Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: European marketers buy more inventory from PMP’s than U.S. marketers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Key takeaways:

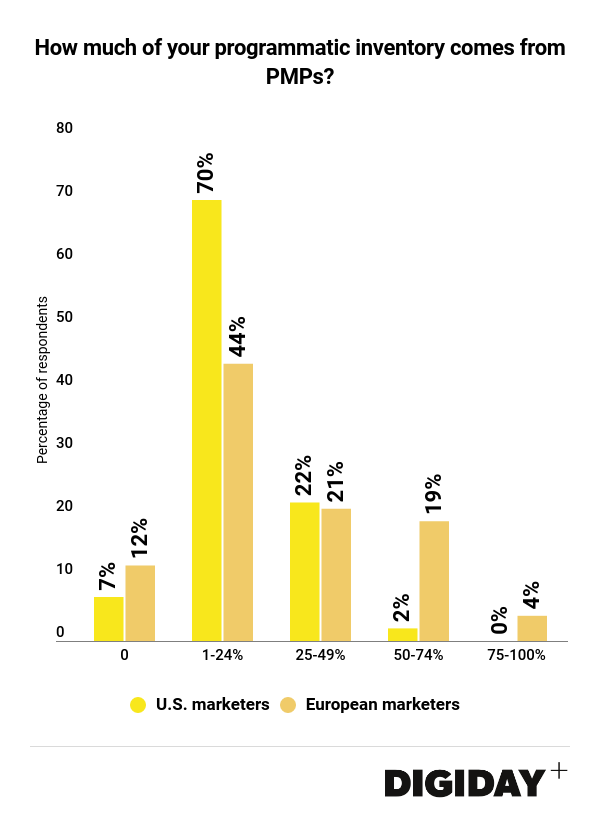

- More than 20 percent of European marketers purchase half of their programmatic ads from a PMP.

- Ninety-three percent of U.S. marketers purchase programmatic inventory from a PMP.

- Eighty-eight percent of European marketers purchase programmatic inventory from a PMP.

Deals through private marketplaces or “PMPs” were once a niche part of marketers’ media budgets, but are becoming increasingly critical to marketers’ media strategies. With rises in programmatic spending in both the U.S. and Europe, we asked 98 brand and agency marketers at the Digiday Programmatic Marketing Summit in New Orleans and in Estoril, Portugal what percentage of the digital ad inventory they purchase now comes from a PMP.

According to the results of the Digiday survey, more marketers in the U.S. purchased inventory through a PMP than their European counterparts. Ninety-three percent of U.S. marketers did so compared to 88 percent of European marketers. However, European marketers buy a higher proportion of their inventory from PMP’s than their U.S. counterparts. Twenty-three percent of European marketers said at least 50 percent of their programmatic inventory comes from PMPs, whereas just two percent of U.S. could say the same.

PMP spending in the U.S. is growing. Ninety-seven percent of U.S. publishers in a previous Digiday survey said they plan on increasing the amount of deals transacted through a PMP in the coming year. Meanwhile eMarketer estimates that PMPs will account for $8.99 billion of the $39.1 billion spent on digital display spending in 2018, a 37.3 percent year-over-year increase.

However, Europe has traditionally seen higher PMP usage than in the U.S., especially in markets such as the Netherlands and Germany where PMPs are responsible for almost all programmatic transactions. France is also experiencing an increase in PMP spending.

GDPR could also accelerate PMP usage in Europe. Because the GDPR set strict limits on how information can be collected from consumers and the use of third-party data in advertising, the use of third-party data in programmatic exchanges has predictably lessened. That means the value of open inventory on exchanges could decrease without third-party data to prop it up. As marketers search for sources of first-party data to buy inventory with, publishers will serve as a primary source because of their close relationship with users. Given the declining value of programmatic inventory in open exchanges marketers could be convinced to pay a higher price in PMPs for premium first-party data informed inventory.

More in Marketing

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.