- 01 The pandemic changed the Amazon landscape

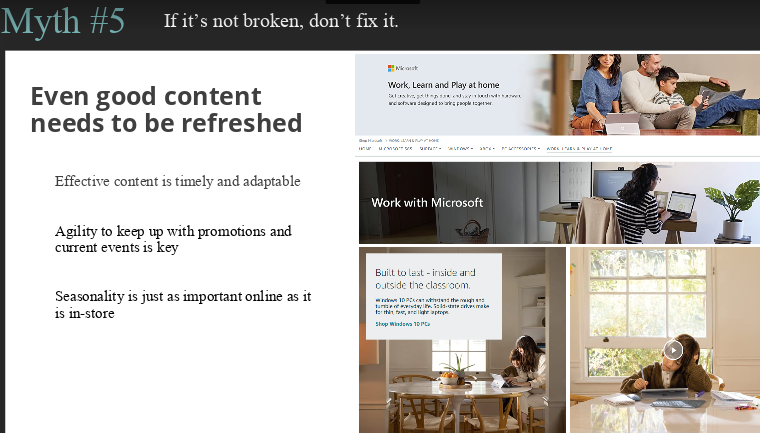

- 02 Brands should be capable of regularly changing up their page content to reflect their customers’ lifestyle at any given time

- 03 Buying trends have changed as consumer behavior has changed

- 04 Playing defense on your keywords and search terms is crucial

- 05 Amazon isn't just about search anymore

- 06 Luxury is warming up to Amazon

- 07 Overheard

- 08 WTF: Amazon ad terms, explained

- 09 Presenter slides: Luxury on Amazon

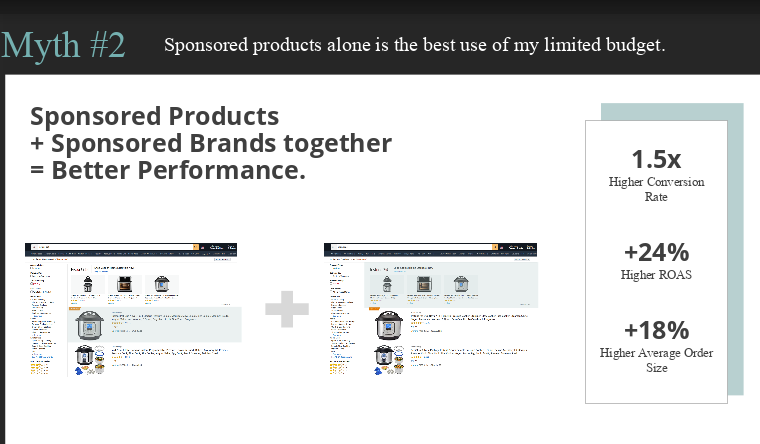

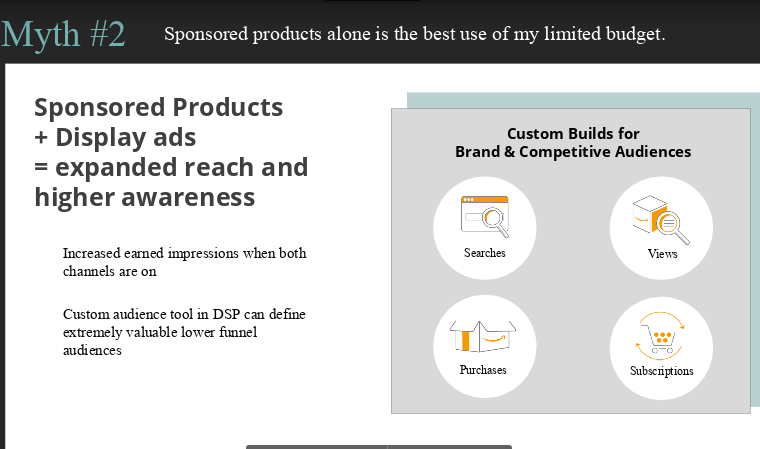

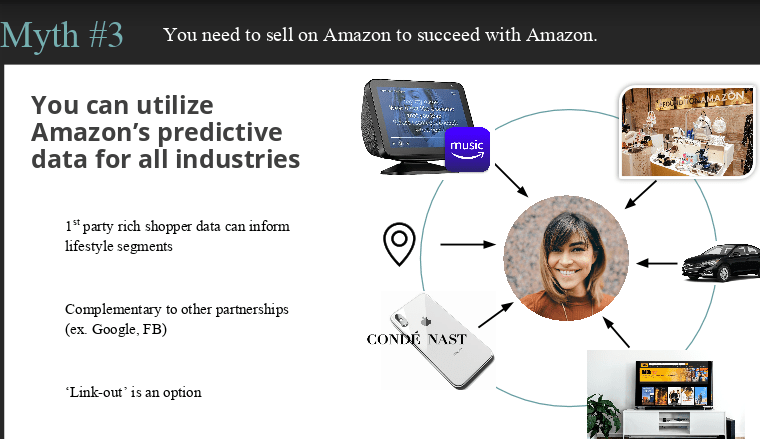

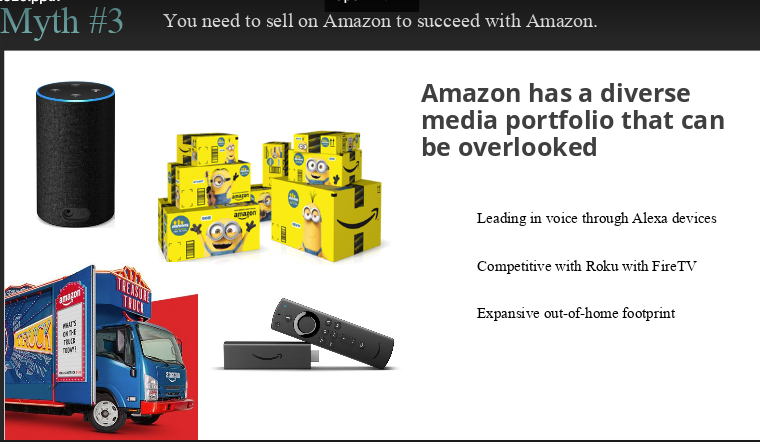

- 10 Presenter slides: Cracking Amazon Advertising

- 11 Event video

Mastering an Amazon advertising strategy has never been more critical for brands than it is now. In March, the pandemic rapidly converted a cohort of online shoppers who newly counted on the platform to safely deliver their essentials, and now, these consumers are sticking around for not only the convenience of e-commerce, but to discover new products and engage with brand content. In this span of time, brands have had their quarterly digital marketing plans upended, but not without a unique opportunity to reap the rewards of an online shopping surge. Amazon presents an evolving playbook of options across the entire marketing funnel, and brands should be taking steps to make sure they’re taking full advantage of everything from keyword search to brand awareness.

Digiday’s Deep Dive: Amazon Advertising Strategies is a collection of videos, presenter slides and key takeaways from our event that will provide valuable tips and key insights so your brand can come out on top in the competitive Amazon ecosystem.

The evolving e-commerce blueprint

In just a few short days in March 2020, Amazon went from being an online shopping destination to a lifeline for millions of locked-down consumers, and it changed the advertising landscape for brands as they knew it. Brands that carried essential items saw their products flying off the virtual shelves, and in turn, faced unprecedented challenges in supply chain and logistics. Other brands had to quickly adapt their product offerings and messaging as consumer behavior transformed to reflect the quarantine lifestyle. All of it unveiled a glaringly tough reality: if a brand didn’t have their product and brand presentation on Amazon in tip-top shape, it was going to show now more than ever.

Ad strategy on Amazon is one critical gear in this entire system of moving parts. No longer can brands solely rely on spending patterns and marketing funnel strategies from previous years. If they’re being strategic, then Amazon ad agencies will be working around the clock to constantly be reviewing a brand’s ad performance on the platform and alter budgets and tactics accordingly. “The person who is managing your ads should be reevaluating every single day,” said Daniel Owen, evp of digital marketing agency Direct Agents.

But success on Amazon relies on so much more than measuring ROAS (return on ad spend), which can be good news for brands with a limited ad budget. Success requires taking into account the entire picture of a brand’s online presence, everything from packaging and display, right down to customer satisfaction on a brand’s e-commerce channels. Meeting consumers where they’re at and knowing which products will resonate with them is critical for creating efficient ad campaigns—it’s important brands know what Amazon product offerings will do better for brand awareness versus conversion.

