Last chance to save on Digiday Publishing Summit passes is February 9

Retail briefing: Amazon makes private-label push for holidays

Subscribe to the Digiday Retail Briefing: A weekly email with news, analysis and research covering the modernization of retail and e-commerce.

For Amazon, this year’s Black Friday-Cyber Monday is all about itself.

The company is using one of the biggest shopping weekends of the year to push sales on its own private label brands — all 130 brands, which run the gamut from apparel to home furnishings. (They also include Amazon devices, like Kindle and the Echo portfolio.)

Last year, Amazon used the holiday period in December to focus on private-label fashion brands, including Lark & Ro, The Lovely Tote and The Fix. It also launched three activewear labels in the same time: Peak Velocity, Rebel Canyon and Goodsport. This year, there’s more activity beyond apparel, with focus extending to home goods brands like Rivet and Stone.

“Amazon’s areas of focus is a precursor to what we can expect in 2019,” said Gartner L2 associate director Oweise Khazi. “Discounting in fashion was table stakes on the platform,” but the additional discounting across the board indicates what areas Amazon wants to disrupt, said Khazi.

Amazon’s push into private label has been one of the more aggressive moves this year. Because Amazon has massive customer data as well as control over everything from how it chooses to advertise others’ products versus its own — plus its innate scale — means its push of private label is a much bigger threat. It also can be tricky: For non-Amazon brands that are selling wholesale to Amazon, they now find themselves in the position of competing against the home team, which is also doing major discounting.

Amazon is the undoubted king of this year’s shopping bonanza. Gordon Haskett analyst Chuck Grom said Sunday evening that nearly 65 percent of shoppers expect to shop at Amazon.com, with 44 percent expected to shop at Walmart and Jet.com. — Shareen Pathak

This week in DTC

Need another sign that digitally native, direct-to-consumer brands are basically starting to look like every other brand out there? Here’s one: They are beginning to spend media dollars on TV. From Everlane to Allbirds, these Instagram-born brands are appearing during network TV. Now, TV companies are noticing — NBCUniversal’s set up a new offering specifically to court these brands.

By the Numbers: Sign Amazon is taking over the world

Market share of online revenue, week before Thanksgiving:

Amazon: 73.8 percent

Walmart: 9.4 percent

Target: 5.3 percent

Jet.com: 0.1 percent

Best Buy: 11.4 percent

Chart of the week

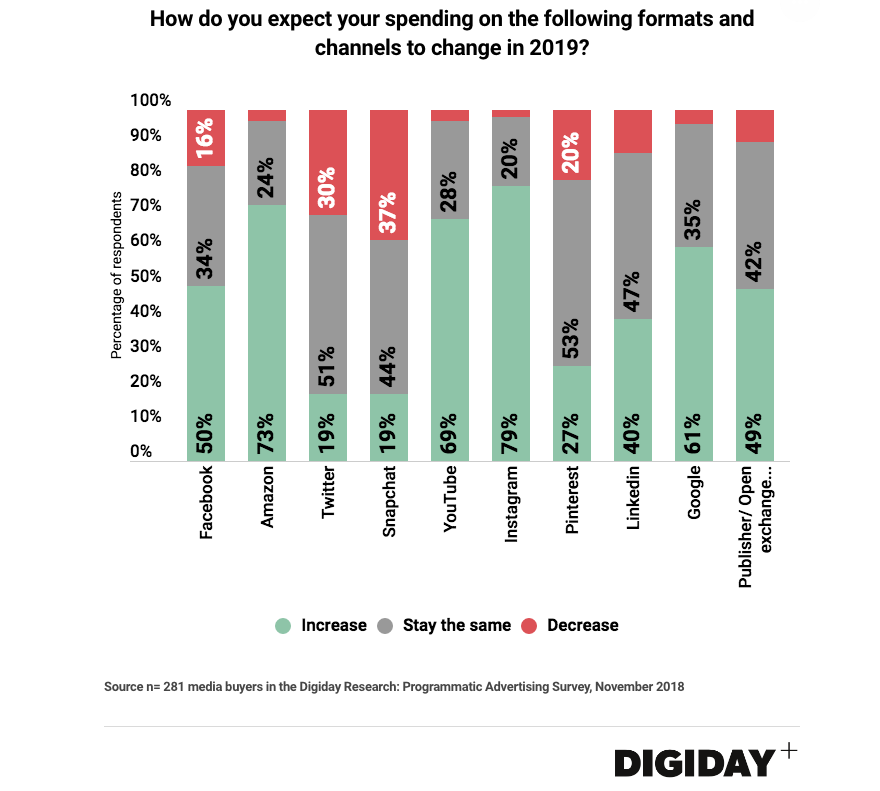

2019 is poised to be a happy year for Amazon and Instagram, according to a survey of media buyers by Digiday. In a November 2018 survey of 469 media buyers from Digiday+’s propriety research panel of media and advertising executives, 79 percent say they plan to increase their spending on Instagram in 2019, and 73 percent expect the same for Amazon.

Don’t forget Shopify

It’s not all about Amazon. Shopify, the $17 billion e-commerce platform responsible for operating dozens of direct-to-consumer sites, is becoming more vocal about the role it plays in driving holiday sales to brand dot-coms. Over the weekend’s high-traffic shopping days, Shopify’s more than 600,000 merchants, which are about 75 percent small businesses and direct-to-consumer brands, managed to steal some market share from big third-party retail platforms by offering perks like free shipping and discounts. According to Shopify, it was a record-breaking sales year for the holiday weekend. On Black Friday, Shopify merchants drove $573 million in sales, a figure that surpassed 2017’s total by early afternoon. At its peak, Black Friday sales reached $37 million per hour, and $870,000 per minute. — Hilary Milnes

What we covered

Amazon’s move to New York is an indication of how serious the company may be about its burgeoning ads business — and may lead to a new talent crisis for agencies.

- Agencies should worry that there will be significant talent flowing to HQ2

- The move to NYC means Amazon will be closer to the theoretical Madison Avenue — from whom it wants to get a bigger share of budgets next year

- Read more on Digiday.

To win over potential young customers, Walmart is getting creative.

- The company has launched a site that helps kids learn about their toys and add them to wish lists

- This also helps the retailer learn more about how kids play with its products

- Read more on Digiday

More in Marketing

Star power, AI jabs and Free Bird: Digiday’s guide to what was in and out at the Super Bowl

This year’s Big Game saw established brands lean heavily on star power, patriotic iconography and the occasional needle drop.

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?