Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

This is the fourth of a four-part series, “The Future of Automation,” which looks at how smart publishers are reorganizing for the age of the machines. Digiday will explore these issues and more at the Digiday Exchange Summit, Jan. 30-Feb. 1, in Miami.

For many publishers, the world of automated ad buying is a grudging necessity. They’ve dragged their feet, fretted over the implications, and cautiously entered the world of machine-based buying.

Not Forbes. The 96-year-old publisher is emerging as a vocal proponent of automated ad buying — not just real-time bidding, mind you — as a net positive for top-line publishers who are used to commanding rich ad rates. For Forbes, the shift to programmatic buying simply isn’t something publishers should fear.

It is somewhat ironic that Forbes would have this position, considering it was the poster child for inveighing against the perils of commoditization at the hands of ad exchanges when Forbes.com was led by Jim Spanfeller. Things are clearly different now.

“I think we’re all looking at banners as an endangered species; they’re part of why machine buying is appropriate,” said Meredith Levien, Forbes’ chief revenue officer. “There’s so much inventory and better ways to prove that value.”

This point of view was forged by hard experience. Levien, who joined Forbes in 2008 from The Atlantic and rose to chief revenue officer in 2012, has been a big key in making this transition. Forbes isn’t a newcomer to this world. It started trying to figure out programmatic buying in 2010, when its executives saw its online ad pricing power eroding. Forbes cautiously dipped its toes into the programmatic waters, but just a year later, 98 percent of Forbes’ advertising business, including print revenue, still came from direct sales.

The problem, and many publishers face this, is that too many of those direct sales were what Levien calls the “transactional RFP” variety. Translation: Sales people were slinging banner ads. That’s not a long-term strategy in a world where Razorfish chief media officer Jeff Lanctot says agencies want to move to the “no-banner planner.”

“Our belief that we can play in programmatic stems from a lot of confidence in our digital business and premium business,” Levien said. “We have to get to the place to feel confident in how we were doing in the space to be as aggressive in programmatic.”

Forbes in November 2011 linked with The Rubicon Project to launch a private ad exchange but then switched over to Google in the beginning of last year. Forbes is using a private ad slot in the ad server to sell its inventory on Google’s ad exchange, AdX. Unlike many publisher private exchanges, the exchange is open to all advertisers to bid on Forbes inventory. It is a pretty open approach for a top-notch publisher, with no price floors, block lists and full-price transparency. This is a way to get around the disappointment of private exchanges: Many publishers have so zealously closed them off that they haven’t seen much volume. Levien says that hasn’t been a problem, as Forbes has seen programmatic rise to 10 percent of digital ad revenue. Forbes also sells some inventory through the DoubleClick Ad Exchange.

The company boasts its digital business had double-digit growth in 2012 over 2011. Levien said that in 2012, Forbes achieved its best financial performance in the last five years. Overall growth in digital revenues (up 16.3 percent in 2012 compared to 2011) was a significant contributor to the overall performance of the company.

Forbes is complementing its ad sales force of about 35 with a programmatic team of six. This programmatic team includes technologists who work with the premium team to use first-party data for advertisers and figure out ways to add a programmatic angle. Levien said there’s a lot of training and teaching about how a programmatic solution can actually do a better job of solving a marketer’s problem.

“The digital team over there has always been at the forefront of programmatic selling, really pushing the envelope around the enabling of monetization channels,” said Joe Kowan, practice lead, digital trading and activation at MEC Global. “By embracing RTB as much as they have, the challenge Forbes will face is on the direct-sales side, as they’ll need to be considerably more creative to convince buyers that they have more to offer than just whatever shows up in general auctions. They’ll need to add considerable value into their up-sell to entice buy-in for bigger programs.”

Forbes is trying to address this. It recently rolled out an organizational structure so that the sales, marketing and ad team operates with an eye towards growing the premium business and move more heavily to the programmatic space.

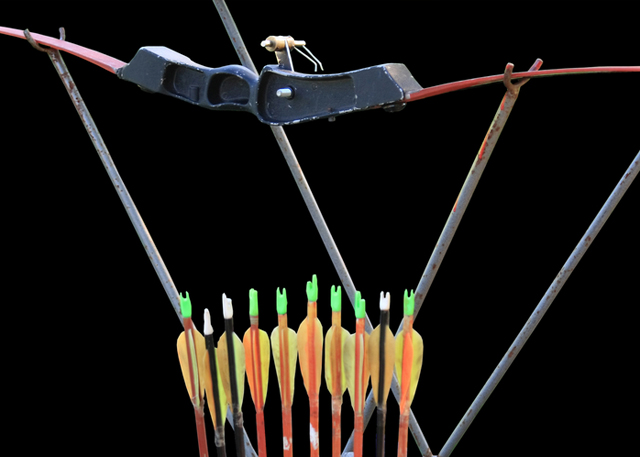

“Programmatic isn’t a magic bullet to save digital advertising,” said Levien. “It’ll change a lot of it but won’t fix it. It’s just another arrow in the quiver of arrows.”

Image via Shutterstock

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.