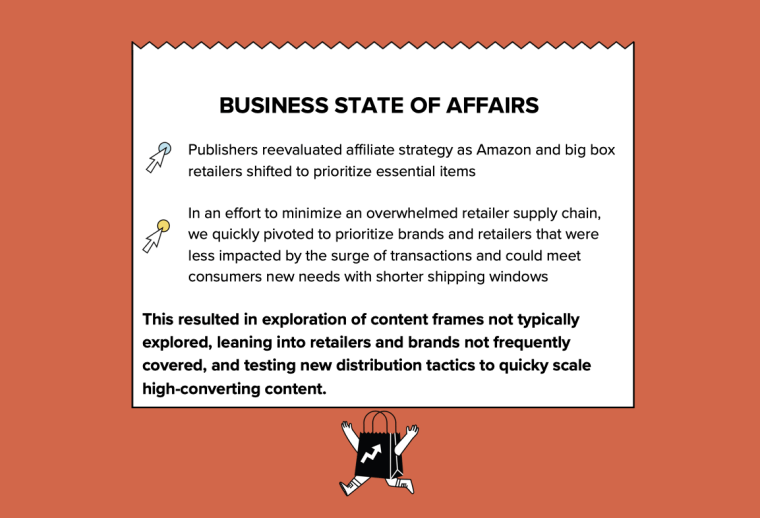

Publishers’ growing commerce businesses got a wakeup call as coronavirus hit: Amazon cut commissions for referrals to products classified as “non-essential.”

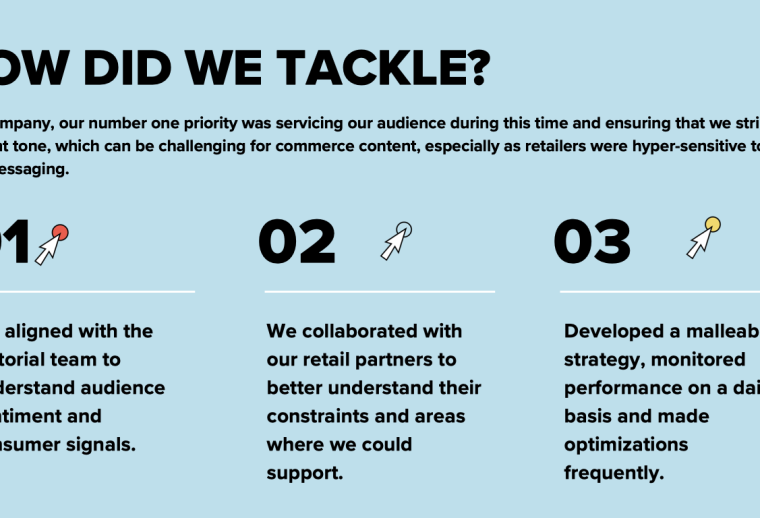

BuzzFeed initially took a hit during that time, but was able to rebuild that revenue stream by tapping into more direct relationships with 1,000 retail partners, said Nilla Ali, BuzzFeed’s svp of commerce, in the latest edition of the Digiday+ Talks. She even expects that commerce revenue will be up year over year a the end of 2020.

“More people are shopping online, conversion is higher and we’re getting better at anticipating consumer demand because it’s happening in real time,” said Ali. “If you have not had a commerce business in the past or you haven’t doubled down on it, now is the time to do so.”

