What’s moving the needle in online video advertising? Responses to a Digiday and Adap.tv “State of the Industry Survey” in online video reveal two strong trends: increased convergence with which online video and television advertising are being planned and bought and the expansion of programmatic buying.

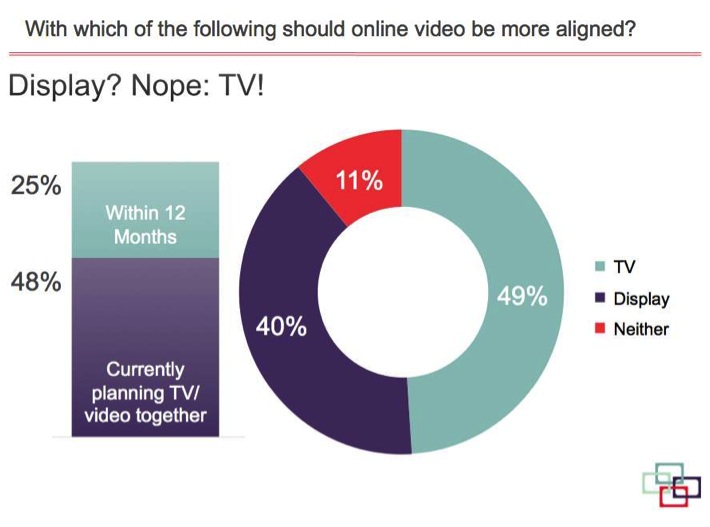

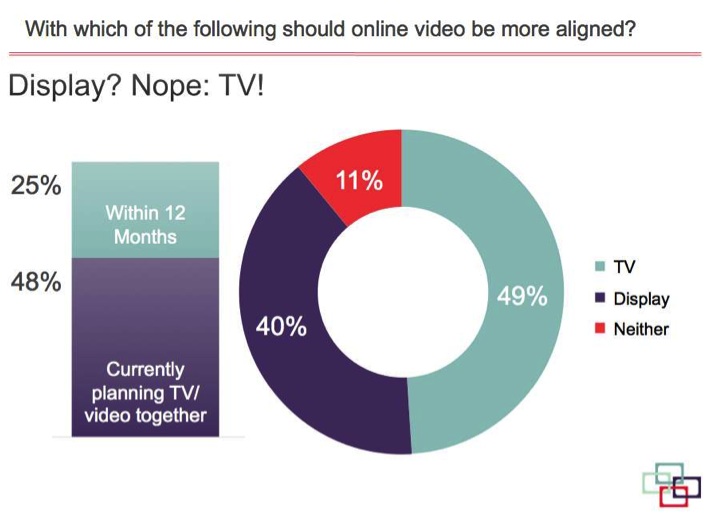

In Digiday’s semi-annual poll of predominately digital agencies, brands, publishers and ad networks or intermediaries that comprise the marketplace for online advertising, respondents told us that the rate of planning television and online video ads together will grow by more than 50 percent in the coming year. Specifically, 48 percent of advertisers and agencies already are planning TV and video together, and 25 percent more will be doing so within the next 12 months. Put another way, among leading video buyers, nearly three quarters of all online video buyers will be planning TV and interactive video together by this time next year.

Given the choice of with which medium online video should be most aligned – TV, online display or “other” – respondents said TV by more than 23 percent over those who said display. An 11 percent minority still said they think online video represents a new medium entirely, but even fewer respondents suggested that online video might be a replacement for TV.

Nearly two-thirds of respondents across the industry (62 percent) said that their use of online video is more likely to be a complement to TV rather than a replacement for TV, up slightly from last year.

That said, only 20 percent of advertisers said they expect to buy their video advertising this year “at an upfront,” and for more than half (54 percent of respondents), it was anticipated to be less than 5 percent of their total 2012 purchase. This number was down 10 percent from 2011.

The missing link in uniting these two mediums? Two-thirds of buyers say that a key factor in fusing TV and online video is unified measurement. Brands are increasingly united in expressing their primary campaign objective: “brand engagement,” according to 73 percent of respondents. But while “brand lift” was cited by both advertisers and their agencies as the best metric of success in measuring online video ad campaigns after the fact, the two remain divided when it comes to the importance of click-throughs.

