Secure your place at the Digiday Publishing Summit in Vail, March 23-25

As Chipotle rehabilitates its image following an E. coli outbreak that left 500 people sick in the U.S., the company is being battered once again for its decision to close stores nationwide this afternoon for a safety meeting.

Today’s meeting is meant to outline the chain’s new food safety guidelines to franchise owners and employees, happening between 11 a.m. to 3 p.m. local time. As a result, Chipotle’s 2,000 locations will effectively be closed the lunch hour rush. This is not a detail that escaped competitors.

First up is Moe’s Southwestern Grill. The chain, with more than 600 locations nationwide, bought ads online and off touting the fact that it’s open today.

Here’s Moe’s full-page ad in the USA Today:

Throwing shade #Moes #Chipotle pic.twitter.com/Ueir9wGw2g

— Garin Flowers (@GarinFlowers) February 8, 2016

Moe’s also bought sponsored ads on Instagram and Twitter:

Every #Chipotle is closed today for a food safety mtg. #Moes decided to use this as fuel. https://t.co/FWlgD222zL pic.twitter.com/L6fX705MRd — Taylor C. Shaw (@taylorcshaw) February 8, 2016

Shots fired, and a free burrito. Today’s a good day @Moes_HQ pic.twitter.com/0rqXPK4Ol3

— Nathan Crunkilton (@NCrunk) February 8, 2016

“We are competitors,” Moe’s CEO Bruce Schroder told CNN Money about the ads. “And we didn’t want the category to go dark for a day, so why not give Moe’s a try?”

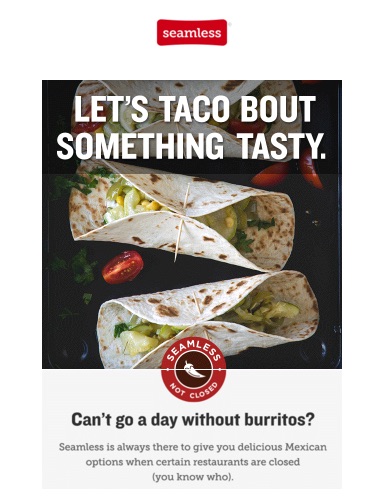

Seamless and GrubHub sent out similar emails to customers shading Chipotle’s closure too, even mimicking Chipotle’s logo:  On the Border, another competitor, is also running a promotion that takes a dig at Chipotle:

On the Border, another competitor, is also running a promotion that takes a dig at Chipotle:

Our Border Bowls and Burrito Boxes are just $5 TODAY ONLY while the other guys are closed. #chips& #salsa #included pic.twitter.com/7AktbGN9mC

— On The Border (@ontheborder) February 8, 2016

But don’t count Chipotle. The beleaguered chain is giving out free burritos in a text message promotion aptly called Raincheck, seen here:

Chipotle is giving away a free burrito.. This is real. Thank me later!!! pic.twitter.com/sK4JKhnhBu

— Things Athletes Like (@Things4Athletes) February 8, 2016

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.