and Canada — the first outcomes of which will be published in the America First Trade Policy Memorandum.

Does the DST stand to have an impact on advertising?

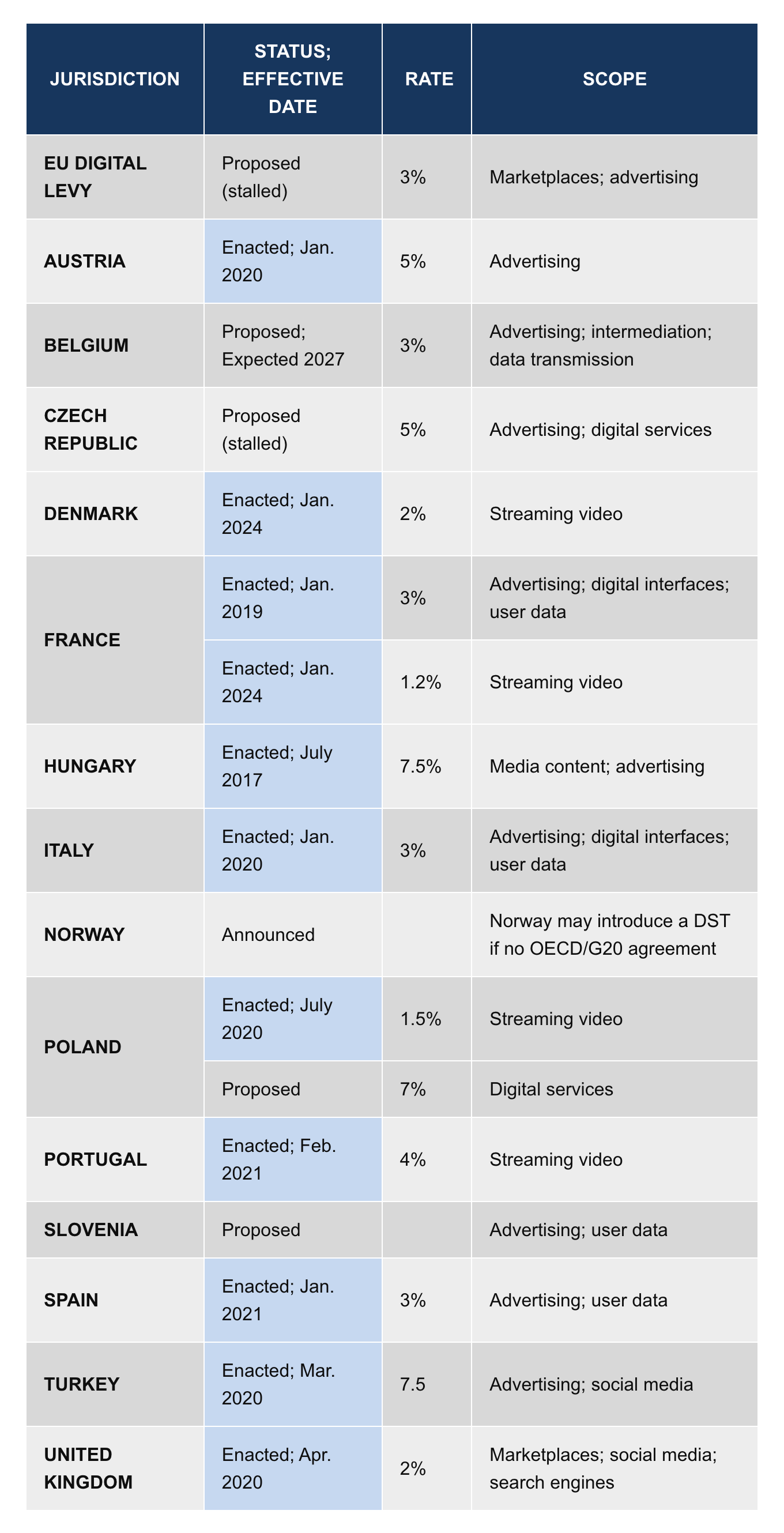

In short: yes, but not everywhere. According to law firm Skadden, Arps, Slate, Meagher & Flom, these are the levies and what services will be in scope across the EU and the U.K.:

“DST decrease profitability, hurting publishers and vendors and giving them less incentive to invest,” Weide said. “Worse products and services are the result, slowing advertiser spend.”

However, each platform has taken its own stance as to how it’ll front the DST levy.

Google and YouTube, for example, have passed the cost of DST onto their advertisers. In the U.K., where the DST levy is 2%, advertisers serving ads in the U.K. across the two platforms will be charged an additional 2% on top of their usual ad budget.

However, Amazon has taken a different approach. The tech giant has chosen to pass its DST costs onto third-party sellers by increasing seller fees, rather than lumping the cost on advertisers.

Apple has taken a similar stance by pushing the tax burden to app developers who use its platform.

Meta has chosen to absorb the cost itself — the only platform to do so.

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.