Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Even for a $260 billion commerce giant like Walmart, Amazon is a foe best not approached head-on. Instead, Walmart has crafted an e-commerce strategy that’s decidedly un-Amazon: Walmart isn’t hung up on people buying things online.

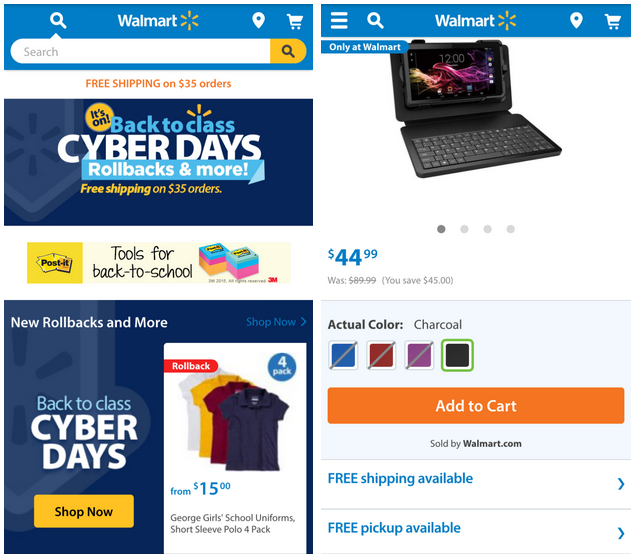

Instead, Walmart is flexing a resource that Amazon lacks: 11,000 global storefronts that can serve as online order pick up locations and shipping fulfillment centers. But there’s one area Walmart is aiming to be very Amazon-like: Providing a great user experience, only Walmart views its user experience as stretching from the online, on mobile and in-store.

Walmart’s Silicon Valley tech and innovation arm, @WalmartLabs, is dedicated to building out and improving the company’s online and mobile commerce experience. One of the lab’s main priorities is restructuring the retailer to better reflect the behavior of the omnichannel consumer.

“Our customer is shopping on mobile, online and in stores,” said Bao Nguyen, a spokesperson for Walmart’s global e-commerce. “So our focus is on how to work with our stores to connect the digital and physical experience, and ensure our customer has a relationship with us across the stores, online and mobile.”

After relaunching Walmart.com in August last year, Walmart announced in February that it would devote more than $1 billion to improving its e-commerce business. The retailer’s online component is currently being blown away by Amazon: In 2014, Walmart’s online sales were $12.2 billion; Amazon’s were $89 billion. In April, the breadth of Walmart’s e-commerce offerings amounted to 1 percent of Amazon’s. So, Walmart is anchoring its digital counterpart with its storefronts.

According to Nguyen, the company’s digital strategy is optimized for one of the primary ways the customer uses the site: to research and prepare for an in-store visit. That’s a very different use case from Amazon’s.

“Their target is people who know Walmart, and know they can trust their low prices,” said Vilia Ingriany, lead of UX at Fantasy Interactive, and Bojan Wilytsch, FI’s design lead. “On the website, they’re paying attention to not overloading people with too much. It’s streamlined.”

As Walmart beefs up its e-commerce strategy to serve the omnichannel consumer, its brick-and-mortar stores still play an integral part in its digital offerings. Walmart’s physical stores (5,200 of which are in the U.S.) have proven valuable: When Walmart launched a sale on July 15 in response to Amazon Prime Day, Nguyen said the number of online orders designated to be picked up in a store increased by 300 percent.

“Building our e-commerce capabilities means connecting physical and digital,” said Nguyen. “That means leveraging touch points we have to get an order to our customer, and that’s largely our stores.”

Still, during the online and mobile shopping processes, Todd Lefelt, managing director of UX at Huge, felt Walmart could elevate its in-store pickup option. “Brick-and-mortar is Walmart’s biggest competitive advantage, so it would be smart to highlight the ‘My Store’ feature more prominently throughout the checkout process,” he said.

Ingriany agreed, saying Walmart would benefit by actively encouraging users to pick up in stores, but said the company does a good job in letting shoppers know if a product is available in a nearby store.

“I think Walmart has tried to simplify a lot of things to the minimal, and you can see that in the look and feel of the website,” said Ingriany.

Minimalism is important for a clean, friendly UX, but it only counts if the process is efficient. At the point of transaction, Walmart has done away with the option to checkout as a guest, following suit with Amazon. The point, according to the company, is to be able to know more about the customers making purchases online. Ingriany said that this could deter more casual users, especially since unlike Amazon, Walmart doesn’t offer one-click checkout.

Jeremy Belcher, associate director of UX at Big Spaceship, said Walmart should pay attention to speed, citing an Amazon-released statistic that said when their site slowed down by 100 milliseconds, it cost them 1 percent in sales.

“Site speed is super important,” said Belcher. “At Walmart and Amazon’s scale, that can amount to huge losses. It would be smart for Walmart to up the speed of their experience.”

Lefelt pointed out that Walmart’s customer base likely errs on the side of less tech savvy (according to Nguyen, 60 percent of Walmart customers own smartphones; Pew Research indicated that 64 percent of American adults own a smartphone of some kind). For its purposes, Lefelt said, Walmart’s UX is sufficient.

“It’s vanilla,” he said.

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.