Agencies put click-throughs near the bottom of their list of favored metrics, but brands ranked it third, ahead of common TV metrics. While still low on the scale of things, we did note a dramatic rise in brand attention to TV-centric metrics of GRP and TRP. While they barely registered a blip in last year’s survey, they’ve moved into double digits now reflecting industry efforts to try to synergize television and digital video metrics.

The second key impetus to online video ad buying is a marked rise in video inventory sourcing via automated environments. Advertisers who are demanding pricing efficiency are finding it from a mix of suppliers including exchanges (29 percent vs. 15 percent in 2011), demand-side platforms or DSPs (32 percent vs. 15 percent in 2011) and trading desks (27 percent). Trading desks were included for the first time as a choice in this year’s study but were only narrowly edged out by DSPs.

Because advertisers were allowed to pick as many outlets as they typically employ, and because the ownership of such buying channels often overlaps, it would be speculation to assign a market share to any one buying method. If anything, it’s apparent that a strong third of online video advertisers is sampling a number of methods looking for value.

While publishers have been slow to respond to this trend towards automation, there appears to be great potential for private advertising marketplaces among publishers with video content. Just 8 percent of our survey respondents currently employ such a sales platform, but more than 28 percent say they will employ one within the next 12 months. The notion of private marketplaces is still far from mainstream, as 17 percent of publishers surveyed are still unclear as to what a private marketplace entails.

Overall, the outlook for online video budgets is strong, with the vast majority of brands, agencies and ad networks (96 percent) estimating that their budgets will increase an average of 23 percent in 2012. Publishers, too, have expectations for double-digit growth in online video budgets. Greater than 80 percent of publishers said that CPMs are up an average of 11 percent from 2011. More than 83 percent of publishers said their fill rate is up by nearly 14 percent from last year.

Some 638 agency, brand, publisher and video intermediaries responded to the survey, which was sponsored by adap.tv. For the year ahead, our analysis concludes that the industry should:

• Look for growth to continue in online video ad uptake, in tandem with digital television planning. Driving this trend:

o Brand and agency interest in synergizing SiSoMo (sight, sound and motion)

o Tools from providers like Nielsen that deliver the toggles for ad planners to determine their desired reach and impact

o The transparency and availability that derives from exposure of more online video content via RTB

• Look for publishers to accelerate efforts to move video buyers onto private marketplaces but also to expand their efforts into custom and branded content as a way of deepening their most important one-to-one relationships.

• Look for both buyers and sellers to try to coalesce around an engagement metric for SiSoMo that aligns campaign aims in both television and online video. Accelerating this trend:

o The move to yet more platforms beyond the Web that compound the need for unified metrics

o The sudden ramp-up in interest for connected television as the potential missing link between television and interactive audience engagement metrics.

• Expect the continued expansion of RTB platforms in online video, and for buying efficiencies participants experience to put pressure on television content producers to offer similar buying solutions to displace the television upfront once and for all.

Complete slides, as presented at the Digiday Video Upfront Monday, are available here, and you can watch the full presentation below.

More from Digiday

PepsiCo, Innovid and Paramount+ are 2024 Digiday Video and TV Awards winners

This year’s Digiday Video and TV Awards winners found success with emotional stories and meaningful experiences that foster connections and drive brand affinity. This storytelling extended to social video campaigns, emerging technologies and offerings to reach wider audiences with compelling content. For instance, in the Best Ad Tech Innovation category, PepsiCo won for using enhanced […]

How lack of motivation could be seen as a hindrance to solving programmatic fraud

Casale outlined some of the main challenges to solving the problems of fraud in the programmatic world — the latest boogeyman being MFAs

VaynerMedia CEO Vaynerchuk: Media, creative agencies must reunite to create ‘common sense’ marketing solutions

Vanyerchuck said media and marketing needs to have a better understanding of consumer attention and pivot to create creative that consumers will consider vs. industy creative.