Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Most millennials probably don’t know who Helen Gurley Brown is, but the Cosmopolitan brand Brown built is resonating with the young set — on Snapchat, at least.

Cosmopolitan says it’s averaging 3 million viewers a day on Snapchat Discover, a milestone that could appeal to some advertisers who wonder whether these media channels on the messaging app are desirable places to run their spots. Cosmo, which has been a Discover partner since the service launched in January, has seen traffic go from about 1.8 million a day to 3 million viewers since the summer, according to Kate Lewis, vp and editorial director of digital at Hearst Magazines, which owns Cosmo.

When asked whether the app is worth the editorial effort, she replied: “Oh my god yes. It’s been amazing, and we have about 3 million people a day on the Discover platform.”

Media partners like Cosmo, BuzzFeed, Vice and the recently added Refinery29 post daily editions of their stories to Discover and sell ads amid the articles and videos.

Discover is just one of the several revenue-generating areas. There also are Live Stories, which show user-generated video collages from special events, as well as sponsored filters and lenses, launching soon.

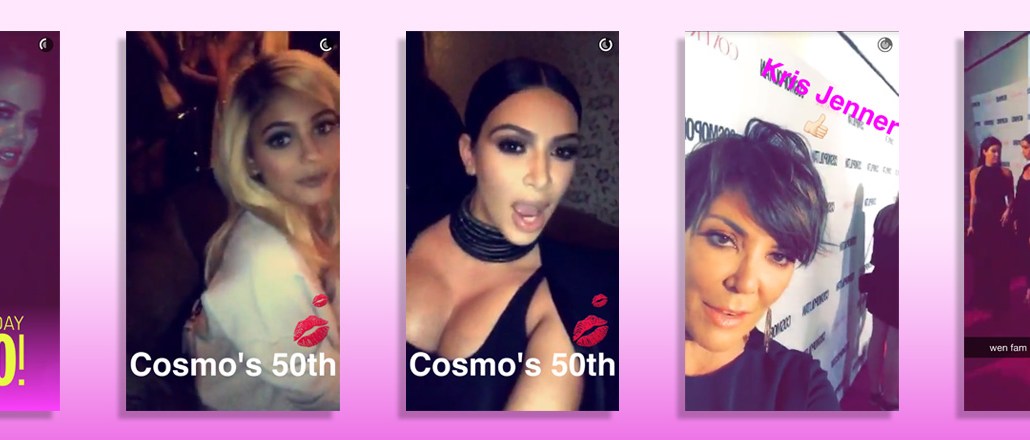

Just this week, Cosmo hosted a Live Story for its 50th anniversary, which it celebrated with a magazine cover featuring the Kardashians, who also starred in its Snapchat videos around the event.

Covergirl sponsored the anniversary Live Story.

Lewis also said that people share Cosmo content in large numbers, which is an activity that is not typically associated with Snapchat, because sharing and retweeting are not common there.

That may be changing, though. Cosmo’s Discover stories are shared up to 1.2 million times daily, Lewis said.

Mostly only editorial content, not paid videos, are allowed to be shared, and brands have been asking the Discover partners to allow people to start passing along their videos.

One top Snapchat advertiser said that it wanted sharing on its videos to maximize reach and that it would help put ads right into users’ main messaging feeds from friends.

The advertiser also said Sponsored Lenses would be popular for that very fact, because they are inherently meant to be shared. Lenses are basically animated filters, and they are expected to launch as ad units later this month.

“I think filters and lenses are the ad products that will get the most traction,” the advertiser said. “Most brands on the platform are not sure that Discover and Live Stories are growing relative to audience size.”

Lewis said that Cosmo delivers high content-consumption rates for advertisers. Drawing on stats from September, she said 72 percent of users clicked through every story after they opened the Cosmo Discover tab.

There’s also a guarantee commercials are glimpsed between stories, which is something brands are concerned with on Snapchat and elsewhere online.

“If you’re an advertiser, that’s what is so challenging in the digital space: Will people see the ad?” Lewis said. “And on Snapchat, there’s no question that they will.”

It’s clear that some of the media partners are working well on Discover. BuzzFeed has said about 20 percent of its audience is on Snapchat.

The format has its difficulties, though, too. Even Snapchat just shut down its own Discover channel.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.