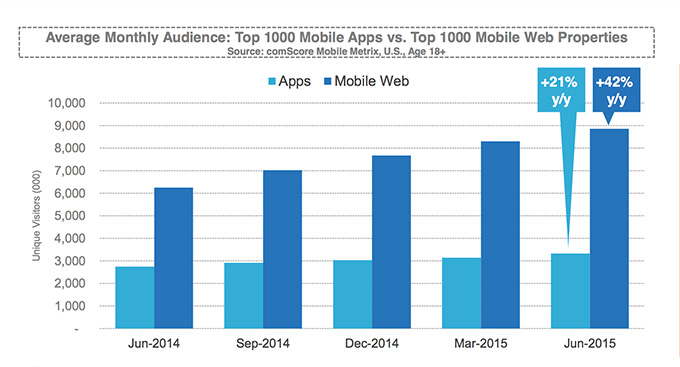

The mobile Web is exploding, on average growing twice as fast as traffic to apps, according to comScore’s latest mobile report. Monthly visitors to the top 1,000 mobile Web properties rose to 9 million people on average, from fewer than 6 million a year ago, the report shows.

“Total digital audiences have grown 22 percent year-over-year, which is crazy if you think about it, because desktop has flattened out and it’s driven all by mobile,” said Andrew Lipsman, comScore’s head of marketing and insights. “And really, it’s more about the mobile Web than apps.”

The average traffic of the top 1,000 mobile websites grew 42 percent, while the average traffic of the top 1,000 apps grew 21 percent.

That part of the report looked at broad trends in how traffic is distributed across mobile, outside top apps like Facebook and YouTube.

The rise in mobile traffic on smartphones is viewed as a recruiting path for digital publishers to turn visitors into more engaged app users, who are even more loyal readers, more like the people who frequent the most powerful social and entertainment apps.

“It’s all about the power of habit,” Lipsman said.

The mobile report looked at things like how often people clicked on their favorite apps and how many apps they put on their homescreens, just a quick click away.

Here is a look at what else the annual U.S. mobile app report revealed:

Mobile traffic

The average monthly audience of the top 1,000 apps and 1,000 mobile Web publishers rose 21 percent and 42 percent, respectively, year-over-year.

App breakdown

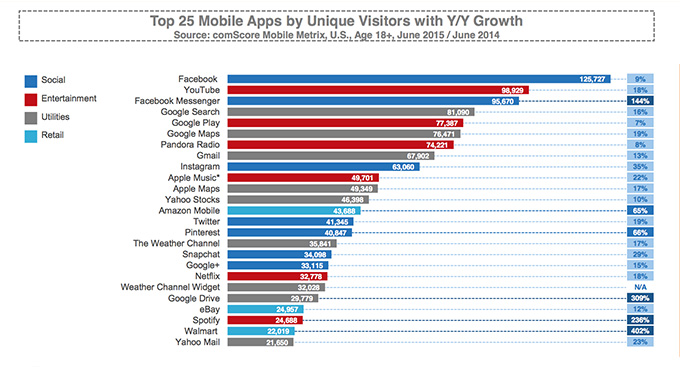

Eight of the top 10 apps are owned by either Facebook or Google. Also, Pinterest’s monthly traffic rose 66 percent and Snapchat’s by 29 percent.

Good service

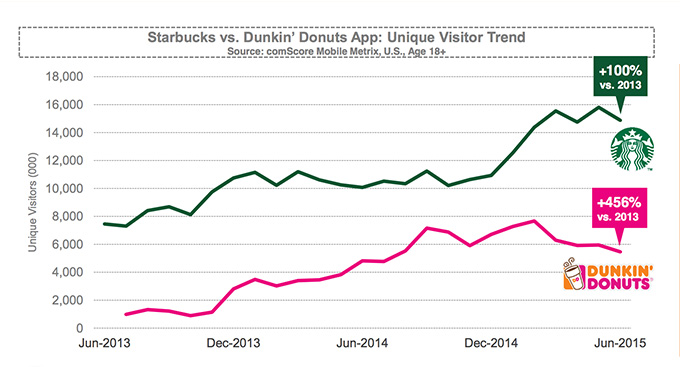

Brand apps can draw a big audience if they provide some habit-forming utility. In the past two years, Starbucks doubled its app audience to about 15 million people. Dunkin’ Donuts’ users rose 453 percent over that time to almost 6 million visitors a month.

