Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Armed with technology, advertisers can spend less and still grow sales

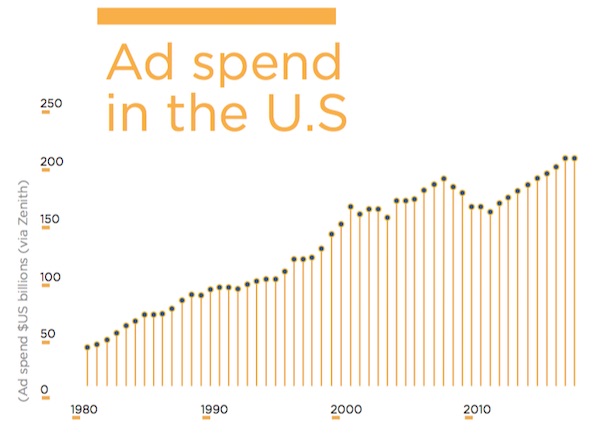

For almost a century, ad spending has hovered around 1 to 1.5 percent of GDP, and this year will be no different, if the forecasts are right. Zenith Media, one of the most widely cited forecasters, projects that this year’s total ad spend will reach $197 billion in 2017, based on the belief that advertising’s share of the gross domestic product will remain constant.

But what if these forecasts are wrong?

As technology has improved, the ability to reach specific audiences has become more efficient and cheaper. Display ads are getting cheaper, and brands like Unilever and Procter & Gamble are showing it’s possible to slash ad budgets without seeing drops in sales, says media industry analyst Rebecca Lieb. Brands are getting choosier about how they spend digital ad dollars at a time when TV ad spend — which accounted for the bulk of total ad spend over the past half century — is beginning to decline.

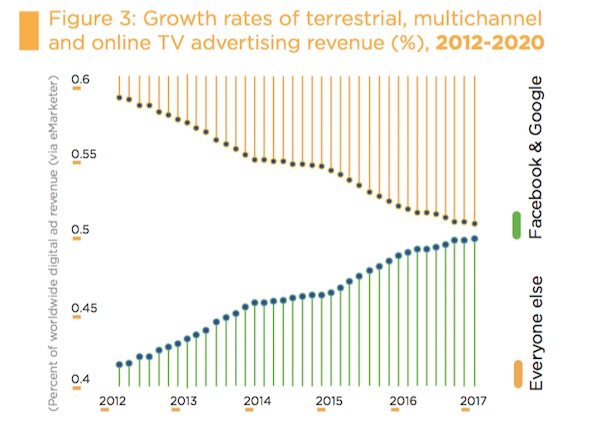

Experts predict the growth in digital spend will offset the decline in TV spend. But maintaining digital advertising’s current level of growth is a bit unsustainable, says Pivotal Research analyst Brian Wieser.

Ad spend usually grows 2 to 3 percentage points annually, but lately it’s grown about 5 percentage points per year. The majority of this growth comes from Google and Facebook, which reap more than half of all digital display and mobile ad dollars. A slowdown from either of these companies could end the precipitous growth in digital ad spend.

If brands spend less on advertising, they’ll likely spend that money toward using consumer data to reach people through direct marketing tactics like targeted emails, Wieser says.

Should ad spend decline, marketers will spend more resources on analyzing data to figure out new ways of driving organic engagement, says Cheryl Huckabay, the head of brand media at ad agency The Richards Group. Attribution and measurement companies will become even more valuable as marketers try to understand the value of the customers they already have.

More in Marketing

In graphic detail: How Anthropic’s Pentagon refusal is paying off in downloads, brand trust and enterprise deals

OpenAI’s Pentagon deal seemed to spark uproar among its users, many of whom were against it. Anthropic’s refusal to agree to the terms was seen by users as the more trustworthy alternative.

How AI could disrupt retail media’s $38 billion search ad market

ChatGPT and other AI chatbots could divert shoppers from retailer sites, putting the $38B retail search market at risk.

‘Brand safety is moving from fear to curiosity’: Zefr’s Raddon on content-level accreditation – and what it exposes about the industry

The threat is no longer a discrete piece of bad content that a keyword list or a domain block can catch. Its volume.