Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

As Instagram’s Stories product creating huge competition to Snapchat, brands and advertisers are trying to figure out which works best. Here’s a cheat sheet stacking up the two platforms.

Users

- Instagram monthly active users: 700 million; daily active users at 400 million

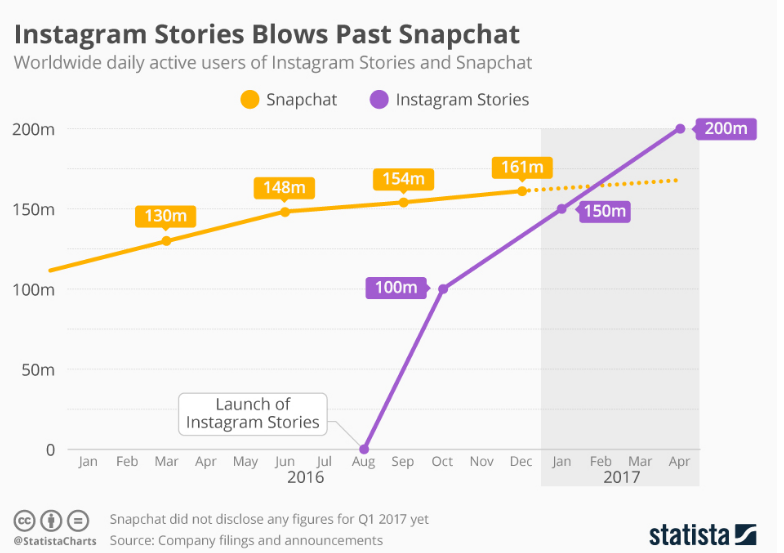

- Facebook’s me-too strategy seems to be working, at least in the short run. Instagram Stories surpassed 200 million daily users at the end of April.

- According to Snap’s first-quarter report, the app has 166 million daily users in total. Here’s a chart from before the filing showing how quickly Instagram stories passed Snapchat.

- Snapchat users skew younger: 60 percent of its users are under 25, and according to Nielsen research commissioned by the company, it reaches 41 percent of all 18- to 34-year-olds in the U.S. Instagram skews older: Pew estimates that the platform does well with 30- to 49-year-olds, with 33 percent of Internet users in that group using it.

- For influencers on the platform, opens have also decreased. A report by Delmondo found that unique viewers per Snapchat story have gone down 40 percent. A report by Amplify found that influencers see 28 percent higher open rates on Instagram Stories compared with Snapchat.

Ad formats

Snap Ads: Snap Ads are video ads that can be up to 10 seconds long. They live within friends’ stories and on Discover, and can be paired with articles or app installs. They come with a “swipe-up” functionality that lets you add websites or other destinations.

Snapchat sponsored Geofilters: Geofilters let brands add a filter onto Snaps. Geotagged, Snapchatters in a specific location can see the filter and use it in their Snaps. There are restrictions: For example, brands can’t buy a cheap geofilter ad for a city block in Austin during SXSW because there are premium geofilters available then.

Snapchat sponsored lenses: Lenses, which like Geofilters live in the “Camera” section of Snap, let users overlay the lens over their own faces. They can now be targeted by age, gender and interest categories, and the company recently introduced World Lenses, which let you add augmented reality elements to anything you take a picture or video of — not just your face.

Instagram photo ads: In square or landscape, a static photo with a “Shop Now” link can take you to the brand’s site or elsewhere.

Instagram photo ads: Up to 60 seconds long, videos also let you link out.

Carousel ads: These let users swipe around to view more photos or video as part of one ad that appears in the feed.

Instagram Stories: These ads appear between your friends’ stories and can be video or static. As of a couple weeks ago, Instagram now lets brands buy ads across objectives like reach, video views, traffic, conversions and mobile app install. There are now global stories that collect stories being posted across a certain location or venue that provide even more reach.

Cost

- Buyers say Instagram Stories is about $3 to $4 CPMs, and completion rates are between two and three times higher on Instagram than Snapchat.

- Instagram Stories ads are purchased through Instagram’s self-serve function.

- Instagram ads cost a little more than Stories, between $5 and $7 CPMs.

- The new change is that Snap Ads are now also sold via a “bidded auction,” so pricing can be set by the market.

- As Snap’s self-serve Ads Manager gets ready to open this month, there will be zero minimum spend for advertisers.

- Snap Lenses’ minimum price has also dropped since they can now be targeted — but they’re still pricey, costing upward of $300,000 for one day.

- Snap Geofilters can be bought for as little as $5 via self-serve, and CPMs can be as low as 27 cents (for geofilters in crowded areas) to as high as $48.

The buyer view

“If you’re a brand looking to do a lot with influencer marketing — and who isn’t — influencers have a larger following on Instagram. And there have been a ton of Snapchat influencers moving to Instagram,” said Will Thompson, director of social at Giant Spoon. “Snapchat is more of a media play. And lenses have been commoditized across Instagram now. Snap Ads now feel like pre-roll. I think Snapchat is still cool; it’s just more of a second-screen experience to bigger events.”

“The cost for Instagram is right now lower than Snapchat, but we anticipate that will normalize once self-serve opens up on Snapchat,” said one buyer. “The big thing is still targeting. Instagram is Facebook targeting. That’s why I think Snap is leaning more heavily into selling us on its custom content.

“We’re keeping a close eye on Snapchat growth. I know it’s dipping. As long as it doesn’t go negative, then there is value. If they go negative, we’re going to rethink.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.