In fact, awareness and recall is sometimes an area that brands overlook when it comes to optimizing their presence on the platform. Andrea Hippeau, Principal of early stage venture capital fund Lerer Hippeau, admits that it’s the case that, unlike a brand’s own DTC website, brands have less control over their presence on Amazon, from the aesthetics and feel of the site, to how algorithms affect product display, to access to certain data. However, it’s worth putting in the effort wherever possible, she says. “It’s still hard; you only have so much text to put your brand story in and so many images you can upload,” Hippeau said. “So it’s really a whole new beast and I think that it’s something that shouldn’t be taken for granted and needs to be closely managed.” Of course, brands need consumers to get to their pages, and the challenge is navigating and experimenting with Amazon’s ad resources like paid product search to defend key search terms, as well as its DSP in order to get relevant content and videos in front of customers.

With more consumers taking to the internet to shop, the scope of what brands and products work on Amazon is also shifting. “I don’t think consumers are really willing to go to five to 10 destination sites to shop anymore, so you need to be aware of where consumers are buying your competitors and if that’s mainly on amazon then that’s probably something you should to invest in from the very early stages,” Hippeau said. That includes, possibly somewhat surprisingly, those in the luxury segment. Amazon has been doing more in recent months to attract prestige brands to the platform, recognizing the opportunity to capture a new kind of shopper. For these brands—and really any brand—conquering third-party sellers can seem daunting at first, but there’s no shortage of hacks and maneuvers to deploy.

Here’s what you need to know.

State of the industry

As lockdown took effect in March, shuttering brick-and-mortar retail, most people probably assumed it was business as usual over at Amazon and for businesses selling through the e-commerce giant. Nothing could have been further from the truth.

With “normal” life completely upended, brands realized they couldn’t talk to consumers the same way they would have pre-pandemic. Brands scrambled to align their messaging strategies with the changing needs of the moment.

The distribution pipeline was also disrupted. For a few weeks, Amazon’s Fulfillment by Amazon (FBA) service, which handles shipping for third-party vendors via Amazon warehouses, was only sending out essential items. Brands were not prevented from selling non-essential items, but they were on their own when it came to shipping orders. This forced many brands to rethink their advertising plans to avoid advertising for an item if they couldn’t fulfill the order.

Though shipping non-essential items was a headache, Hippeau of Lerer Hippeau said many brands as of late are finding that consumers are in an exploratory mood, willing to switch brands or purchase in a category they had never shopped in before. “What we have seen…is a really strong lift in direct digital,” she said. “Companies are seeing falling customer acquisition costs on the digital channels, arcing back to three years ago. Also organic channels and organic sales—a big lift there too as consumers have been able to figure out exactly where they want to spend and are thinking about spending outside of essential products. They have the time, and they obviously have to order online.”

Of course, the pandemic has forced brands to adapt their messaging and presentation in response to a drastic, society-wide and global change in lifestyle. But there’s also a valuable, evergreen takeaway in all of this.

Ben Knox, vp of e-commerce at Super Coffee said, “If you’re spending money on advertising to a product page that falls flat on empathizing with the consumer, than your advertising is going to fall flat.” Life for Super Coffee’s customers is less on-the-go than it was pre-pandemic, so the brand is emphasizing other themes to address that shift. Meanwhile, Rob Towne, director of performance marketing at mattress brand Purple said the company had reworked its advertising and on-site messaging to reflect the transformation of their white glove delivery operations—which normally would have seen delivery men entering the home to help with installation—after COVID-19 hit.

