Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

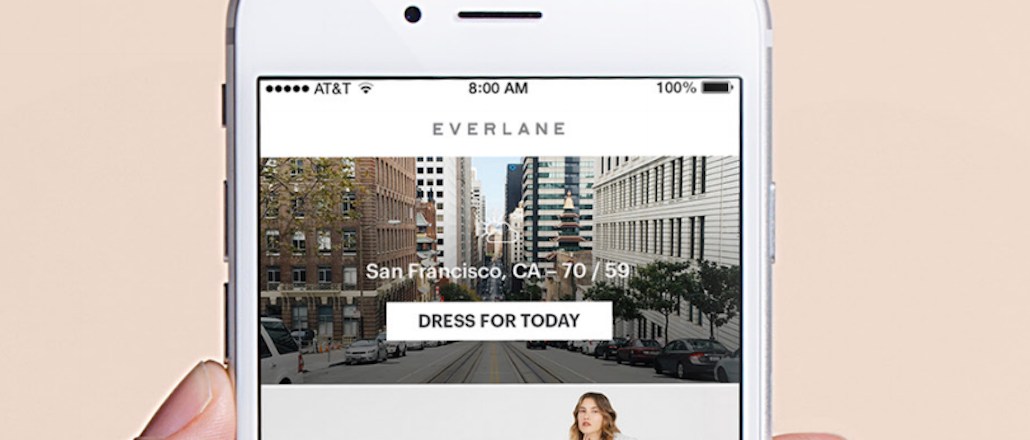

Online-only retailer Everlane has added a new digital storefront: a native mobile app, available today for iOS.

Coming five years after the San Francisco brand’s launch, the shift to mobile is a deliberate one. The brand’s stated overall goal is to “make online shopping better than offline,” and now, the retailer considers mobile a key part of online commerce. While Everlane sells well-made basic apparel and accessories for men and women, what sets it apart is its transparency: It’s open about where its clothing comes from, as well as where item-markup originates.

In the first iteration of its mobile app, the company’s strategy is to incentivize downloads and simplify checkout. CEO and founder Michael Preysman said that the company noticed that while 40 percent of its traffic was coming from mobile, only 18 percent of its transactions were. Preysman recognized that was “the norm” for retailers, then set out to solve the problem that all companies in the industry are facing. The solution: make mobile transactions possible with one tap.

“We first thought mobile Web would suffice, but we saw that people were shopping, but not transacting there,” said Preysman. “But since people are getting more comfortable on mobile, we knew customers would take to it if we invested in a mobile app.”

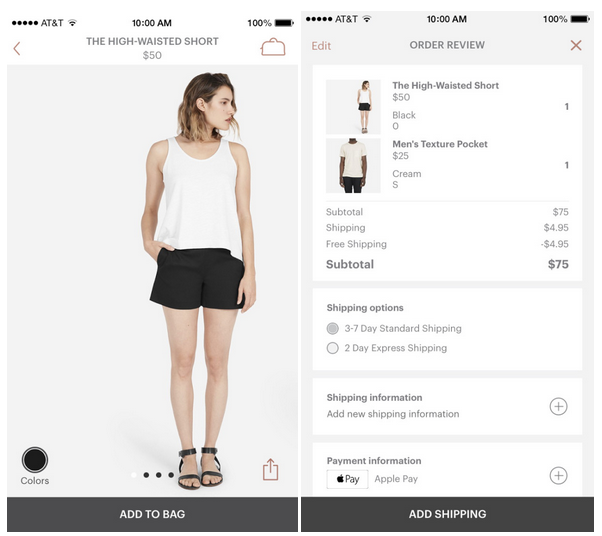

In building the app, Everlane focused on getting the experience right by emphasizing photography and getting the speed of the app’s abilities up to desktop standards. Each product page on Everlane’s mobile app is photos first, details second, to maximize the visibility of the items. To incentivize downloads, Everlane plans to offer exclusive and early product releases to mobile shoppers.

But pretty product photography and shopping incentives don’t chalk up unless a shopper is compelled to purchase on his or her phone. Preysman said he knew that nobody wanted to be bothered tapping in their credit card numbers on a tiny screen, so checking out on Everlane’s app is pared down to one tap that either activates a transaction through Apple Pay or through the shopper’s Everlane account. In the end, mobile checkout ended up being two times faster than on desktop.

For many brands that realize that people are constantly tuned into their mobile phones, a solution is to test one of the many buy buttons being rolled out by Facebook, Pinterest, Twitter and Instagram, which handle seamless transactions within social platforms. But Everlane’s social strategy doesn’t focus on pushing product; instead, the team displays its dedication to transparency, sharing glimpses into its production process. On Snapchat, for instance, the brand showed a tour of one of its factories.

“We’re open to all of it, but we don’t see that social buy buttons are the future that everyone is talking about,” said Preysman.

A study by Invesp predicted that social commerce would amount to 5 percent of online retail revenue in 2015. While instantaneous purchases on social platforms are becoming more ubiquitous, there are still drawbacks to partnering with companies like Facebook for mobile checkout. Jason Goldberg, vp at Razorfish, told Digiday that while instant buy functions on social platforms could be helpful for mobile commerce, it’s “not a no brainer,” as much of the transaction — user experience, customer service — are left in their power.

For Preysman and Everlane, building out a native app meant the team could prioritize what made sense for its consumer.

“People are always on the phones; they’re always on mobile,” said Preysman. “So we optimized for big photos and clear transactions.”

More in Marketing

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.