Secure your place at the Digiday Publishing Summit in Vail, March 23-25

A recent study conducted by FaR Partners for Adyoulike, a company which serves in-feed ads to apps and websites, claims native advertising will account for 9.2 percent of total digital display spend by the end of 2014. That statistic has been credulously — and widely — parroted in the trade press.

But the study, which attempts to define a zeitgeist (in a way that is perhaps beneficial to the company that commissioned it), accidentally underscores a core problem with the industry today: There is no actual consensus around what we’re talking about when we talk about native advertising.

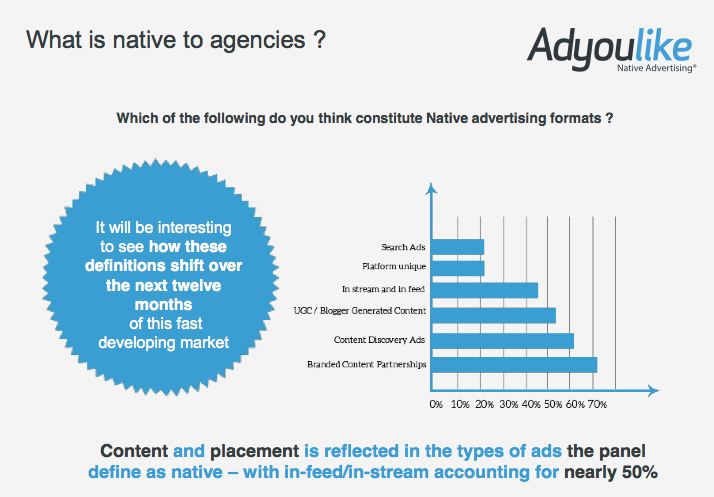

The study of over 500 senior executives at the U.K.’s 20 biggest media agencies found that 83 percent of agencies already buy native ads and the rest intend to do so imminently. But the study gets murky in that it defines native advertising. To start with, it uses two key characteristics: content and placement. Agency chiefs were questioned about their plans to buy ads where “the content of the page must be extremely relevant to the content of the ad” and “the placement of the ad must be as integrated as possible into the content.”

As such, survey respondents suggested everything from in-stream ads, content discovery ads, platform-unique ads and branded content partnerships to search could be described as native.

Responses to the survey highlight the problem with asking questions about an often misunderstood, catch-all term like native. One respondent to the survey, a digital strategist, said it’s hard to say how much ‘native’ will increase in the future, “because it’s not as if there is a native advertising budget.”

He’s not alone. MediaCom U.K.’s head of content Nick Cohen recently told Digiday that the term confuses more than it illuminates: “We don’t really actively go out to clients and say, ‘You should be doing native advertising.’” If native advertising doesn’t have a budget, isn’t that an indication that it’s more of a characteristic of different types of ads, rather than a product or channel in itself?

Perhaps there’s a reason for surveying the use of ‘native advertising’ over particular categories of products, like those from Facebook and Twitter or branded content partnerships or other formats categorized by the IAB’s native advertising playbook. The growth of one might help convince some of the growth of the other when lumped in together under one catch-all term.

IAB UK CEO Guy Phillipson recently described the term native as ‘one of the best rebrands our industry has seen in recent years’, and perhaps the term has been hijacked to aid the marketing aims of basically anyone outside of the traditional display business.

Adyoulike’s assertion that “the continued ineffectiveness of display advertising” is the main driver for native advertising growth has irritated some. “The industry really needs to call out spurious statements like that. I’m surprised trade publications even print that,” said Simon Redican, CEO of the U.K.’s newspaper and magazine circulation body NRS.

Adyoulike content and publishing director Dale Lovell concedes that there’s confusion in the marketplace around this term. “One of the difficulties of attributing the size of the market is because native is a new proposition and is coming into prominence. [Native advertising is] essentially the industry trying to make ads better: better conversions, engagement and more relevancy,” he said.

“One positive which came out of the study from our point of view is that it’s only growing.”

More in Marketing

Why Edward Jones’ agentic AI trial comes with limits

Edward Jones tests agentic AI to drive marketing productivity, taking a measured approach as it stops short of full automation.

Footwear brands navigate uncertainty after latest tariffs flip-flop

Some 99% of footwear sold in the U.S. today is imported, according to the Footwear Distributors and Retailers of America.

Brands at eTail Palm Springs share lessons on the ‘messy middle’ of building AI tools

Here’s a rundown of lessons brands have shared about their AI implementations so far.