Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Vinyl’s comeback continues to break records.

Vinyl music sales have increased by 52 percent year-over-year to $222 million, according to a new midyear report from the Recording Industry Association of America. Vinyl’s continued growth brought in almost $60 million more than ad-supported streaming services during the first half of 2015, according to the report, which underscores the complexity of the state of the music industry.

Ad-supported streaming — which includes services like YouTube, Vevo, and Spotify’s free version — did grow, just not as quickly: A 27 percent year-over-year increase to $163 million.

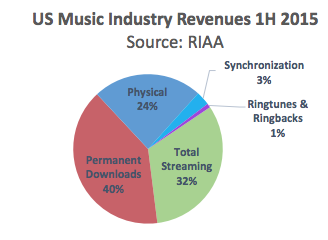

Other key takeaways from the report: digital downloads of tracks and albums are declining, but streaming is entirely making up the difference. “It’s a transition of one form of digital to these streaming pieces,” said RIAA data analyst Joshua Friedlander. “Consumers are not buying a specific album, but gaining access to a whole library in one form or another.”

There are a surprising number of bright spots for an industry that is half the size it once was: Streaming music revenues — including paid subscriptions to services like Spotify, ad-supported on-demand services and distributions by the performance rights organization SoundExchange — reached all time highs for the first half of the year, breaking the $1 billion mark.

“Overall, the music industry has become the most-digital in terms of all traditional media outlets — magazines, newspapers — in terms of transition,” said Friedlander. “There is more optimism out there than there was. Two-thirds of the market is still physical [CDs]. It used to be monolithic. Now it’s a mix of things, a revenue diversification that makes a more stable source to grow off of.”

Money spent on paid subscription services grew by 25 percent to $478 million. For the first half of 2014, the average price of a subscription was $97 per year. In the first half of 2015 that average increased to $118 per subscription.

Money spent on paid subscription services grew by 25 percent to $478 million. For the first half of 2014, the average price of a subscription was $97 per year. In the first half of 2015 that average increased to $118 per subscription.

Apple Music, which launched on June 30, was not included in the report, however. And with 11 percent iOs users reporting that they are currently using the service, the RIAA expects paid subscriptions to continue ticking upward in the second half of the year.

“I think it’s going to have a positive impact,” said Friedlander. “These services have mostly grown through word of mouth. There hasn’t been a big Spotify advertising push. When you get a player like Apple involved, that really generates a whole new level of awareness.”

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.