- Brands can prepare for a crisis by refocusing effort on their fundamentals. A strong brand presence across Amazon’s various features gives the brand a solid foundation to get through tough times. This means, firstly, Amazon advertising should elevate the brand’s hero products. It doesn’t matter if a given product is selling perfectly well without the added push of advertising – your best-sellers help build consumer trust in the brand. Amazon ads are not the place to push an early version of a product.

- “There isn’t a lot of room for error, so you have to be really careful about the product experience and then really doing as much follow up as possible with the consumer,” Hippeau says. That follow-up could mean a call to action displayed on the product’s packaging, or something else that brings the consumer back to the brand’s website. Customer support teams should also be familiar with Amazon. “You can’t do it as an afterthought or haphazardly. …That’s a great way to get a bad rap and get your product and brand pushed out of the algorithm,” Hippeau added.

- Puja Patel Rios, vp of e-commerce at Cora, said sales of the brand’s feminine care products have increased since the COVID-19 outbreak began. “There are things that I think helped us for sure during that time period—strong ratings and reviews, and just having a healthy brand presence,” she said. Cora’s average daily sales in the period following the outbreak were double their usual average—some days they were four or five times higher.

- Although Cora was helped by being considered an essential product, and thus able to use FBA through the height of pandemic disruption, the brand’s robust e-commerce presence went a long way to giving it the ability to excel. “I think what helped us during that period was having those foundational elements in place already, like having a strong brand store, having hundreds of, if not more, ratings and reviews,” Patel Rios said. “So when she came in and she started looking to bulk buy, it was really easy for her to make those decisions and opt for Cora.”

- Brands can plan for future disruptive events by crisis-proofing their supply chain and distribution networks. To avoid being over-reliant on Amazon for shipping, brands should explore backup options and prepare to diversify distribution.

- “Make sure you have a really involved supply chain with Amazon,” Maggie Curran, VP of Sales, E-commerce & Business Divisions at Belkin said. “We’re seeing a lot of warning signs from Amazon that they’re going into the holidays and Amazon Prime day and they’re worried about their own fulfillment, so make sure you have those things in place now.”

BOTTOM LINE: Covid-19 changed the game for many brands and advertisers on Amazon, and in doing so, highlighted the necessity for brands to have the fundamentals in place to weather the tumultuous circumstances of the consumer demand. There’s no telling what the future of the pandemic could bring, so it’s key that brands are proactive when it comes to managing their supply chain and logistics and keeping on top of their brand messaging to stay in tune with customer sentiment.

If there’s one thing that the pandemic has taught brands, it’s to expect change, and to expect it often—and nowhere is this more true than in the case of purchasing behavior. Over the last several months, brands have seen unexpected spikes in product categories, from PPE, to outdoor gear, and they needed to adjust their ad strategy accordingly. It’s now more important than ever for brands to avoid squandering their hard-earned ad dollars on a mountain bike that’s already sold out on Amazon, and this is why Daniel Owen, EVP at digital marketing agency Direct Agents observes the top million keywords as they shift each week. “We call it the ‘Amazon consumer pulse,’–you’re getting the real intent of users on a week to week basis,” he said. Ultimately, if brands can get a handle on the trends before the consumer demand is there, they can leverage this knowledge to adjust product development and innovation, sourcing, as well as budgeting and strategizing around creating efficient ad campaigns.

- Be nimble with your ad spending and with testing out different strategies day to day. The days when ad spend could be strategized months in advance are long gone. Today’s environment calls for a more nimble approach—experimental yet focused. Amanda Stone, director of e-commerce at vitamin brand Olly, said the company’s original Amazon advertising strategy for 2020 envisioned a health-centric Q1 messaging shifting seamlessly into a conversion push in Q2. “Our initial 2020 strategy was … Q1 is really big for the vitamin industry; it’s all around health, ‘new year, new you’ …” Stone said. “This is a great way to win new customers. it’s a great time to focus on upper funnel and branded tactics because there are already a lot of traffic and conversion happening naturally in the category. That would be a strong time and when we invested heavily in things like Fire TV. … Q2 was a heavy conversion tactic driving strategy. This would be a really important time to use Amazon advertising and get really granular around those search keywords.”

As it happened, Olly has been dealing with a large influx of customers, but largely as a result of the COVID-19 pandemic. The company no longer needed to waste ad spend on persuading consumers that they need to buy vitamins—consumers were lining up to buy vitamins—but they were encountering shoppers new to the category who were looking for supplements to help them boost their immune system, sleep better, or deal with stress. Stone said this change in circumstances called for a need for the company to double down on ensuring their advertising strategy was efficient, and fortunately, the company was already well-versed with testing and rotating through a variety of tactics on Amazon. “That’s the key when using Amazon advertising is to not be scared to test things,” she said. “You can fail really quickly, you can fail really cheaply and every failure is just a learning to help you improve your ad campaigns.”

- Amazon advertising is like a shop window for a brand, and just like a storefront, Amazon ads should be used as a space to show off the brand’s best products. Brands should only advertise the items that will offer the customer the best experience the brand can deliver, so brands should strategize beyond the product itself. For example, Stone says that Olly is fortunate to have operations and logistics capabilities to be proud of, and these attributes will form part of the customer experience resulting from any purchase via the brand’s Amazon advertising.

The pandemic underlines this necessity more than ever before. “This is is a time where consumers are open to buying a different brand based on availability or based on their changing needs,” Stone says. “But if you fail them in delivering that experience…they will quickly move on.”

- Brands should be monitoring total category sales trends even in areas that are seemingly unrelated to their product category. For example, Belkin benefited from a rise in demand for “health and wellness” products because they sold UV wireless sanitizers for mobile phones, and they also performed well in “education and working from home” because quarantine demanded that parents and teachers buy chargers and other equipment for homeschooling, while employees had to DIY a home office.

