Dailymotion has a new daddy.

French media giant Vivendi, which owns Canal Plus Group and Universal Music Group, has acquired an 80 percent stake in the video company for $241 million. It comes at the end of a long, long courtship for Dailymotion, which was originally pursued by Yahoo in 2013 before the deal — Yahoo was reportedly offering $300 million for a 75 percent stake in Dailymotion — was scuttled by the French government.

The deal is an important one within the larger online video landscape, but even more so for Dailymotion. The company likes to claim it’s the second-biggest video platform behind YouTube, averaging 128 million unique visitors per month across the globe. Of course, YouTube, with its 1 billion global users, dwarfs any true comparison between the two video sites.

Still, while Dailymotion may never catch YouTube — or even newer rivals like Facebook — when it comes to scale of audience, there are a few reasons why Vivendi turns Dailymotion into a far more interesting and relevant company for the online video industry. Here are five:

More ‘Dailymotion Originals’

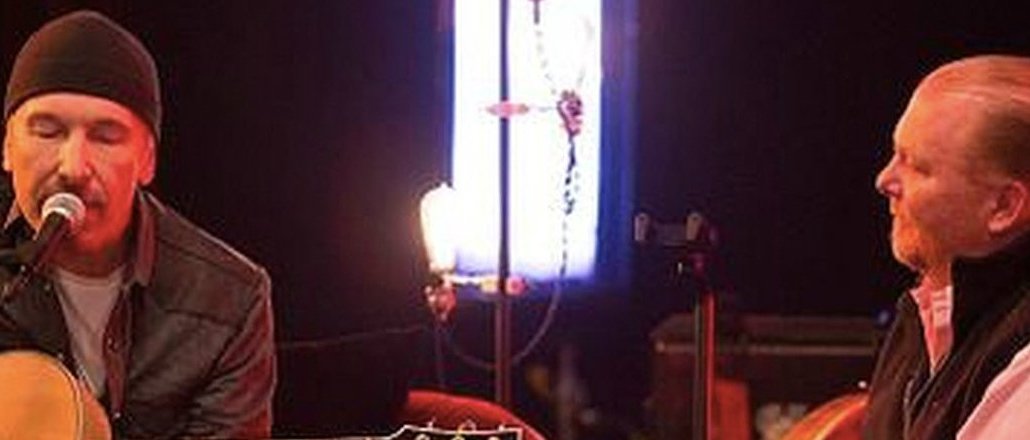

For any online video network or publisher, original video is now a vital part of its content mix. Dailymotion has made some overtures in this area, most notably with the food and music series “Feedback Kitchen” in partnership with celebrity chef Mario Batali.

Now under Vivendi’s control, Dailymotion will be doing more original video. In a statement, the media giant said Dailymotion will develop “original and distinctive content and formats meeting the expectations of a whole new generation of digital consumers.”

This is also good news for video creators, producers and distributors, who now have a new (well-funded) buyer for their content. “The marketplace wants that,” said David Anderson, svp at MediaLink. “If Dailymotion can come out with a strong original content strategy — even if it’s short-form with modest production budgets — there would be a lot of interest.”

It could also serve brands. “Their reach alone will make this a compelling alternative for brands who would otherwise be trolling YouTube looking for the right MCN partner,” said John McCarus, chief strategy officer of LIN Digital.

More premium content on Dailymotion beyond originals

Vivendi owns Canal Plus Group, which owns a massive pay-TV business and one of the largest film producers and distributors in the world, and Universal Music Group, which has an ownership stake in Vevo. Immediately, Dailymotion now has access to a wide range of “premium” content, from films and TV shows to official music videos.

For an ad-supported platform, that is massive. It’s unclear how much content Vivendi’s film and TV subsidiaries will distribute on Dailymotion, but the companies confirmed some will be made available. The deal gives Dailymotion “access to particularly attractive music and audiovisual content,” Vivendi said in a statement.

Dailymotion is now an international player

Vivendi has up to $15 billion to play with following a series of divestments by chairman Vincent Bollore. That’s not to say Dailymotion will have access to all of that cash, but now a subsidiary of the media giant, it has more funds to focus on its own international expansion, which includes the growing Asian market.

In terms of domestic, it means Dailymotion also has the opportunity to more directly compete with YouTube. “I think the creative community as a whole is always looking at new outlets,” said Anderson. “The question is, how do they do it? Do they start by establishing a meaningful presence in Hollywood? Can they do exclusive deals with big YouTube creators and shift audiences over, like Vessel?”

Dailymotion could change Vevo’s fortunes

Vevo, while a well-recognized brand in online video, has a particularly rough economic model.

It’s got no shortage of traffic — more than 44 million unique viewers in May alone, according to comScore. However, a large percentage of that traffic is happening on YouTube, which means splitting ad revenue with Google’s video platform. (YouTube generally takes 45 percent of all revenue generated from ads.) In addition to YouTube, Vevo is also obligated to pay record labels and artists from whom they’ve licensed music.

Dailymotion, with its own video technology, gives Vevo the chance to create a new revenue stream. “Like most YouTube multichannel networks, Vevo has for some time been dying for off-YouTube incremental revenue streams,” said McCarus. “Vevo pairing with Dailymotion could be a game-changer for both platforms — although Google’s stake in Vevo would prevent a total mutiny.”

Vivendi could go over-the-top

Vivendi is rumored to be building an over-the-top video-streaming service to rival Netflix in Europe. The ability to launch and maintain direct-to-consumer video platform in multiple countries requires a lot of technological know-how. Dailymotion has that.

“I think every media company out there is trying to figure out some sort of strategy to connect more directly with consumers,” said Anderson. “Look at Fox [Networks Group], they just announced their first-ever president of digital, and his job is to build a direct-to-consumer business.”

Vivendi’s Canal Plus also has a growing YouTube business, with more than 40 channels it either owns or operates on behalf of others. Similar with Vevo, these channels also have to share advertising revenue with YouTube. On Dailymotion, it would stay in the family.

Image via Dailymotion / “Feedback Kitchen”

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.