Last chance to save on Digiday Publishing Summit passes is February 9

For all the talk about “showrooming” and Jeff Bezos mercilessly pursuing world domination, e-commerce remains a fraction of the size of the good ol’ brick and mortar industry. But times are changing.

Physical retail in the U.S. deals in trillions of dollars, while e-commerce dabbles in mere hundreds of billions. Americans are expected to spend $304.1 billion and $4.1 trillion on e-commerce and physical retail, respectively, in 2014. By 2017, those figures are expecting to increase to $440.4 billion and nearly $4.9 trillion, according to eMarketer.

E-commerce is growing more quickly than physical retail, however, thus explaining the number of agencies, brands, platforms and, to a lesser extent, publishers interested in building out their digital retail capabilities. E-commerce’s year-to-year growth rate is projected to be in the teens throughout the next several years, while physical retail’s will remain in the single digits, according to eMarketer.

An interesting trend within e-commerce’s growth curve has been the rise of “m-commerce” in recent years. M-commerce — using mobile devices (smartphones and tablets) to buy goods online — is becoming an increasingly larger portion of digital retail. In 2012, m-commerce constituted just 11 percent of U.S. e-commerce sales, according to eMarketer. By 2017 it’s expecting to account for more than a quarter. It’s growth will slow from astronomic (82.6 percent) to healthy (15.9 percent).

As e-commerce is expected to grow, so are retailers’ digital media budgets. The U.S. retail industry is expected to increase it’s digital advertising spending from $10.6 billion this year to 13.8 billion in 2017, per eMarketer. Retail’s percentage of the total U.S. digital advertising market is expected to stay steady at approximately 22 percent during that time.

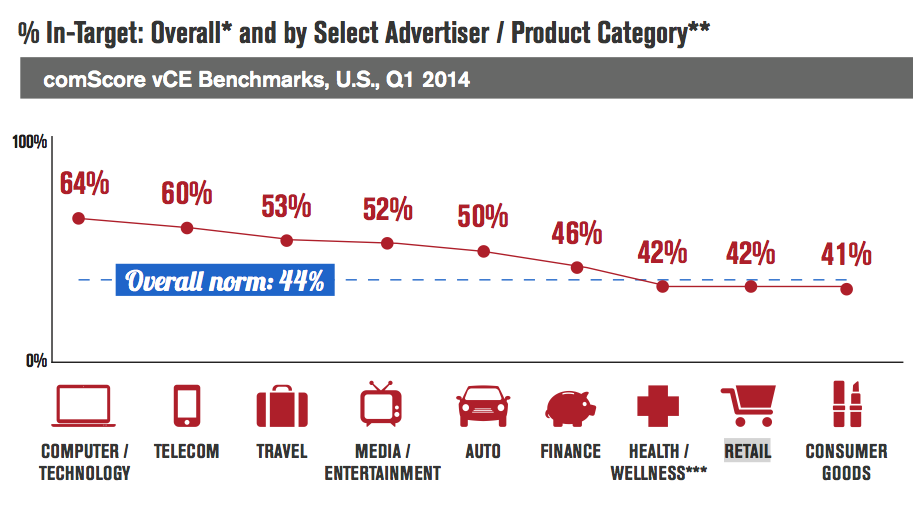

Despite making up a fifth of the U.S. Web advertising marketing, retailers are inefficient digital marketers relative to companies in other industries. A recent comScore report showed that only 42 percent of retailers’ digital ads reached their intended target market in the first quarter of 2014, less than the Web’s paltry overall average of 44 percent. The only category to perform worse than retail was consumer goods, curious considering CPG are widely regarded as sophisticated marketers, comScore notes in the report.

Image via Shutterstock

Image via Shutterstock

More in Marketing

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.

Programmatic is drawing more brands to this year’s Winter Olympics

Widening programmatic access to streaming coverage of the Milan-Cortina Games is enabling smaller advertisers to get their feet in the door.