Along with this, Curran said, the important thing is to look at the long-term trends. “Initially, we were targeting ‘work from home’ keywords, but that had a really short blip,” she said. “Really focusing on, though, the products people are using for working from home—which would be WiFi, and a lot of education products that Belkin sells for schooling from home—those have continued. Changing those search tactics and really focusing in on the product and how people are using them in the home…has been really key.”

BOTTOM LINE: The shifting circumstances of the pandemic in the months ahead could spark a new wave of major shopping trends and demand for certain products—and brands need to be on their toes. In this instance, it’s crucial that brands think about the big picture and prioritize their overall customer experience on Amazon. Major shipping delays or unavailable merchandise could result in negative reviews detrimental to a brand’s overall image and algorithm, so if it looks like a product is sure to sell out, brands should have an elastic advertising back-up plan ready to go.

Anyone who has searched for a product on Amazon knows that the top brand and product listings that appear are prime real estate for getting in front of a consumer, and no brand A wants a competitor to appear in the sponsored listings when a consumer’s original intent is to find brand A. However, in the days of the pandemic, many brands’ budgets are stretched, and being hyper-strategic about keyword bidding is more important than ever.

How a brand tackles this depends on a multitude of factors—in fact, in some cases, outbidding a competitor to win a search term may not be worth the money if the brand is confident the consumers searching their brand name have the intent to buy their product anyway. Others, however, prioritize playing defense. “Our stance generally has always been to win and defend Cora as a brand,” said Patel Rios of Cora. “Thankfully it hasn’t been so aggressive that we’ve gone back and forth and now the bid is totally out of hand and we can’t justify that spend.”

- When developing a keyword-centric advertising strategy, brands need to break their budget down and understand what they are spending on each keyword. Ben Knox of Super Coffee says brands should categorize each keyword in terms of the “buckets” they belong to. For example, some keywords relate to the brand itself. Others are relevant to the category, while others still are important to the brand’s ability to challenge competitors in the market.

Each keyword will perform differently, depending on what phase of the purchasing journey the consumer is in. Knox says that there’s more competition over category-level keywords, because those come into play when the consumer is still shopping around with an exploratory mindset. These keywords will perform less well than brand-centric keywords. The buckets help the brand see how keywords perform relative to their function, rather than in relation to all other keywords. The brand can use this information to set reasonable performance expectations and budgets accordingly.

Knox says investing in competitor keywords tends to be more costly. After all, these often involve a smash-and-grab attempt to snatch a customer who intends to purchase from a competitor. Knox says that Super Coffee has had success converting such customers, but that some brands may prefer to focus on category keywords and consumers who are just browsing the field generally.

- There is no hard and fast rule to allocating budgets for various search terms. Knox said brands often want to find a 50-50 balance in spending between buckets, but in reality, these percentages will vary depending on: one, what level of spend per customer is actually showing results; two, the amount of search terms available within that bidding bracket that will achieve volume; and three, a brand’s overall spending threshold. “Our nature is to want to find rubrics and shortcuts and heuristics, but the truth of the matter is it’s more nuanced than that,” he said.

- Bidding on Amazon ads can get out of control, so brands need to set some boundaries in advance. “It’s important to identify your break-even point of what you’re willing to spend,” says Amanda Stone of Olly. Stone warns against getting caught up in bidding wars with competitors, though she says that if your budget allows you to outbid your competitors, go for it.

However, be aware that appearing in paid search is no guarantee of success—the customer could still opt for another brand. If your brand is performing well in organic search, consider sticking with that strategy.

BOTTOM LINE: Amazon’s competitive landscape means winning a keyword could mean the difference between your brand or product being prominently displayed on an aisle end cap versus being buried in the back. Brands should be constantly be monitoring and re-evaluating their spend and keyword performance to ensure their dollars are being allocated wisely so that when it comes time to defend your brand—or even conquer a competitor—they won’t drain their budgets.

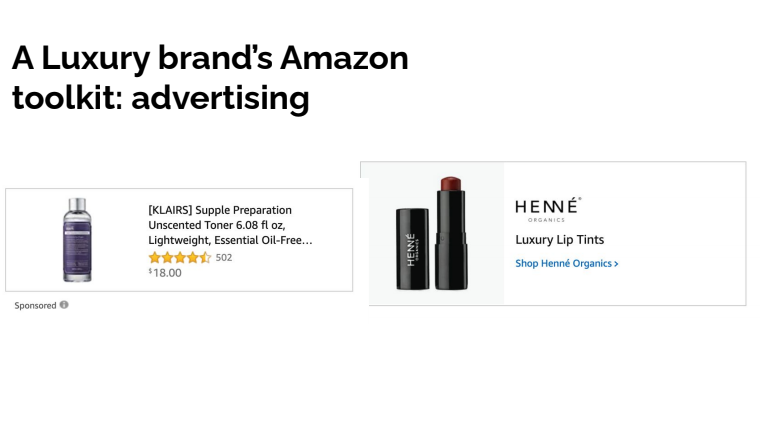

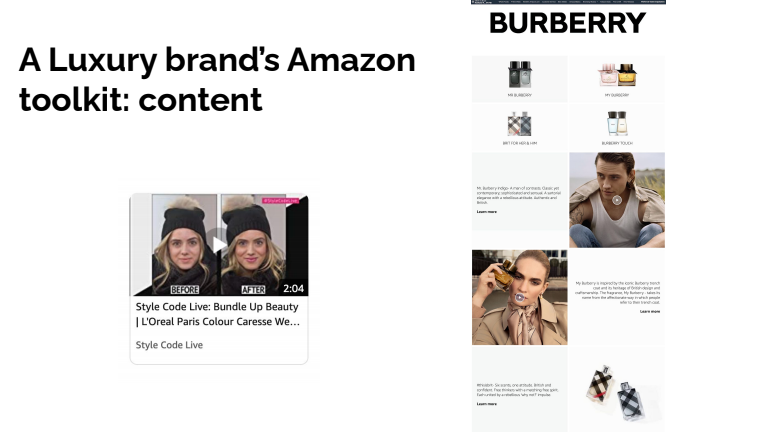

If your brand still thinks of Amazon advertising primarily in terms of search, it’s time to tear up those assumptions. The rise of Fire TV in particular has facilitated a reimagining of what an Amazon ad campaign can do.

