At Condé Nast, yesterday’s competitors are today’s collaborators. Condé is striking video-distribution deals with publishers such as BuzzFeed, Vox and ABC News, media companies it views as valuable partners in a video-consumption landscape dominated by YouTube.

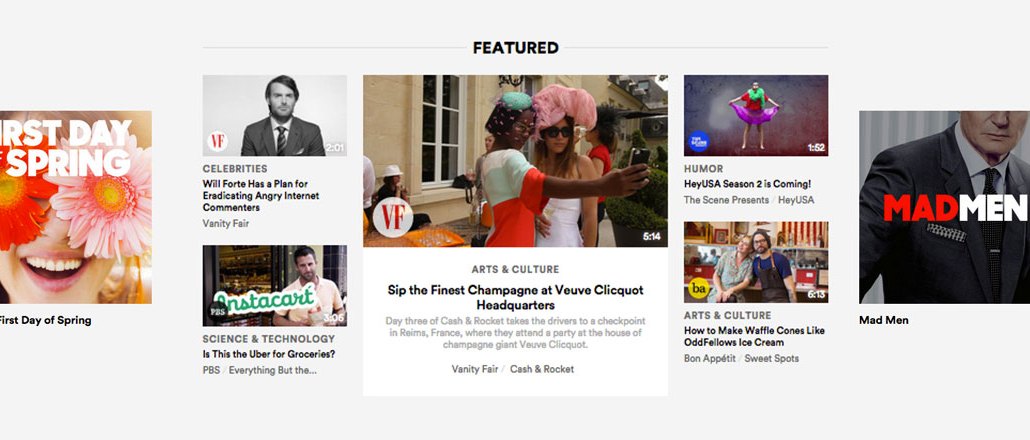

Condé Nast’s 8-month-old video platform, The Scene, hosts everything produced by Condé Nast Entertainment, the media company’s video production arm, as well as video from close to a dozen content partners. Condé is offering these media partners one-year, non-exclusive distribution deals, according to a term sheet provided by a source. The revenue split is better than YouTube, which typically keeps 45 percent of ad revenues on partner channels. In return for non-exclusive access to all of its partners’ ad-supported video, Condé Nast sells video advertising against those videos, handing 60 percent of that revenue to its partners and bagging 40 percent for itself.

“We knew that, like us, other content creators like us were looking for quality, well-lit destinations for their video,” said Fred Santarpia, evp and chief digital officer at Condé Nast. “When we went to market, we found there was an appetite for that.”

Condé’s video deals cover revenue generated on TheScene.com as well as The Scene apps, which are coming to iOS, Android and PlayStation, the document reveals. Apps for The Scene are already available on Roku, Apple TV and Xbox.

Condé Nast isn’t looking to The Weather Company, PBS or its other content partners to bring new viewers to its video hub — none of their videos on The Scene are exclusive to that platform — but it does want to provide a depth and breadth of content it can’t offer on its own, said Santarpia. If The Scene visitors stay longer and watch more content, that means more revenue for both Condé Nast and its partners.

Condé Nast is selling The Scene inventory to advertisers at more expensive rates than open platforms like YouTube attract, confirmed Santarpia. But if partners believe they can earn higher rates than Condé’s sales team, they can buy back up to 80 percent of that inventory on their content from Condé and sell it themselves, according to the term sheet.

Either way, there’s little downside to piping video into The Scene for these media companies. “If you could get 50,000 more streams than you could get on your own, you’re better off,” said the source who shared the document with Digiday.

But The Scene hasn’t been a simple launch for Condé Nast, which is having trouble maintaining consistent traffic to its video platform. After reaching a peak in October 2014, attracting 11.5 million unique video viewers on U.S. desktops, The Scene has seen its audience decline for five straight months, according to comScore data. In February, that desktop audience had shrunk to 2.8 million unique viewers.

“We’re in our peak in the October time frame; that’s our biggest month from an advertiser-demand perspective, and we push the machine in terms of our production during that period,” said Santarpia. “When we start getting into November, December, January and February, we’re practically dark. And if you’re not releasing content multiple times per day or per week, your traffic is going to fall off a cliff. If we get to a point where the ad dollars are justifying the production in those dark months, frankly, we’d probably be increasing our production and see less of that cliff.”

Other media companies didn’t face as steep a cliff — or any cliff — during that time period. Across its network of owned and operated sites, Time Inc. grew its video viewership on U.S. desktops from 6.4 million uniques in October 2014 to 10.7 million in February 2015, according to comScore data. BuzzFeed.com saw its U.S. desktop video viewership fall from 9.5 million in October to 6.7 million in February — a substantial decline, but not as dramatic as The Scene’s 75 percent viewership drop.

Much of The Scene’s traffic today is driven through content-recommendation engines. The top four referrers to TheScene.com are Outbrain, Taboola, MGID and Steepto, collectively driving 59 percent of the site’s traffic, according to Amazon-owned analytics site Alexa.

“We’ve spent a lot of time on video at the firm, and we don’t see any real math in investing in hubs and portals on the part of publishers,” said Steve Goldberg, managing director of digital at Empirical Media, a media consulting firm. “It sounds to me like they spent quite a bit of money acquiring traffic, and the economics of it didn’t pan out, so they pulled back on the acquisition of traffic, which is where they are now.”

“As our content production slows down or speeds up, we calibrate the corresponding marketing efforts, not just in paid, but in social, earned and owned,” said a Condé Nast spokesperson.

It’s tough to drive organic traffic to The Scene, because partners have no major incentive to send traffic there as opposed to their own properties, said Paul Kontonis, executive director of the Global Online Video Association.

“The Weather Company makes its most money when you watch video on Weather.com. They don’t want you to watch it anywhere else. So all these deals do nothing for The Scene’s traffic,” said Kontonis. “And [The Scene] is not going to win on the search engine side of things. So until they have a hit, a show that people really come to them for and they get known for, there’s no audience there.”

But Kontonis isn’t critical of The Scene as a whole; instead, he thinks it needs some time to germinate. “The value proposition is very high at The Scene for viewers. They have some great programming, like that ‘73 Questions’ video series from Vogue. It just takes a really long time to build an audience that will consistently come to a platform and expect great content from it. It’s not easy.”

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.