Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: In-store pickup is still rare among retailers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

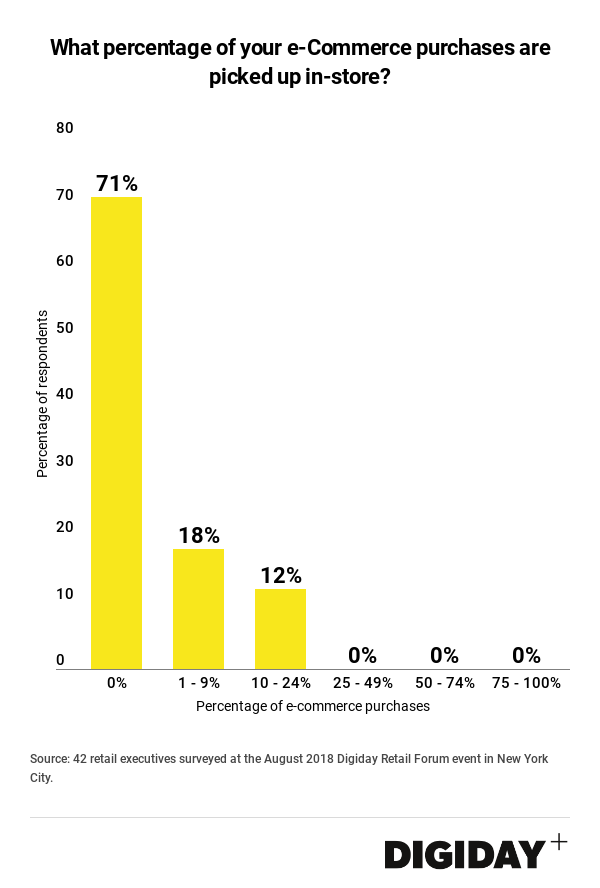

As physical store retail experiences a resurgence, companies like Old Navy and Lowe’s are making the ability to pick up online purchases in-stores a key part of their long term strategies. But according to a survey of 42 retail executives the Digiday Retail Forum, most retailers haven’t deployed a “buy online pickup in store” strategy.

Companies with in-store pick up options are seeing strong consumer adoption, but 71 percent of the retailers polled by Digiday said that they aren’t using an in-store pickup strategy for online orders.

In-store purchase pickups are increasingly popular because they often lead to customers buying more while they’re there. The Home Depot, which has 47 percent its orders picked up, found that in-store pickups often lead to consumers interacting with in-store experts facilitating trust, and creating a deeper relationship with the store.

“Any time we launch something like [buy online pick up in store], a lot of teams are involved, and that requires a high level of coordination,” said Dave Albracht, director of business applications at the Home Depot. “We’ve spent years improving our online and in-store experiences and fine-tuning our supply chain network to make features like this possible.”

However companies capable of successfully enacting an in-store pickup strategy might be solely limited to big box retailers. Companies like Walmart, Home Depot and Target that have successful in-store pickup strategies have thousand of locations that make such tactics convenient for consumers.

According to Target, which has roughly 15 to 20 percent of its online orders retrieved in stores, 75 percent of U.S. consumers live within 10 miles of a Target retail location that enable the company to fill 95 percent of in-store pickup orders within an hour, according to the company.

Although online-only retailers obviously lack the capacity for in-store pick ups, some major retailers like TJ Maxx have chosen to eschew in-store pickup options, focusing instead on improving experiences within its physical retail locations.

Despite the success in-store pickup has generated companies, don’t expect retailers to suddenly offer it as an option. Facilitating in-store product pickup in a lengthy process that takes years of development and significant resource investment.

For more regional physical retailers and online retailers, that might simply mean they lack the resources and sophisticated processes to make such programs feasible. Having few locations and geographically dispersed consumers present obvious logistical challenges to in-store pickup strategies.

Even e-commerce giant Amazon is just beginning to operate manned physical retail outlets for purchase pickups. However the advantage that physical retailers had over Amazon, thousands of physical locations, is quickly diminishing. Currently, Amazon operates 2,800 locker locations where shoppers can get and return packages.

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.