Turns out, the way we live our lives IRL is very similar to how we live them on social media. A new study shows that motivations and emotional responses to a brand’s presence on Twitter are as full of irrational idiosyncrasies as they are in the real world.

“Unconscious Cues” is a new research study from Isobar and Twitter that presents the results of various experiments done to figure out the unconscious drivers of brand perception on Twitter. The study created fictional brands to test the factors that matter when consumers look at your brand on Twitter: Is it the size of the brand’s community? The number of tweets it sends out? The tone of voice in the bio? Or the presence of a “promoted” label on a tweet?

“I’m not sure whether these are things brands think about explicitly,” said James Caig, head of strategy at Isobar U.K. “I think there are generally pretty mixed levels of maturity when it comes to brands understanding what they need to do for social platforms.”

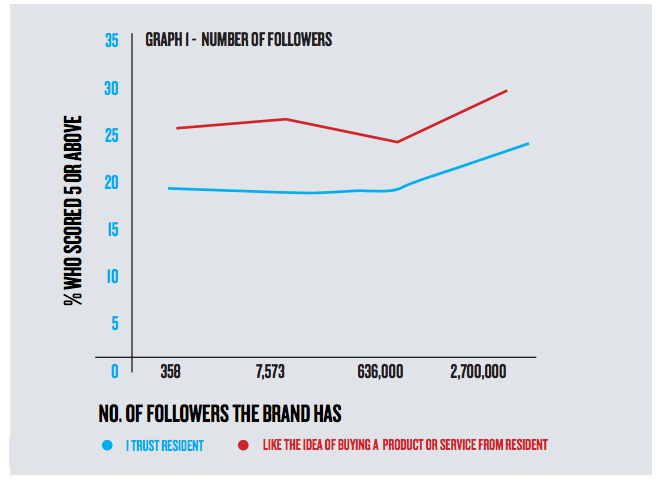

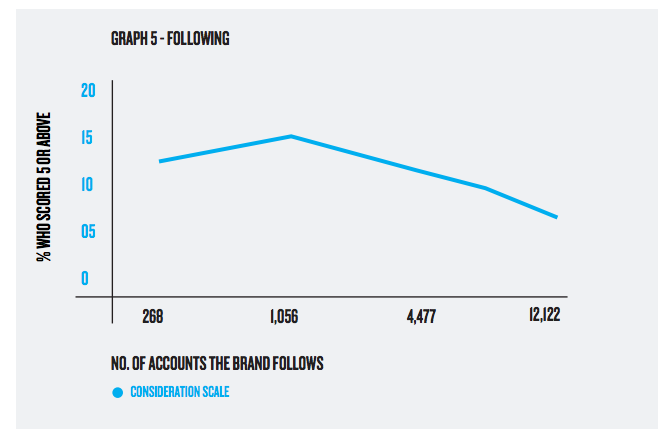

The biggest takeaway from the study is that brands need to be cognizant of “unconscious cues” because those are the ones that have a significant impact on how a customer perceives a brand. A big one is the number of followers the brand has, and the number of people and accounts it follows. High followers numbers impact how much people trust the brand and if they would like to buy something from it. More interestingly, the number of accounts the brand follows — how “exclusive” it is — will negatively correlate with consideration.

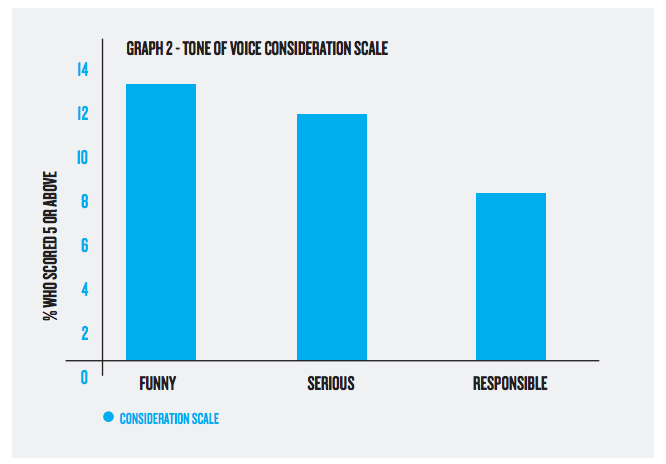

The tone of the brand’s Twitter bio also made a difference. “Funny” works, as does “serious.” The study found there was no difference whether you cracked a funny or made your bio about the story of the brand. Just don’t make it “responsible” — the study found that bios about corporate social responsibility did badly. “Serious” biographies come out tops for “trust,” while “funny” ones win on likeability.

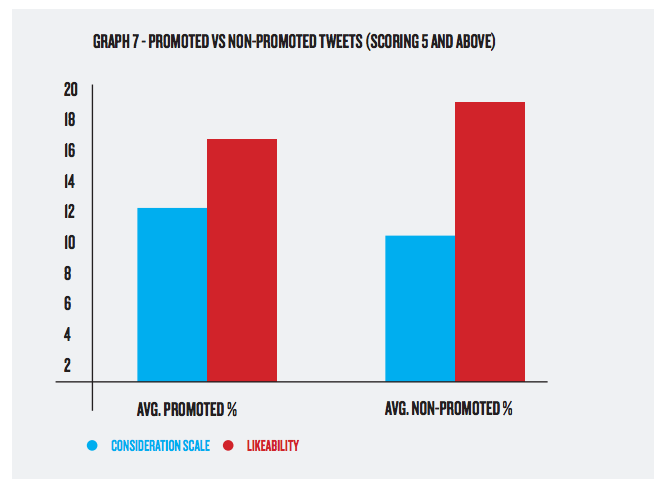

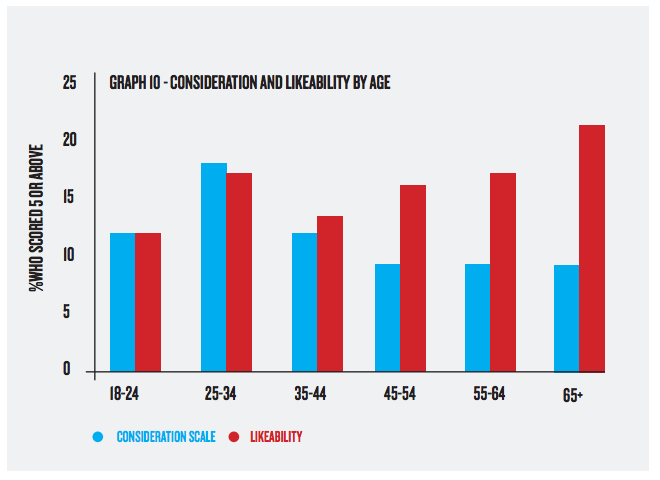

Caig said the most surprising finding was that despite what most brands think, likeability does not correlate necessarily correlate with what the study calls the “consideration” — whether a user will buy the brand or not. “We asked questions on both of those scales,” said Caig. “But the thing I found most interesting was that whatever positively influences people does not increase the propensity of consideration.” When those factors were applied to promoted tweets, it gives us a glimpse into how people think about those, versus organic messages. Caig said that the promoted badge is often a signal that this tweet is about something commercial — so they generate higher on “consideration.” Organic tweets are liked because users are making a conscious choice to follow the brand.

Age is a major factor in determining likeability and consideration, the study found. Older people are more likely to “like” things — but not to buy them. Those between 25 and 34 will be more likely to score tweets higher on a consideration scale. That, said the study, might be driven by the differences in Internet confidence. Older people are more likely to think of themselves as “novices” and are, therefore, less interested in buying a product online.

More in Marketing

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.