We’re seeing more companies using their advertising to build brand awareness, but that also leads straight back to reconsidering if you’re maximizing the impact of your brand landing page. Marketers are upgrading the photography featured on brand pages, reworking their copy, and revisiting the way the brand presents itself across all Amazon touchpoints.

Kiry Masters, founder of Bobsled Marketing is in no doubt that brands can reap the rewards of broadening their approach to Amazon ads to reflect the new potential. “There are limits to the conversations that we can have with Amazon; they’re only going to give us so much, but it’s not going away,” Masters said. “But we’re able to access a different kind of shopper than we would with dot.com or our stores, so let’s make the best of it that we can.”

Masters said brands should immediately take charge of the parts of Amazon they have control over. “The images you’re using, the thumbnails, the gallery, and in the A-plus content page where you can have comparative images, and videos—you can do some really engaging stuff on the product detail page and on a storefront. Amazon has very specific systems and things you can and cannot do, and there’s very few things you can negotiate with Amazon, but what you do have in your control is what does that product page look like and what is that experience like for the customer when they’re searching for information.”

- Marketers need to remember that the customer doesn’t necessarily know everything about their brand, or the individual products. The Amazon brand page is a window into the brand’s DNA, so it’s important to optimize the page to achieve maximum impact.

The customer visiting a brand’s Amazon page will likely have less brand awareness than a consumer shopping on the brand’s website. The respective pages should treat these distinct consumers differently. “We understand that for the average shopper hitting our website, they’re more familiar with our brand,” says Towne of Purple. “But on Amazon, we understand that people need more education because we’re virtually on the shelf with everyone in the same place.”

Towne recommends treating the Amazon brand page like its own landing page. Every content and design element—headlines, bullet points, descriptions, keywords, images—should be tailored to the Amazon customer, wherever they’re at in their journey. “We like to think with a customer-centric view and get as much input as we can from those who might be less brand familiar,” he said. “The truth is, people aren’t as aware as we think. So whatever your product may be on Amazon, just know you know more about the product than the customer does. You need to tell the story from start to finish and you really need to meet people where they are.” Maggie Curran says Belkin International’s approach is to view each component of a brand’s Amazon presence as part of the total, singular story the brand tells via Amazon, not just a driver of one-off sales.

- Data is power on Amazon. Use data to identify target customers and be creative to take advantage of the unique opportunities Amazon offers to speak to those consumers.

Amanda Stone says Olly uses an initial customer purchase as a springboard to pitch additional products to the consumer. For example, Olly’s multivitamin is a big seller, and can be a gateway product leading the consumer to be more open to trying the brand’s probiotics. Stone says that the brand can track this progression and intervene with targeted ads to give the customer some encouragement. “After we already know someone is a multivitamin purchaser, but doesn’t buy other products, we can start serving them ads to specifically relate to the rest of our portfolio…this can all be custom creative to uniquely speak to the consumer.”

Choosing which products to promote may also be determined by the goals of a campaign or the display of their digital shelf. “You’ll see that sometimes your products carry different benefits for you based on what you’re able to achieve,” Stone said. “There are some products that are better for upper-funnel tactics and branded messaging, like a multivitamin…, while there are items that do really well for trying to convert, like melatonin.”

- Brands need to apply a specific set of tactics tailored to getting optimum results from Amazon’s unique platform, but what you do on Amazon exists and intersects within your overall marketing strategy. Success on Amazon is also a function of your activities on other platforms, so stay invested in all digital channels and continue telling your story in the most compelling way you can.

Maggie Curran of Belkin International says brands can’t afford to neglect their other social or e-commerce platforms. “You do have to do them all,” Curran said. “Obviously every brand has to prioritize where their spend is going to be, but you do have to be investing in all of those, because they ultimately drive that overall brand relevance online. Leveraging those to tell one unified story is very critical.”

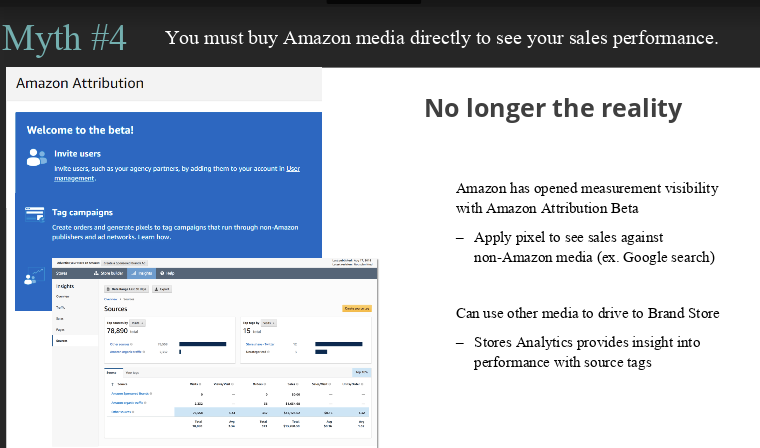

Belkin International’s brands have been able to effectively leverage their direct-to-consumer websites to drive consumers to the brands’ Amazon pages, and brands can measure how their strategies across these channels are doing via tools like Amazon Attribution. “Our online sales with those websites are bigger than ever,” Curran said. “Having a real strategy around all of those and how they tie into one message is really key.”

BOTTOM LINE: Amazon is not simply another sales channel; the platform should function essentially as a brand destination as any other website or brick and mortar would. Brands should aim to deliver an experience that tells a consistent story and is targeted to their Amazon customer, leveraging Amazon’s data tools and insights to help craft efficient messages, share appropriate photos, and create engaging campaigns.

