Publishers made only 14 percent of revenue from distributed content

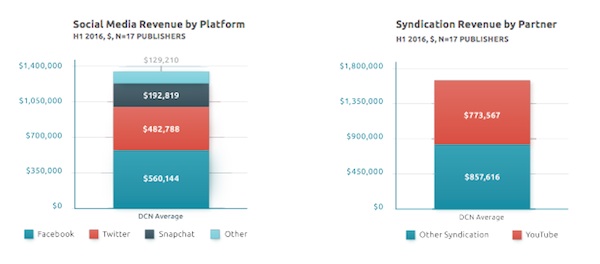

Publishers are only making 14 percent of their revenue from distributing their content on third party platforms, according to a new report from Digital Content Next, the premium publishers’ trade group. The Distributed Content Revenue Benchmark Report, which reflects revenue in the first half of 2016, is based on a limited sample — 17 members — but offers a rare look at how much publishers are making from social distribution. The majority of publishers’ distributed revenue came from YouTube, as newer platforms and features have failed to turn into meaningful revenue streams (see first chart).

Each platform has its own set of monetization challenges. Here’s a breakdown of the major ones:

Facebook

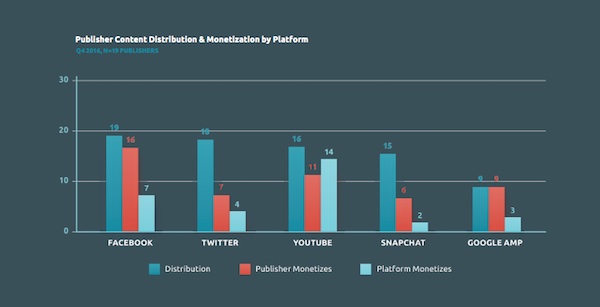

Facebook offers publishers many ways of making money, from Instant Articles to audience extension, and so is also the most widely used for monetization by the publishers surveyed, especially text-based ones. Of the 19 surveyed that use it for distribution, 16 are monetizing there on their own, seven through the platform’s sales arm. Yet many “express deep ambivalence about the platform’s commitment to their success monetizing on the platform,” the report read.

Each feature has its upsides and downsides. Instant Articles offers publishers faster load times, ability to integrate ad serving and measurement services and ability to keep all the revenue. But publishers say Instant Articles doesn’t monetize as well as their own site, few are seeing their own results match up with Facebook’s claim that IA is leading to a 25 percent increase in content consumption, and the data is limited.

As a result, some publishers are backing off their use of Instant. Publishers were having more success with Facebook Branded Content, for its greater publisher control over ad placement, higher CPMs and better reporting. But publishers still had complaints about its targeting and reporting abilities and Facebook’s labeling requirements.

Facebook Audience Extension also has been a popular tool with publishers, who get to keep all the revenue they get from advertisers. Data wasn’t reported separately for Facebook-owned Instagram, but it was seen as having big opportunity for branded content and sponsorships in the areas of fashion and beauty.

But Facebook Live and Suggested Video have been unimpressive. Of 17 publishers using live video, only two Facebook Live launch partners were paid by Facebook for meeting its requirement to produce a certain number of minutes of live video. Only six others reported being able to sell advertising into live video on their own.

Snapchat

The messaging app’s fast growth and popularity with young audiences has made it attractive to publishers, but it’s also the hardest to work with, with its invitation-only Discover section, high publisher requirements, limits on ad tracking, switch to a licensing model that could have limited upside for publishers, and overall lack of responsiveness to publisher requests. “Snapchat exemplifies many of the characteristics that make third-party platforms difficult partners for publishers,” the report reads.

Twitter

Like Facebook, most publishers (18 of 19) are active on Twitter, but only few 10 reported making money there, despite Twitter’s offering favorable terms — publishers get to keep all the revenue from sponsorship and branded content sales, for example. But Twitter hasn’t been able to scale live-streaming and its video ad product, Amplify, so there’s limited upside to publishers.

Google AMP

Google’s fast-loading mobile article feature is seen as more publisher-friendly than Facebook Instant Articles. The search giant is more responsive to publisher requests for accommodation (AMP also is open-source code, which makes it fundamentally different from Instant Articles.) Publishers reported that monetizing on AMP is on a par with their own sites, and a number also are getting increased search traffic there. Some haven’t monetized their AMP pages, though, seeing more revenue opportunity by focusing on their own sites.

YouTube

The video platform is still by far the most established as a revenue source for publishers. Sixteen publishers reported distributing there and 14 were monetizing. The benefits aren’t evenly spread, though: TV/cable companies are monetizing the most on the platform, which is well suited to their video content. As a partner, YouTube gives publishers a variety of ways to make money there, but it also controls the ad sales environment and its terms aren’t as good as other platforms’. YouTube Red, YouTube’s paid subscription service, was another story, with nine publishers using it but none getting any significant revenue from it.

More in Media

Walmart rolls out a self-serve, supplier-driven insights connector

The retail giant paired its insights unit Luminate with Walmart Connect to help suppliers optimize for customer consumption, just in time for the holidays, explained the company’s CRO Seth Dallaire.

Research Briefing: BuzzFeed pivots business to AI media and tech as publishers increase use of AI

In this week’s Digiday+ Research Briefing, we examine BuzzFeed’s plans to pivot the business to an AI-driven tech and media company, how marketers’ use of X and ad spending has dropped dramatically, and how agency executives are fed up with Meta’s ad platform bugs and overcharges, as seen in recent data from Digiday+ Research.

Media Briefing: Q1 is done and publishers’ ad revenue is doing ‘fine’

Despite the hope that 2024 would be a turning point for publishers’ advertising businesses, the first quarter of the year proved to be a mixed bag, according to three publishers.