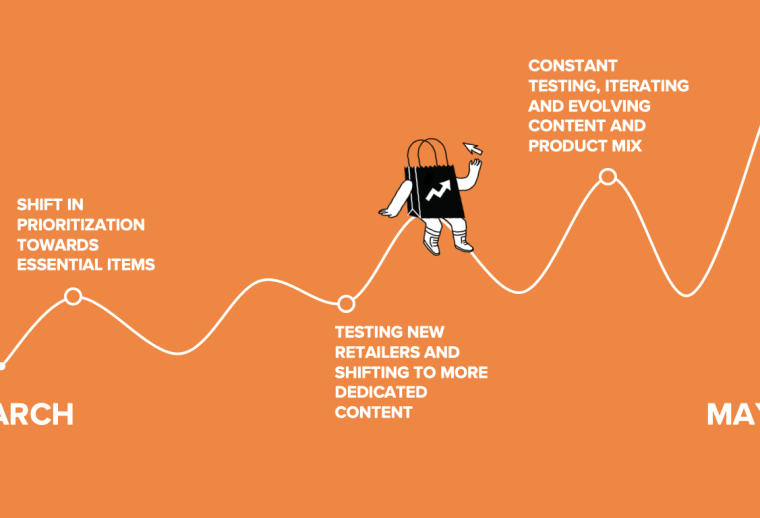

Coronavirus has driven several changes to BuzzFeed’s commerce business, Ali said. “It has upended everything,” she said. Some top changes:

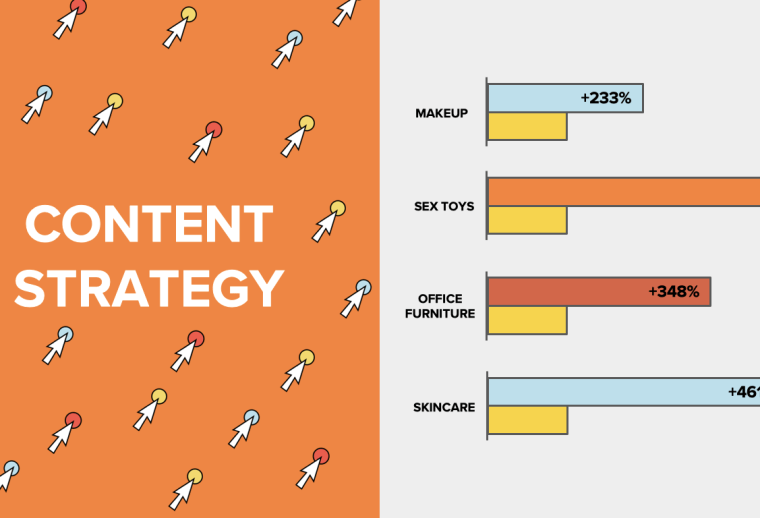

- Traffic to beauty and makeup articles has surged, along with that to home furnishings and, oddly enough, sex toys.

- The editorial team and affiliates team work more closely together, necessitated by rapid changes in shopping habits and retail inventories.

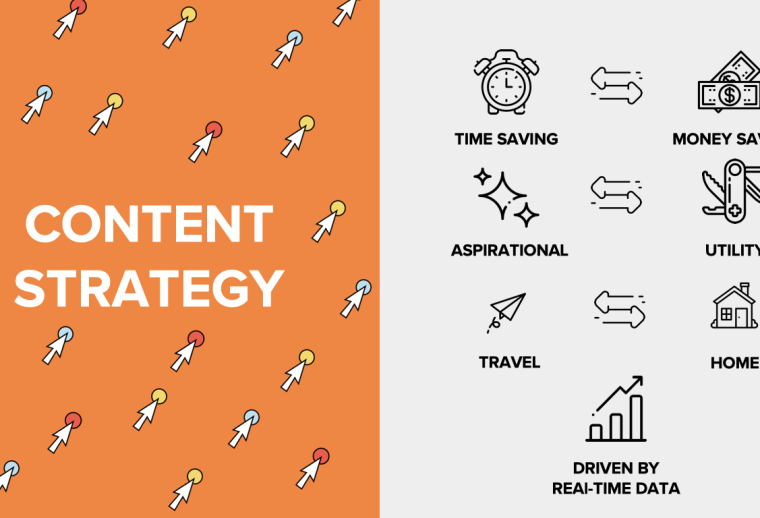

- Retailers have relied more on promotional tactics, leading BuzzFeed’s commerce content to emphasize cost saving and utility rather than time saving and aspirational.

“Test as many things as you can right now because the influx of people shopping online means the signal we can get in real time is much faster,” said Ali. “It is a time to be risky and get as many learnings under your belt as possible and make money while you’re doing it.”

In the latest Digiday+ Talk, exclusively for Digiday+ members, Ali talks about where BuzzFeed placed its bets on commerce during the pandemic, and where her team anticipates the possibility for more growth.