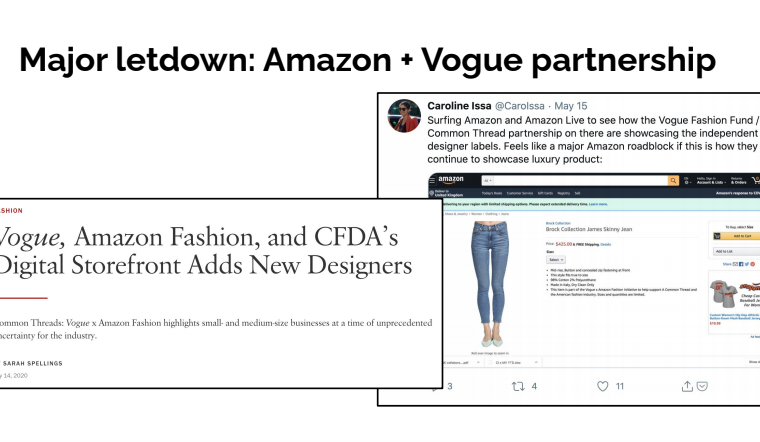

In the past, received wisdom among luxury brands has leaned towards disdain for Amazon. Amazon’s brand of e-commerce was regarded as utilitarian and convenience-centric, ill-suited to the mores of luxury. Brands also wanted to retain their exclusivity. Staying away from Amazon and similar e-commerce platforms meant luxury brands could retain aesthetic control of their online channels. Just as important, the luxury purchasing experience was not muddled in with other brands and lower-end products.

“Anecdotally it comes back to this: luxury brands didn’t want their products to be sold to customers and have it in the same shopping cart as their toilet paper,” said Kiri Masters, founder of Bobsled Marketing and a Forbes Retail contributor.

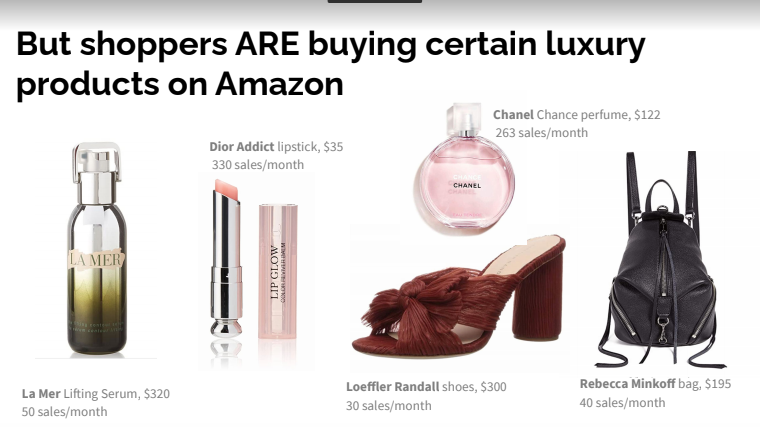

Gradually, the luxury market has come around to Amazon, and with good reason. “It’s recently become apparent to more forward-thinking luxury brands that shoppers are buying luxury products on Amazon,” Masters said. La Mer, Dior, Chanel perfume, and Rebecca Minkoff bags are among the companies seeing good sales each month.

It’s not just that brands are recognizing that Amazon accounts for more than 50% of all e-commerce transactions. Brands are also seeing that Amazon shoppers represent a very diverse demographic, including significant overlap with their own affluent core consumers. “Even for the Chanels, the Elizabeth Ardens, there’s this recognition that we can’t ignore it now,” Masters said. “Although it’s not the same experience as walking into a Chanel store, people still want to buy their perfume and have that delivered to them safely and conveniently.”

“This is where people are starting their shopping journeys, this where they’re ending their shopping journeys,” Masters adds. “You can’t ignore that Amazon makes up such a significant part of the shopper journey across all types of purchases and we’ve been at a point over the last few years where it’s just become impossible to ignore the part that Amazon plays in most of our lives.”

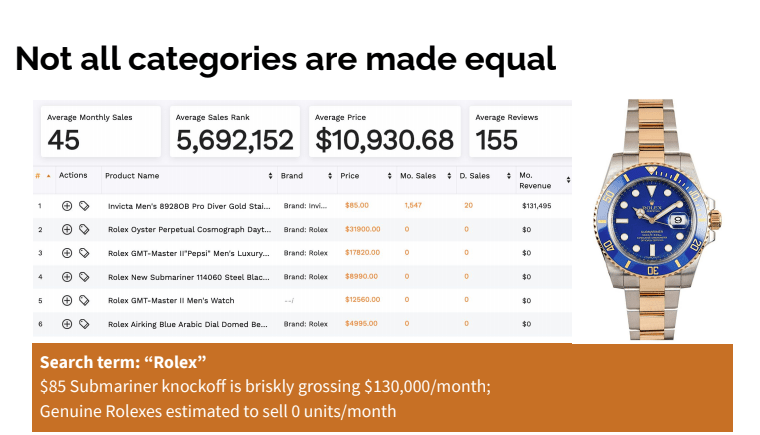

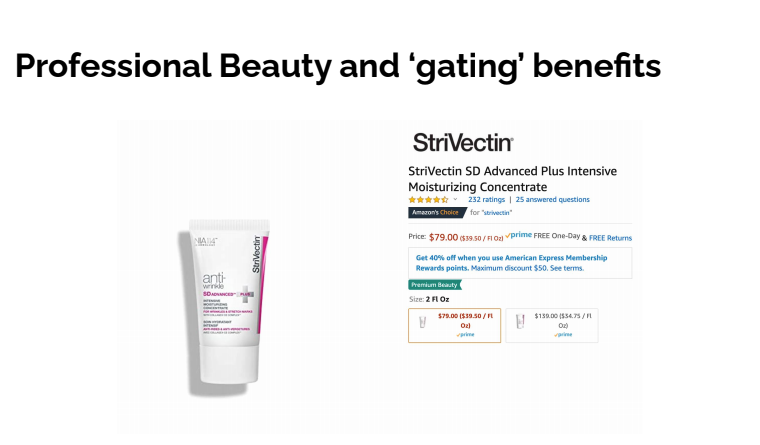

- Luxury is coming to Amazon—but not all luxury categories mesh well with the platform as it is now. In some categories, like apparel and fashion accessories, the prevalence of counterfeits is a deterrent, while some brands—not to mention luxury consumers—view the platform’s utilitarian aesthetics as a turn-off. In contrast, Amazon runs a premium, invite-only platform that presents luxury beauty brands with a more elevated e-commerce space.