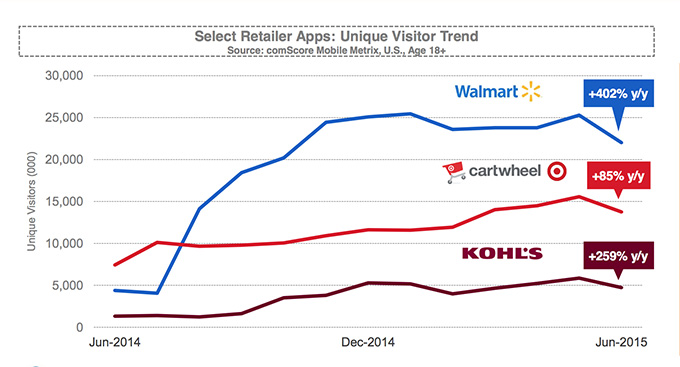

Retail story

Real-world retailers are gaining ground on sites like Amazon. Walmart cracked the top 25 of all U.S. mobile Web properties, and app visitors rose 400 percent year-over-year to more than 20 million people. Target and Kohl’s showed similar strength.

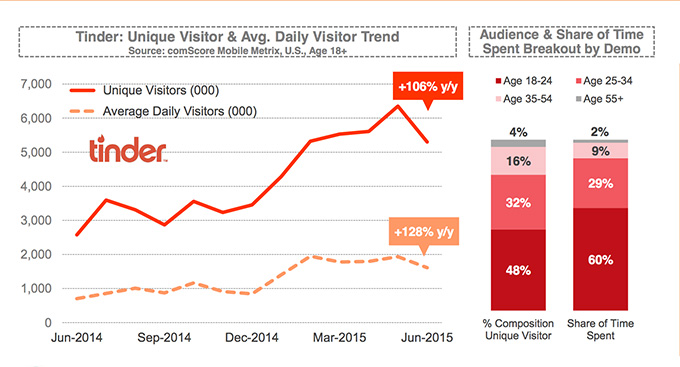

Tinder attraction

As for Tinder, unique visitors doubled year-over-year to about 2 million a day, and four out of five Tinder visitors are younger than 35.

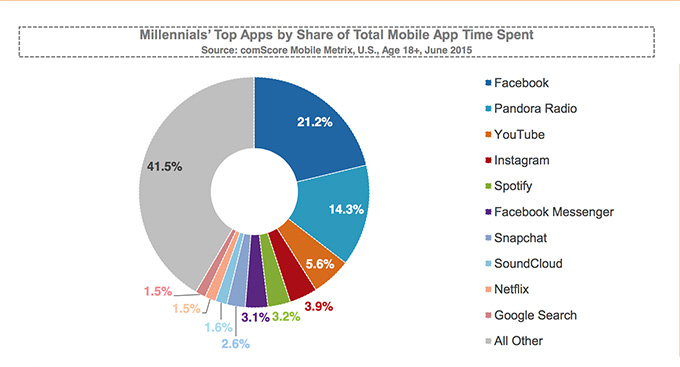

Millennial time

Here’s how Millennials spend their time on their phones: Facebook gets more than 20 percent of Millennial attention, and Pandora and YouTube are the only other two apps with more than 5 percent of time spent. Snapchat’s piece amounts to about 3 percent of time spent.

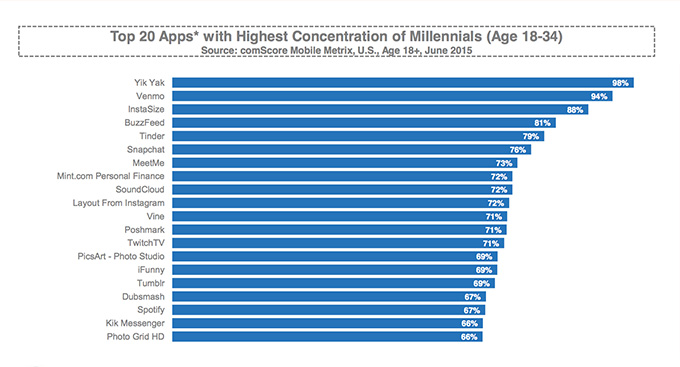

Mostly kids

Here are a bunch of apps that are mostly made of millennials — apps like Yik Yak, Venmo and Instasize with almost all their users in the U.S. between 18 and 34 years old.

More in Media

Meta AI rolls out several enhancements across apps and websites with its newest Llama 3

Meta AI, which first debuted in September, also got a number of updates including ways to search for real-time information through integrations with Google and Bing.

Walmart rolls out a self-serve, supplier-driven insights connector

The retail giant paired its insights unit Luminate with Walmart Connect to help suppliers optimize for customer consumption, just in time for the holidays, explained the company’s CRO Seth Dallaire.

Research Briefing: BuzzFeed pivots business to AI media and tech as publishers increase use of AI

In this week’s Digiday+ Research Briefing, we examine BuzzFeed’s plans to pivot the business to an AI-driven tech and media company, how marketers’ use of X and ad spending has dropped dramatically, and how agency executives are fed up with Meta’s ad platform bugs and overcharges, as seen in recent data from Digiday+ Research.