Taking big bets on promotions

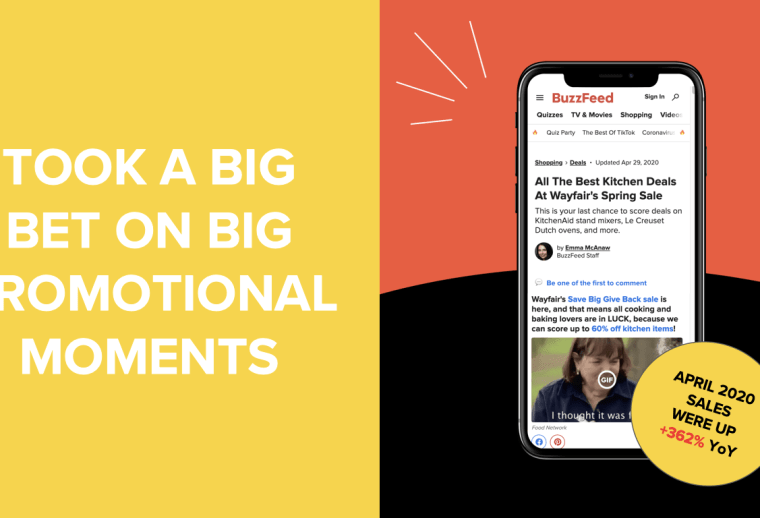

Promotions put on by retailers have offered a unique opportunity for BuzzFeed to grow its affiliate business during the pandemic, Ali said. Having ongoing conversations with its retail partners to learn about any promotions enabled the publisher to produce timely content that it could pass on to its consumers.

And because the prices of the products in the promoted content were less expensive, there were products that would fit in consumers’ budgets, who are mindful of their spending given the economic downturn. “Even if overall spending is down, more people are shopping online so the pie is bigger,” Ali said.

- “The retail space was becoming hugely promotional,” said Ali. “We’re seeing sales and discounts happening across the board that were comparable to what we typically see in Q4 during Black Friday/Cyber Monday, which presented a new opportunity for publishers to take action on.”

- One promotion in particular that Ali said her team took a big bet on from a content perspective was a sale that home decor and furniture company Wayfair had in April. She said that the edit team doubled down on content and specifically leveraged social media and newsletter channels to push this content to readers. The team also did on-site promotions of this content to drive awareness to the sale. The testing around the distribution strategy paid off as April 2020 Wayfair sales increased 362% year over year.

- If there are certain retailers or products that you haven’t leaned into in the past but have a promotion for products that are timely and likely to resonate with your audience, Ali said that now is the time to dedicate your distribution channels to pushing those things because it is likely that they will pay off now more than ever.

Managing affiliate partnerships

BuzzFeed has thousands of retail partners, which can make managing those relationships a daunting task, regardless of the size of your commerce operation. While only 10-20% of those relationships are currently having active conversations with the publisher, she said that there are still a lot of relationships that need to be maintained weekly to ensure that BuzzFeed is abreast of the promotions retailers are doing and the trends they are seeing in their customers’ purchasing.

On the other hand, publishers are in the unique position to serve as a major resource for retail partners right now.

- Retailers also do not want to come across as trying to capitalize on a tragedy, so they are turning to BuzzFeed, and other publishing partners, to serve as a guide in approaching consumers in a way that comes across as helpful, Ali said.

- Do not be afraid to use affiliate networks and affiliate agencies who can do most of the leg work for you, especially if your team is lean. Ali said that this is a significant resource that the publisher has been leaning on during this time as her team works to stay up to date on the latest movements in the retail environment.

The impacts on advertising

Typically publishers cannot, at-scale, drive the purchase intent that other media buys can, especially when the content being produced is extremely timely with what consumers are actively looking for, Ali said. But this time period has allowed BuzzFeed and other publishers to prove that they are able to push forward more conversions, like in the Wayfair example.

Therefore, publishers can start to look more at not only selling ad campaigns featuring commerce opportunities, but also look at how to include storytelling and the discoverability of new brands and products in those campaigns.

Publishers also have a goldmine of data around what consumers and both reading and buying, Ali said, putting them in a great position to bring these two areas together within branded content. She said there is a great opportunity to tie the affiliate business into the branded content business right now and after the pandemic.