Case in point: Vogue and the Council of Fashion Designers of America (CFDA) recently launched Common Thread, an Amazon store intended to showcase the work of 20 independent designers. But Amazon is a challenging place for brands in the luxury apparel and fashion accessories categories. The platform’s user experience can be underwhelming for the luxury shopper, as Masters explains. “It really seems to fall flat when you look at Amazon’s utilitarian imagery,” she said.

Beauty brands tend to fare better, partially thanks to the Premium Beauty platform Amazon offers. “You get a lot more control over who can sell your product,” Masters said of the invite-only beauty hub. “They’ve seen a lot of success with this model; it’s something that isn’t rolled out to any other brand, with the exception of Apple and some other large brands that have significant counterfeiting,” she added.

- Third-party resellers may be a thorn in the side for luxury brands, but that’s no reason to neglect to use Amazon. A passive response simply concedes territory to the third-party vendors. Instead, brands should view the presence of third-party challengers as a motivation to seize back control of their brand and products on Amazon.

Third-party resellers can damage consumer trust in the brand. Brands need to be proactive in minimizing that risk. A major headache for brands in the luxury space is that third-party sellers may not strictly be selling counterfeits, but, rather, expired inventory. “We see that in the comments from a lot of shoppers in their reviews,” Masters said. One hack she recommends is that brands consider creating a form of DIY authentication—marking products or their pages with an additional logo to demonstrate that their products are the genuine article. “This can be a helpful hack to get closer to that ideal scenario where you know customers are getting that legitimate product,” Masters said.

Brands certainly can’t wait around for Amazon to take action, because third-party resellers are here to stay. Masters says Amazon regards these vendors as playing a useful role in the platform’s ecosystem. “During the pandemic, these third-party resellers really helped plug in a gap in the supply chain,” she said. “So they’re very reluctant to give brands the full control of fulfilling these items.”

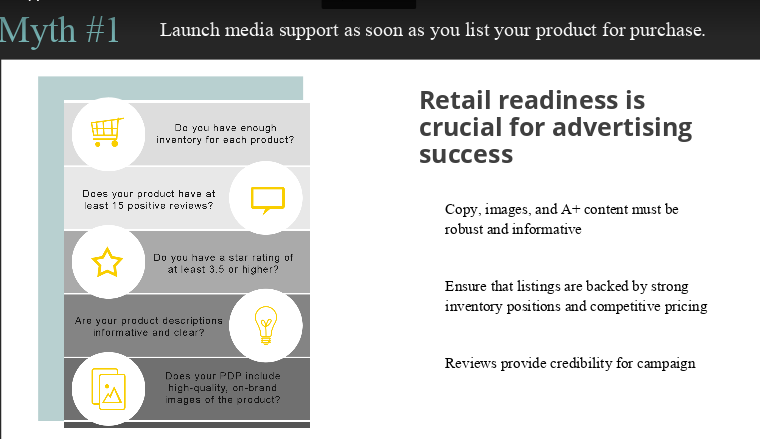

- The value of being retail-ready is under-appreciated. Ad campaigns are more glamorous and fun, but brands have to be on the front foot when it comes to making sure every cog in the retail machine is running smoothly.

Masters says brands should consider the following questions: Do you have inventory available so you don’t run out of stock and leave the door open to third-party resellers? Has your supply chain been cleaned up so you have fewer issues with third-party resellers? Do you have your compliance and product safety information ready to deploy when Amazon decides to audit your products (which can cause your products to be taken offline for days)?

“There is a lot unsexy operational stuff that needs to be in place to make sure that all these fantastic ad campaigns that you’re running are actually going to run because you have inventory available,” Masters said. “That’s a very much overlooked factor.”

BOTTOM LINE: Increasingly, luxury brands are testing the waters with Amazon, and it can be a source for a new cohort of customers if brands play their cards right. Luckily for prestige beauty brands learning how to navigate the platform, there is a model to reference: Lady Gaga’s Haus Laboratories. The made-for-Amazon brand is using most of the tools and techniques of a best in class ad campaign strategy to have, and can serve as a guide if brands don’t know where to start.

“A really big part of Amazon is that it’s constantly changing. The landscape changes, the consumer sentiment changes; you have to be really nimble.”

– Puja Patel Rios, VP E-commerce at Cora

Patel Rios knew that Cora team didn’t have the resources or expertise to navigate the always fluctuating circumstances of Amazon on their own, so they set out to find an agency to help. When vetting companies, Patel Rios wanted to avoid one with a cookie-cutter, “rinse and repeat” approach to the platform. “We wanted to know how they would react if something changed or something went wrong, which inevitably will happen,” she said. Patel Rios suggests brands should consider an agency that not only demonstrates that they’re highly adaptable, but can manage both the operational logistics side and the advertising side, as one will closely impact the other.

“Amazon is not the problem. It’s taking a microscope to your problem.”

– Amanda Stone, director of e-commerce at Olly

Brands should note that just as Amazon can highlight a company’s best features, it can also expose the weak links in the chain. “If you don’t have a perfect product, if you don’t have a perfect price, if you don’t have a perfect consumer response, Amazon is the place that is going to amplify that for you,” Stone said, noting her support team at Olly is constantly monitoring and managing customer feedback and sentiment by staying active and responsive in reviews, email, and social media. Olly is also working to ensure its communications are accurate so as not to lead shoppers astray when a listing says an item is in stock, when it actually isn’t.

