Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This week, executives from retailers large and small — including Target, Tiffany & Co., Macy’s and M.Gemi — gathered in Napa, California, for the Digiday Retail Summit, focused on the changing state of retail.

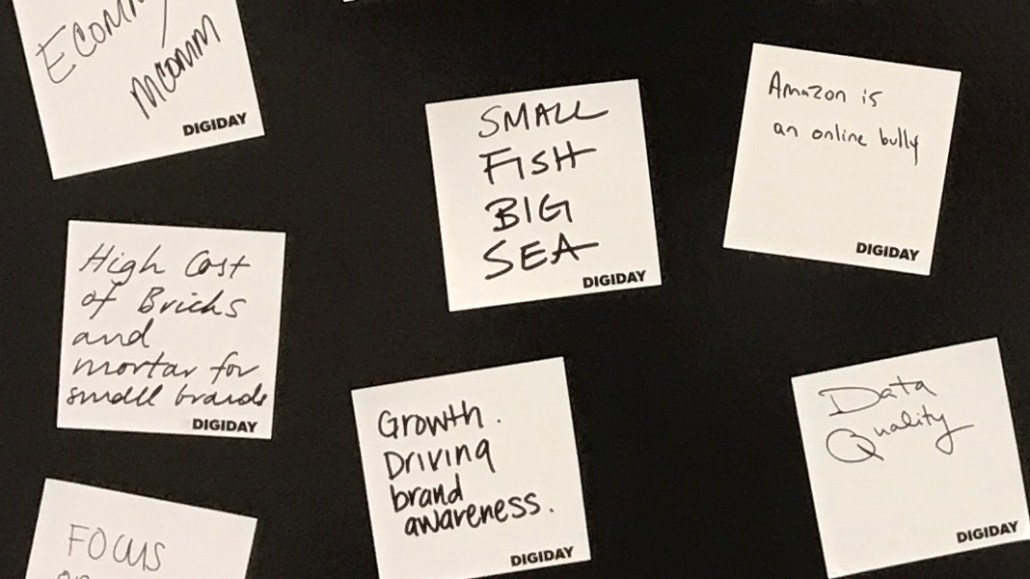

We held group meetings where retailers discussed some of the biggest challenges they’re facing today, including remaining competitive as the industry explores new sales channels and embraces data and technology. The following are highlights from Day 1’s session on the store of the future. Attendees agreed to openly comment on the record, in exchange for anonymity.

Defining the store of the future

“We talk about the store of the future in present tense: How are we effectively interacting with customers in multiple ways? It’s not just about getting them to come into our store or go to our e-commerce page; we’re looking at whether sales have continued to grow day after day and remaining one step ahead of the competition.”

“Is the purpose of the store of the future to sell? To brand? To drive online sales? We’re still figuring it out.”

“The store of the future means something different to different retailers. What are you aiming for? Providing an omnichannel experience? Successfully tracking your consumer from online to your store? It’s more a mindset.”

“[Retailers] usually associate the store of the future with AI, but the focus should be more on basics: scalable dressing room sizes, a smaller footprint, more curation. Look at Bonobos’ Guideshops. You walk in, you get great service, you don’t wind up with shit thrown all over the place — it’s an easy experience for the customer.”

“When we think about the store of the future, we don’t want it to be touch screens on the wall. We want it to be aggressive, yet feel like it’s not there.”

“Between mobile, desktop and the store, the experience should be frictionless. What you experience when you’re on the phone and when you go to the store should play into the same story.”

“The store of the future may come down to finding the right balance: How do you combine your e-commerce solutions, which provide ease for your customer, with brick-and-mortar — because people still do like to go shopping.”

Roadblocks for retailers

“Technology is moving so quickly, and we still plan three to five years out. When the time comes to implement our ideas and ‘new’ technologies, they’re irrelevant.”

“Our customer is shopping online and in-store. At my workplace, these two areas are in silos. As we try to bridge those silos, budgets get complicated — a lot of things get complicated.”

“At some point, there is going to be a mix of consumers: Some are going to be digital-only, some are going to be omnichannel, some are going to be in-store-only. How do you speak to all of them in a personalized way, to make them want to purchase and come back?”

“Retailers need to be doing something differently than they see now and what they did yesterday. There’s a lot of importance in looking ahead five years and brainstorming possibilities, so they’re not just in the same place. It’s not easy, but it pays to be disruptive.”

More in Marketing

In graphic detail: How Anthropic’s Pentagon refusal is paying off in downloads, brand trust and enterprise deals

OpenAI’s Pentagon deal seemed to spark uproar among its users, many of whom were against it. Anthropic’s refusal to agree to the terms was seen by users as the more trustworthy alternative.

How AI could disrupt retail media’s $38 billion search ad market

ChatGPT and other AI chatbots could divert shoppers from retailer sites, putting the $38B retail search market at risk.

‘Brand safety is moving from fear to curiosity’: Zefr’s Raddon on content-level accreditation – and what it exposes about the industry

The threat is no longer a discrete piece of bad content that a keyword list or a domain block can catch. Its volume.