Last chance to save on Digiday Publishing Summit passes is February 9

When Seamless and GrubHub merged in late 2013, they formed the Voltron of food delivery. But while the two brands have combined forces, they continue to operate as separate entities within the GrubHub portfolio, which also includes MenuPages, Allmenus, Restaurants on the Run, as well as DiningIn.

That, however, hasn’t stopped the two behemoth brands from collaborating across offices and teams — which have built a unified technology stack, aligned their tech and marketing efforts through a new product marketing team and put data at the forefront of a number of external efforts this year.

“One of the most important things I had to do was to unite the two brands and different teams around one vision and devise strategic goals to move in that direction,” said Barbara Martin Coppola, GrubHub’s CMO, who was brought in from Google earlier this year. “We defined that common vision together, which was to ‘move eating forward’ by evolving who we are in the market and achieving growth goals, both in terms of new diners and more orders.”

It was also necessary to break down walls between the two U.S. offices, in New York and Chicago, according to Coppola. Before her, they were made up of a bunch of “mini-teams with their individual subcultures.” She not only made sure that the 80-plus marketing team members were well embedded within other teams but also created an entirely new department — the product marketing team — so that marketing and tech especially could work more closely together.

That said, the company is retaining two distinct brands, according to Coppola because Seamless is more popular in New York while GrubHub is big everywhere else.

GrubHub has lately focused on group ordering and targeting groups of diners at once. Group ordering lets members of a group — a family, co-workers, frat bros — to simultaneously order individual meals that come packaged separately, delivered together, but with the option to pay individually. Last month, it extended that feature in the form of a GrubHub app for Apple TV, which lets groups order food at the click of a button.

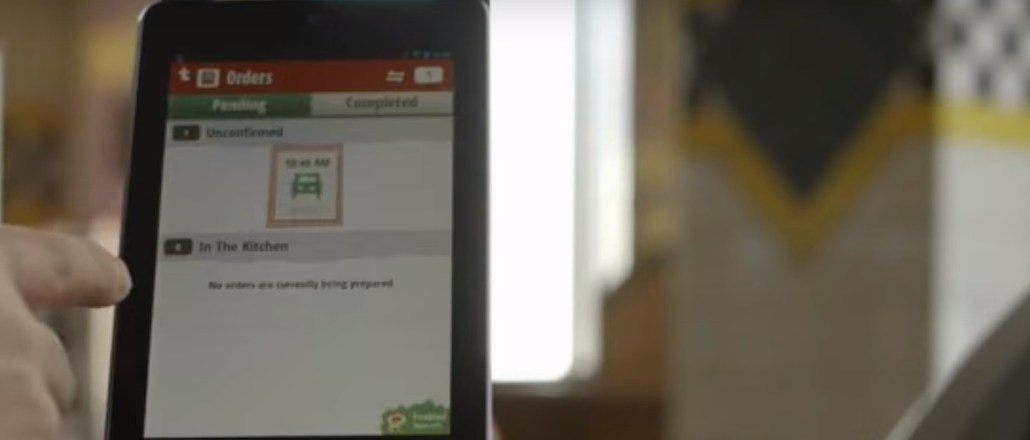

To pull this off, both GrubHub and Seamless have also unified into a single technology stack, allowing them to run frequent tests to see what helps diners make easier decisions about what they’re eating, such as “Popular Near Me,” which helps users discover new restaurants and cuisines in their vicinity.

Today, GrubHub’s portfolio processes an average of 220,000 orders in a day, serving a community of approximately 6.4 million active diners. And while it remains the biggest player in restaurant delivery, several upstarts — from DoorDash to Caviar — are trying to carve their own slices of the segment. DoorDash is reportedly raising a new round of funding at a $1 billion valuation.

To remain competitive, GrubHub is trying hard to figure out how to employ its insights to better customize itself to its customers’ needs. The company thanked its highest tippers via email, for example, using its data for targeting and segmentation. It also uses its data to target consumers at opportune times. For example, if it happened to be raining the last few times you ordered Chinese food from Seamless, be prepared for a personalized prompt with a deal to your neighborhood Chinese restaurant the next time clouds darken the skies.

“Marketers wouldn’t have dreamed of these insights in the past. I really believe in the power of data to help us make smarter decisions,” Coppola said. “Through data, we are really trying to bring more relevance to our consumers through all our touchpoints and lead to more engagement and more conversion.”

More in Marketing

Star power, AI jabs and Free Bird: Digiday’s guide to what was in and out at the Super Bowl

This year’s Big Game saw established brands lean heavily on star power, patriotic iconography and the occasional needle drop.

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?