“[Brands should] no longer think about Amazon ads as just search. Amazon ads are search, product pages and display.”

– Adam Epstein, vp of growth, Perpetua

Having an ad strategy that assists in looking at the big picture is critical for brands in the evolving Amazon landscape, and brands need to be playing both offense and defense. “Every single ad unit that Amazon offers, you want to be advertising on in a very strategic way,” Epstein said. “…Amazon is going to continue to open up inventory for all of these new ad units and if you’re not activating them, one of your competitors will.” The ultimate goal is for the brand to develop metrics to observe the performance of all of these different units and test whether they’re seeing organic growth rising as their attributed sales rise—this will mean not only their efforts are working, but they’re not overspending to get there.

WTF is CPA and CPP?

When considering KPIs for ad spend, Ben Knox of Super Coffee suggests that that it might be more strategic for brands to think beyond ROAS (return on ad spend) and consider CPA (cost per acquisition, calculated by the total advertising dollars divided by the number of purchases driven by that ad campaign) or CPP (cost per purchase). This decision highly depends on the type of product in question—if it’s a highly consumable product that a customer will buy on a monthly basis, then it would likely make sense to spend potentially more than the GMV of the first transaction. This is because there’s a higher chance the brand will make their investment back over the lifetime of that customer’s interaction with the brand on Amazon. If it’s a one-time buy, that may mean a brand would want to adopt a more controlled CPP. “That’s why return on ad spend is good for longitudinal comparison for keyword types, but they are maybe not the best metrics for understanding how you should be investing in acquiring customers for your business,” he said.

WTF is Amazon DSP?

Amazon DSP (Demand-Side Platform) is a technology that every brand should consider leveraging alongside sponsored brands and sponsored products. While the latter is a self-service tool that functions like a Google ad, DSP provides brands an opportunity to advertise both within Amazon and across channels. “It’s using Amazon-specific shopper data intel where you can be targeting around [things like] demographics and geo-location, whether you’re trying to grow your target audience or test out new audiences,” Stone of Olly said. “To me, we really just define these as lower funnel conversion-driving tactics. Your goals here should really be about conversion.” If brands want to take this up the funnel or get more competitive with their strategy, then their next option is to work with Amazon directly, which can be more expensive. “I think more and more we’ll see Amazon automate as much as they can and try to get those opportunities into the hands of brands,” Stone said.

WTF is The Vine Program?

The Vine Program is just one option in Amazon’s toolkit to help brands build high quality ratings and reviews. The invitation-only program allows verified customers to deliver honest and thorough feedback. This not only provides the brand with precious insights on how their product is performing or resonating with consumers, but it builds brand affinity with other consumers, offering them a trustworthy and informative resource for making a purchasing decision. Having a sturdy review page on Amazon contributes to a brand’s overall foundation for a successful e-commerce presence, and helps the brand easily and more reliably monitor flaws and respond accordingly. This has been particularly critical at a time where Amazon has been experiencing shipping delays and backlogs in their ordering system due to Covid-19. One particular plus: according to Patel Rios of Cora, The Vine Program is accessible and affordable.

Day 1

- What is Your Amazon Strategy? with Andrea Hippeau, Principal, Lerer Hippeau

- How To Scale Your Amazon Advertising Business Profitably with Shafique Niazi, Associate Director, Amazon & Marketplaces, Rise Interactive and Stephanie Parkison, Sr. E-commerce Manager, Customer Marketing, Tempur Sealy International

- How To Stay DTC While Selling On Amazon with Rob Towne, director, performance marketing, Purple

- Gen C: How Covid Has Shaped The Amazon Consumer with Rina Yashayeva, vp, marketplace strategy, Stella Rising

- Budgets And Spending On Amazon with Ben Knox, vp, e-commerce, Super Coffee

- Balancing Automation & A Hands-on Approach For A Winning Amazon Advertising Strategy with Jake Merrill, senior client strategist, marketplace strategy and Connor Folley, co-founder & CEO, Downstream

Day 2

- Advertising Against Competitors with Amanda Stone, director, e-commerce, Olly

- Beyond Paid Search – Best Practices For Product Pages and Display with Adam Epstein, vp of growth, Perpetua

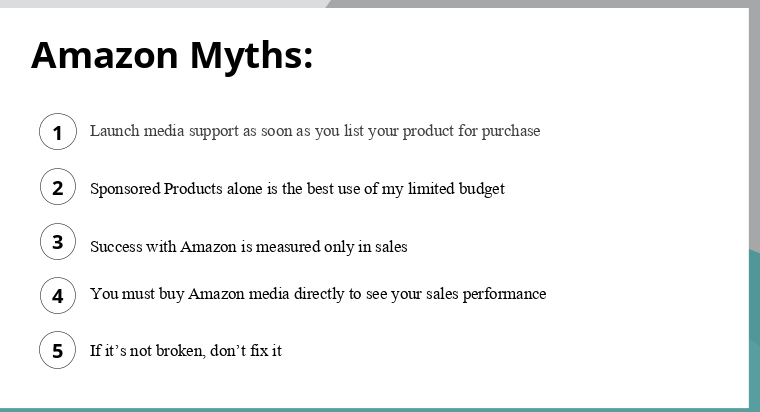

- Myth-busting Amazon with Laura Kaplan, vp, strategy, Sellwin Consulting, Dentsu

- 10 Principles Of Effective Amazon Advertising with John Shea, chief growth officer, Teikametrics

- Luxury on Amazon with Kiri Masters, founder & CEO, Bobsled Marketing

Day 3

- How to Win As a Brand on Amazon with Puja Patel Rios, vp, e-commerce, Cora

- The Big Picture with Maggie Curran, vp, sales, e-commerce & business divisions, Americas, Belkin International and Daniel Owen, evp, Direct Agents