Publishers are cramming more video onto their Facebook pages as the platform rewards them in the form of exposure and in some cases, even financial incentives. A look at the data makes it easy to see why publishers are addicted to the format: they get much higher engagement on video posts than they do on article links.

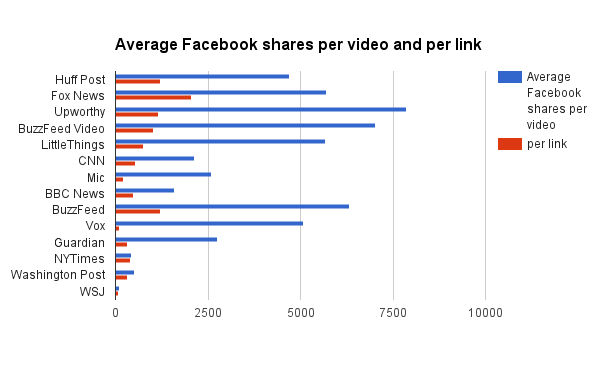

Digiday ran numbers from social analytics service NewsWhip across 14 publishers that are top performers on Facebook. Across the board, publishers’ video (including live and canned video) got an average of 4,036 shares per post. Images were also popular, averaging 3,364 shares per post.

But when publishers shared article links (including Instant Articles, Facebook’s fast-loading article format), they got just 571 shares per post. The least-likely format to be shared were status updates, which got 538 shares per post. The period measured covers April 27 to May 27.

Take The Huffington Post. It posted 739 links during the one-month period and got 1,213 average shares per link like this one having fun at the expense of clumsy dogs, Dogs Who Can’t Catch for Sh*t. In the same period, it posted only 412 videos, but it got 4,715 average shares per video.

The gap tended to be the biggest among native-digital publishers that have had aggressive social distribution strategies. Viral publisher LittleThings got 5,664 average shares per video, such as this recipe for parmesan cups, compared to 754 for its links.

An exception was the Guardian, which posted only 63 videos but averaged 2,754 shares per video, compared to 441 average shares for each of its 1,418 text posts.

As Facebook has changed its algorithm to put more video in people’s feeds, publishers have shifted resources to video production, in some cases, focusing predominantly on video. So even if publishers are still posting more text articles than video, each video is likely reaching more people. (It’s hard to know just how much, though; NewsWhip only provides that data to individual publishers about their own sites, but doesn’t share an industry-wide view of that data.) So it stands to reason that if Facebook’s algorithm puts video in front of people more, these will also be shared more.

Looking at engagement, NewsWhip found that publishers also are seeing less action on links that go back to their own sites. Across 10 top Facebook publishers, monthly engagements (likes, shares and comments) declined to 162 million in April from 287 million in July 2015.

“If video is playing automatically and they can pick up with a story without sound, that seem to be why video is attracting this high level of engagement,” said Liam Corcoran, head of communications at NewsWhip.

As a young publisher, LittleThings sees video as an effective way to grow its awareness; it has not one but three teams dedicated to video, and is looking to monetize them through product placement and sponsorships. But it still posted five times as many text links this past month than video on Facebook, because those can be fully monetized.

“Facebook is prioritizing video, so you know it’s going to push to a larger audience, and we’re always looking for more brand awareness,” said Gretchen Tibbits, COO at LittleThings. Still, she said, “We’re producing more posts versus native video because those keep the lights on, as it were.”

The Washington Post also is looking for the right balance between creating Facebook video to reach new audiences (and potential subscribers) and focusing on video on its own site, which it can charge advertisers a premium for, said Micah Gelman, director of editorial video at the Post.

“Facebook hasn’t really figured out monetization yet,” he said. “The scale is big, but the rest of the ecosystem isn’t there yet. Getting people to come to the Washington Post is also important. But it is a tradeoff.”

Image courtesy of The Huffington Post.

More in Media

Earnings from social and search players signal that AI will be a long-play investment

Giants like Google, Meta and Microsoft say investors and advertisers might have to wait longer for AI to generate a better return on investment.

Why some publishers aren’t ready to monetize generative AI chatbots with ads yet

Monetization of generative AI chatbot experiences is slow going. Some publishing execs said they’re not ready to add advertising to these products until they scale or can build a subscription model first.

Media Briefing: Publishers who bet on events and franchises this year are reaping the rewards

Tentpole events and franchises are helping publishers lock in advertising revenue.